Answered step by step

Verified Expert Solution

Question

1 Approved Answer

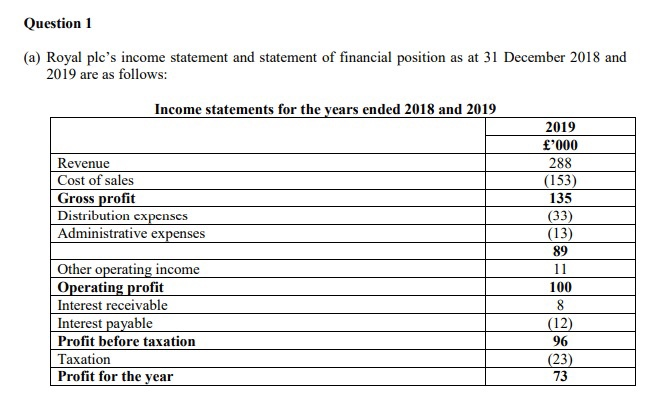

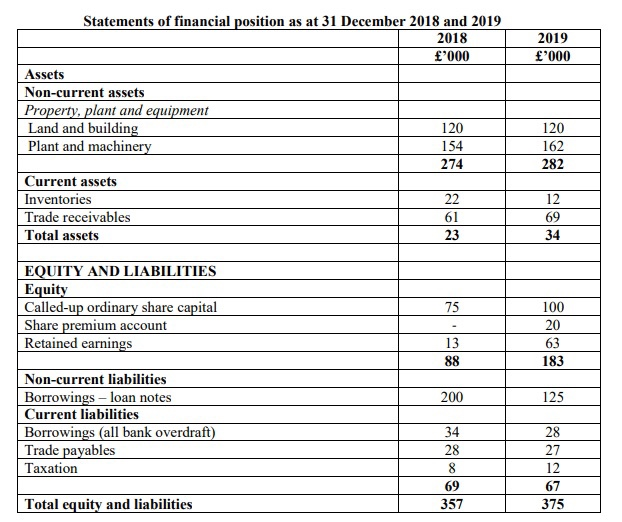

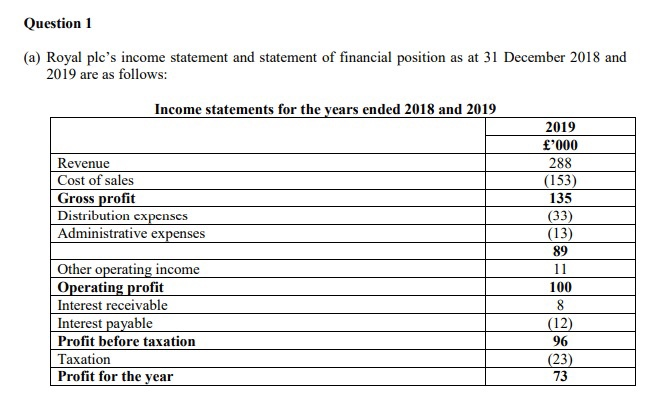

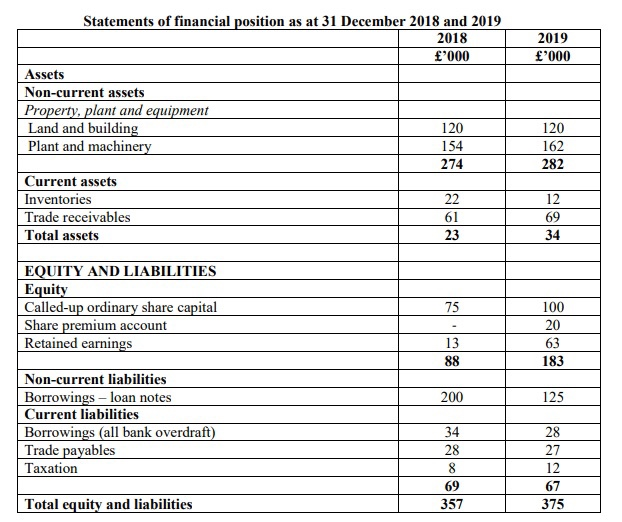

Question 1 (a) Royal plc's income statement and statement of financial position as at 31 December 2018 and 2019 are as follows: Income statements for

