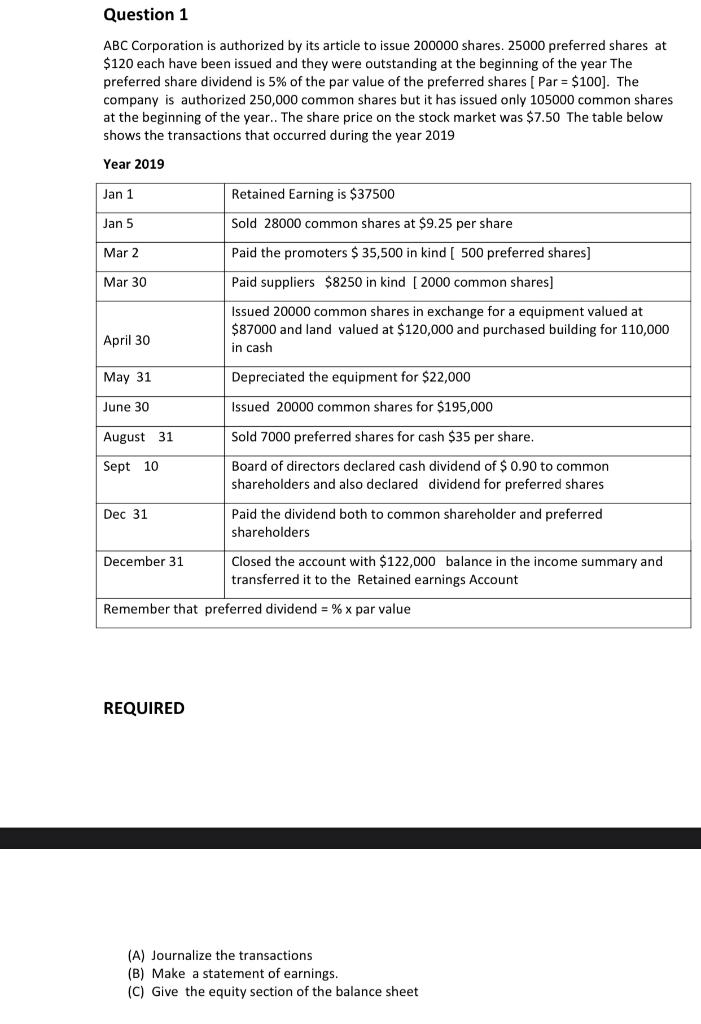

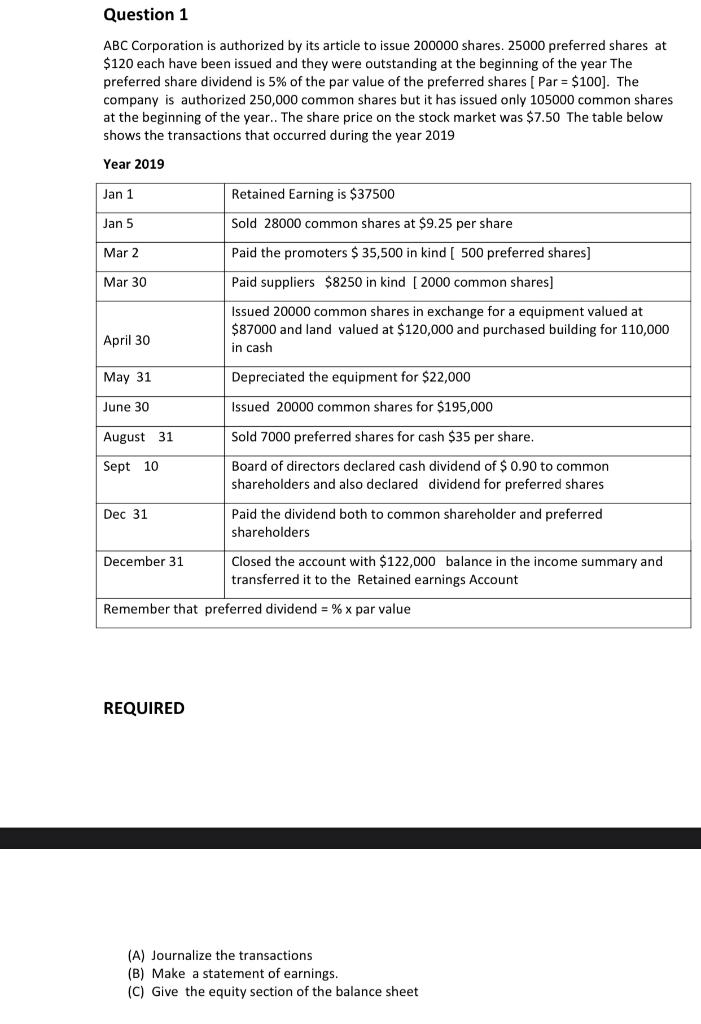

Question 1 ABC Corporation is authorized by its article to issue 200000 shares. 25000 preferred shares at $120 each have been issued and they were outstanding at the beginning of the year The preferred share dividend is 5% of the par value of the preferred shares (Par = $100). The company is authorized 250,000 common shares but it has issued only 105000 common shares at the beginning of the year.. The share price on the stock market was $7.50 The table below shows the transactions that occurred during the year 2019 Year 2019 Jan 1 Retained Earning is $37500 Jan 5 Sold 28000 common shares at $9.25 per share Mar 2 Paid the promoters $ 35,500 in kind ( 500 preferred shares) Mar 30 Paid suppliers $8250 in kind [2000 common shares) Issued 20000 common shares in exchange for a equipment valued at $87000 and land valued at $120,000 and purchased building for 110,000 in cash April 30 May 31 Depreciated the equipment for $22,000 June 30 Issued 20000 common shares for $195,000 August 31 Sold 7000 preferred shares for cash $35 per share. Sept 10 Board of directors declared cash dividend of $0.90 to common shareholders and also declared dividend for preferred shares Paid the dividend both to common shareholder and preferred shareholders Dec 31 December 31 Closed the account with $122,000 balance in the income summary and transferred it to the Retained earnings Account Remember that preferred dividend = % x par value REQUIRED (A) Journalize the transactions (B) Make a statement of earnings. (C) Give the equity section of the balance sheet Question 1 ABC Corporation is authorized by its article to issue 200000 shares. 25000 preferred shares at $120 each have been issued and they were outstanding at the beginning of the year The preferred share dividend is 5% of the par value of the preferred shares (Par = $100). The company is authorized 250,000 common shares but it has issued only 105000 common shares at the beginning of the year.. The share price on the stock market was $7.50 The table below shows the transactions that occurred during the year 2019 Year 2019 Jan 1 Retained Earning is $37500 Jan 5 Sold 28000 common shares at $9.25 per share Mar 2 Paid the promoters $ 35,500 in kind ( 500 preferred shares) Mar 30 Paid suppliers $8250 in kind [2000 common shares) Issued 20000 common shares in exchange for a equipment valued at $87000 and land valued at $120,000 and purchased building for 110,000 in cash April 30 May 31 Depreciated the equipment for $22,000 June 30 Issued 20000 common shares for $195,000 August 31 Sold 7000 preferred shares for cash $35 per share. Sept 10 Board of directors declared cash dividend of $0.90 to common shareholders and also declared dividend for preferred shares Paid the dividend both to common shareholder and preferred shareholders Dec 31 December 31 Closed the account with $122,000 balance in the income summary and transferred it to the Retained earnings Account Remember that preferred dividend = % x par value REQUIRED (A) Journalize the transactions (B) Make a statement of earnings. (C) Give the equity section of the balance sheet