Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 1 ABC Company Ltd., which is effectively controlled by the Zulu family although they own only a minority of shares, is to undertake a

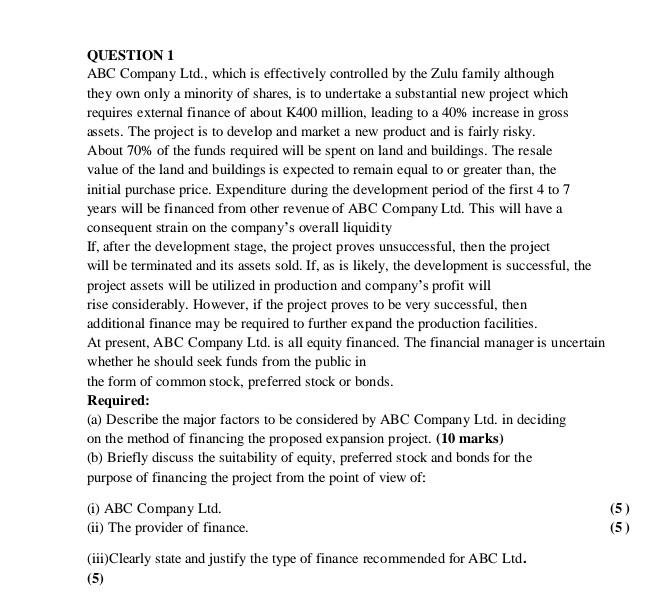

QUESTION 1 ABC Company Ltd., which is effectively controlled by the Zulu family although they own only a minority of shares, is to undertake a substantial new project which requires external finance of about K400 million, leading to a 40% increase in gross assets. The project is to develop and market a new product and is fairly risky. About 70% of the funds required will be spent on land and buildings. The resale value of the land and buildings is expected to remain equal to or greater than, the initial purchase price. Expenditure during the development period of the first 4 to 7 years will be financed from other revenue of ABC Company Ltd. This will have a consequent strain on the company's overall liquidity If, after the development stage, the project proves unsuccessful, then the project will be terminated and its assets sold. If, as is likely, the development is successful, the project assets will be utilized in production and company's profit will rise considerably. However, if the project proves to be very successful, then additional finance may be required to further expand the production facilities. At present, ABC Company Ltd. is all equity financed. The financial manager is uncertain whether he should seek funds from the public in the form of common stock, preferred stock or bonds. Required: (a) Describe the major factors to be considered by ABC Company Ltd. in deciding on the method of financing the proposed expansion project. (10 marks) (b) Briefly discuss the suitability of equity, preferred stock and bonds for the purpose of financing the project from the point of view of: (i) ABC Company Ltd. (ii) The provider of finance. (iii)Clearly state and justify the type of finance recommended for ABCLtd. (5) QUESTION 1 ABC Company Ltd., which is effectively controlled by the Zulu family although they own only a minority of shares, is to undertake a substantial new project which requires external finance of about K400 million, leading to a 40% increase in gross assets. The project is to develop and market a new product and is fairly risky. About 70% of the funds required will be spent on land and buildings. The resale value of the land and buildings is expected to remain equal to or greater than, the initial purchase price. Expenditure during the development period of the first 4 to 7 years will be financed from other revenue of ABC Company Ltd. This will have a consequent strain on the company's overall liquidity If, after the development stage, the project proves unsuccessful, then the project will be terminated and its assets sold. If, as is likely, the development is successful, the project assets will be utilized in production and company's profit will rise considerably. However, if the project proves to be very successful, then additional finance may be required to further expand the production facilities. At present, ABC Company Ltd. is all equity financed. The financial manager is uncertain whether he should seek funds from the public in the form of common stock, preferred stock or bonds. Required: (a) Describe the major factors to be considered by ABC Company Ltd. in deciding on the method of financing the proposed expansion project. (10 marks) (b) Briefly discuss the suitability of equity, preferred stock and bonds for the purpose of financing the project from the point of view of: (i) ABC Company Ltd. (ii) The provider of finance. (iii)Clearly state and justify the type of finance recommended for ABCLtd

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started