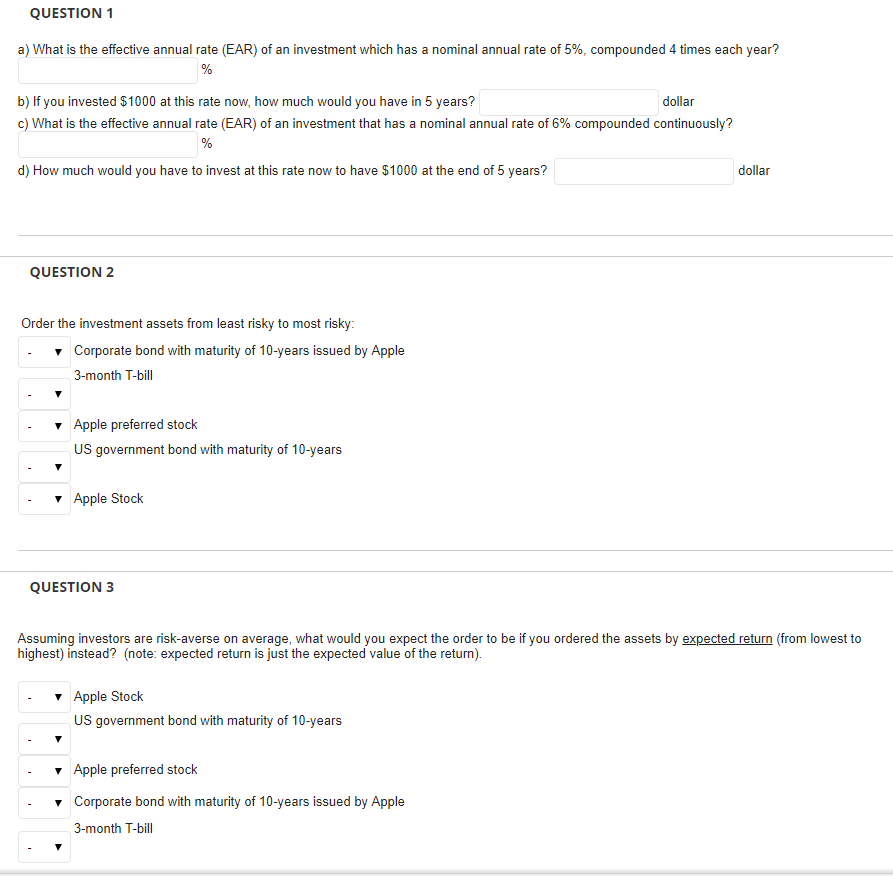

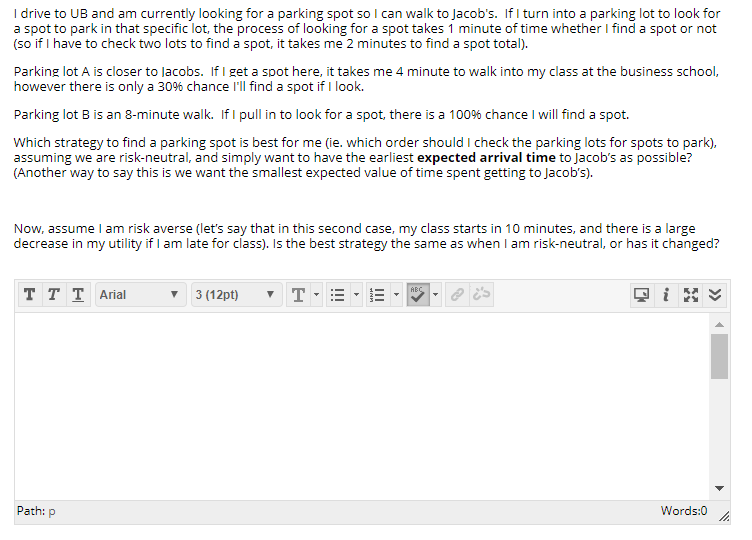

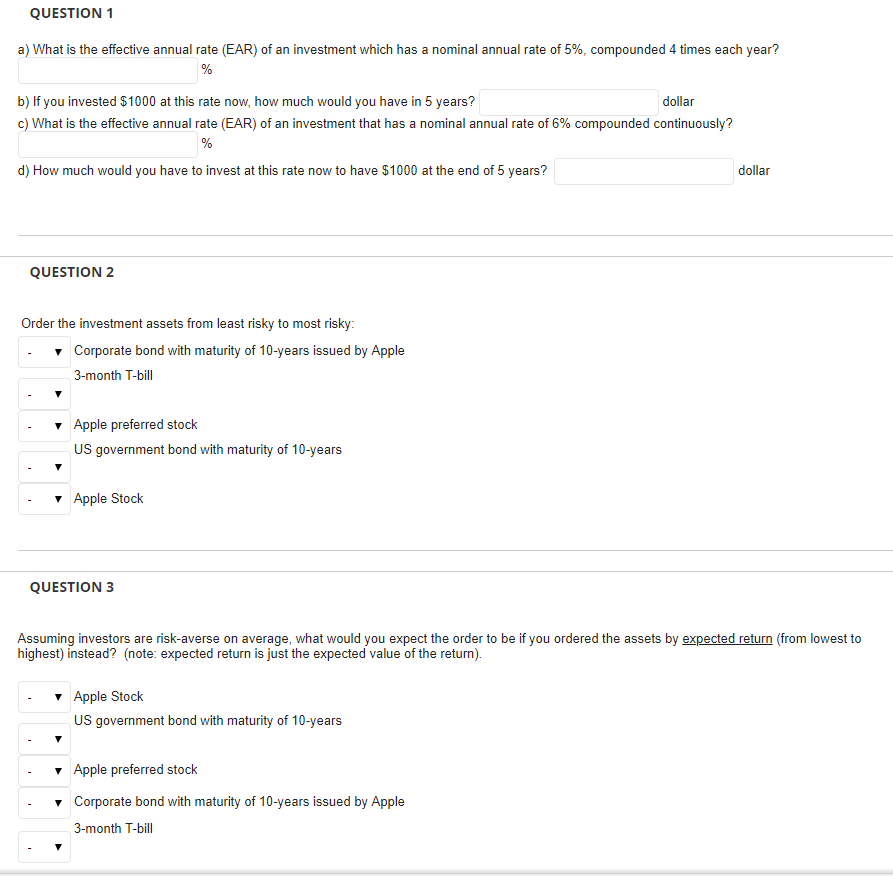

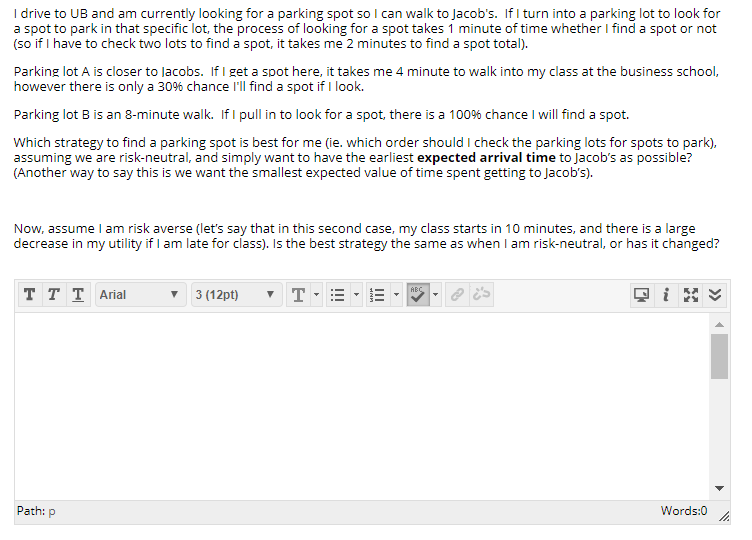

QUESTION 1 a) What is the effective annual rate (EAR) of an investment which has a nominal annual rate of 5%, compounded 4 times each year? dollar b) If you invested $1000 at this rate now, how much would you have in 5 years? c) What is the effective annual rate (EAR) of an investment that has a nominal annual rate of 6% compounded continuously? d) How much would you have to invest at this rate now to have $1000 at the end of 5 years? dollar QUESTION 2 Order the investment assets from least risky to most risky: Corporate bond with maturity of 10-years issued by Apple 3-month T-bill v Apple preferred stock government bond with maturity of 10-years 7 Apple Stock QUESTION 3 Assuming investors are risk-averse on average, what would you expect the order to be if you ordered the assets by expected return (from lowest to highest) instead? (note: expected return is just the expected value of the return). 7 Apple Stock US government bond with maturity of 10-years Apple preferred stock Corporate bond with maturity of 10-years issued by Apple 3-month T-bill drive to UB and am currently looking for a parking spot so I can walk to Jacob's. If I turn into a parking lot to look for a spot to park in that specific lot, the process of looking for a spot takes 1 minute of time whether I find a spot or not (so if I have to check two lots to find a spot, it takes me 2 minutes to find a spot total). Parking lot A is closer to lacobs. If I get a spot here, it takes me 4 minute to walk into my class at the business school, however there is only a 30% chance I'll find a spot if I look. Parking lot B is an 8-minute walk. If I pull in to look for a spot, there is a 100% chance I will find a spot. Which strategy to find a parking spot is best for me (ie. which order should I check the parking lots for spots to park), assuming we are risk-neutral, and simply want to have the earliest expected arrival time to Jacob's as possible? (Another way to say this is we want the smallest expected value of time spent getting to Jacob's). Now, assume I am risk averse (let's say that in this second case, my class starts in 10 minutes, and there is a large decrease in my utility if I am late for class). Is the best strategy the same as when I am risk-neutral, or has it changed? 's Path: p Words:0