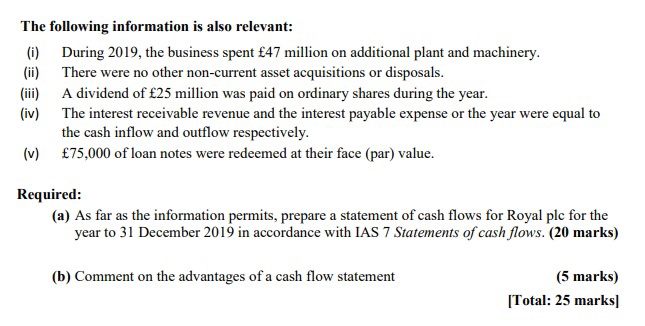

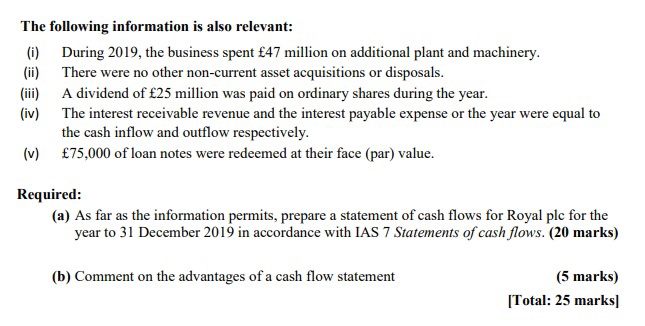

Question 1 (a) Royal plc's income statement and statement of financial position as at 31 December 2018 and 2019 are as follows: Income statements for the years ended 2018 and 2019 2019 f'000 288 Revenue Cost of sales Gross profit Distribution cxpenses Administrative expenses (33) Other operating income Operating profit Interest receivable Interest payable Profit before taxation Taxation Profit for the year (13) 89 11 100 8 (12) (23) 73 2019 f'000 Statements of financial position as at 31 December 2018 and 2019 2018 '000 Assets Non-current assets Property, plant and equipment Land and building 120 Plant and machinery 154 274 Current assets Inventories 22 | Trade receivables 61 Total assets 23 | 120 162 282 12 69 34 | EQUITY AND LIABILITIES Equity Called-up ordinary share capital Share premium account Retained earnings 75 100 20 63 183 13 88 200 | Non-current liabilities Borrowings - loan notes Current liabilities Borrowings (all bank overdraft) Trade payables Taxation 28 Total equity and liabilities 357 375 The following information is also relevant: (i) During 2019, the business spent 47 million on additional plant and machinery. (ii) There were no other non-current asset acquisitions or disposals. (iii) A dividend of 25 million was paid on ordinary shares during the year. (iv) The interest receivable revenue and the interest payable expense or the year were equal to the cash inflow and outflow respectively. (v) 75,000 of loan notes were redeemed at their face (par) value. Required: (a) As far as the information permits, prepare a statement of cash flows for Royal plc for the year to 31 December 2019 in accordance with IAS 7 Statements of cash flows. (20 marks) (b) Comment on the advantages of a cash flow statement (5 marks) [Total: 25 marks

Question 1 (a) Royal plc's income statement and statement of financial position as at 31 December 2018 and 2019 are as follows: Income statements for the years ended 2018 and 2019 2019 f'000 288 Revenue Cost of sales Gross profit Distribution cxpenses Administrative expenses (33) Other operating income Operating profit Interest receivable Interest payable Profit before taxation Taxation Profit for the year (13) 89 11 100 8 (12) (23) 73 2019 f'000 Statements of financial position as at 31 December 2018 and 2019 2018 '000 Assets Non-current assets Property, plant and equipment Land and building 120 Plant and machinery 154 274 Current assets Inventories 22 | Trade receivables 61 Total assets 23 | 120 162 282 12 69 34 | EQUITY AND LIABILITIES Equity Called-up ordinary share capital Share premium account Retained earnings 75 100 20 63 183 13 88 200 | Non-current liabilities Borrowings - loan notes Current liabilities Borrowings (all bank overdraft) Trade payables Taxation 28 Total equity and liabilities 357 375 The following information is also relevant: (i) During 2019, the business spent 47 million on additional plant and machinery. (ii) There were no other non-current asset acquisitions or disposals. (iii) A dividend of 25 million was paid on ordinary shares during the year. (iv) The interest receivable revenue and the interest payable expense or the year were equal to the cash inflow and outflow respectively. (v) 75,000 of loan notes were redeemed at their face (par) value. Required: (a) As far as the information permits, prepare a statement of cash flows for Royal plc for the year to 31 December 2019 in accordance with IAS 7 Statements of cash flows. (20 marks) (b) Comment on the advantages of a cash flow statement (5 marks) [Total: 25 marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started