Answered step by step

Verified Expert Solution

Question

1 Approved Answer

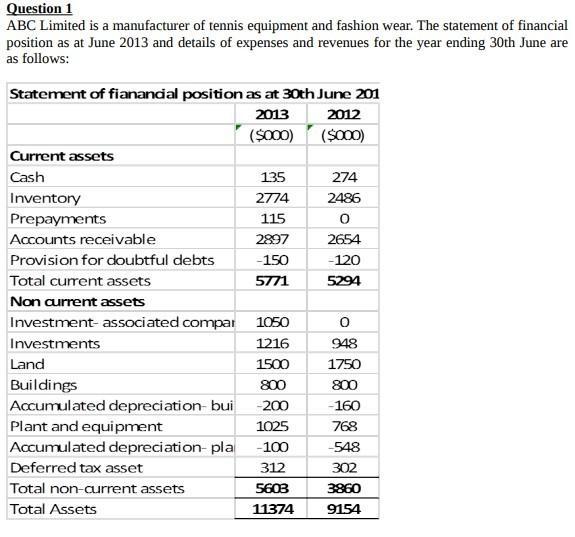

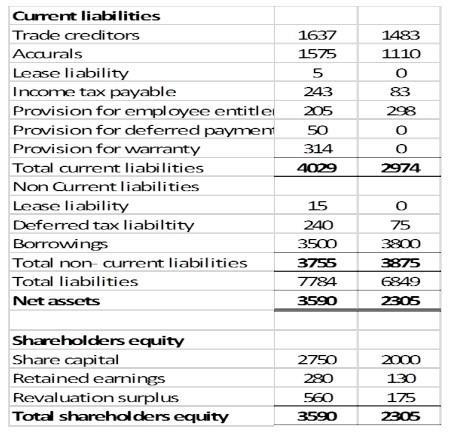

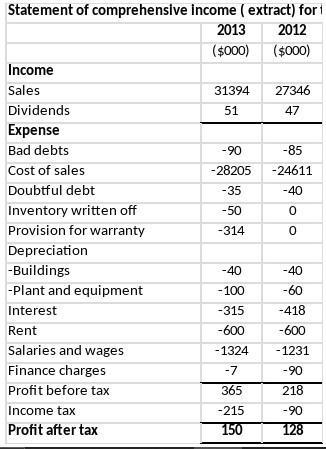

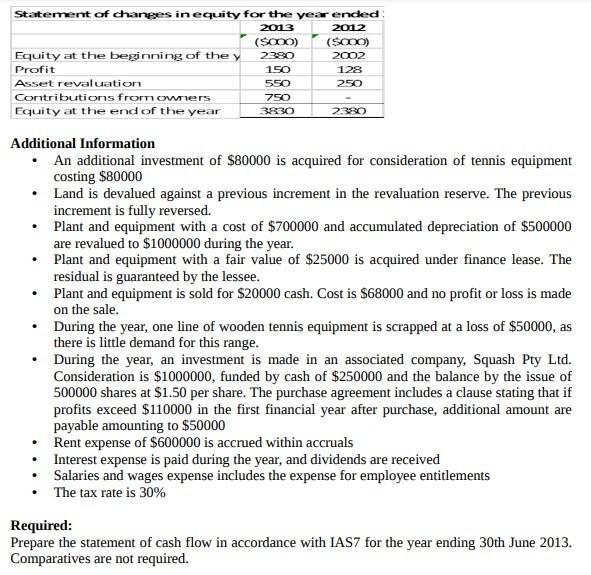

Question 1 ABC Limited is a manufacturer of tennis equipment and fashion wear. The statement of financial position as at June 2013 and details

Question 1 ABC Limited is a manufacturer of tennis equipment and fashion wear. The statement of financial position as at June 2013 and details of expenses and revenues for the year ending 30th June are as follows: Statement of fianandal position as at 30th June 201 2013 2012 ($000) ($000) Current assets Cash Inventory Prepayments Accounts receivable Provision for doubtful debts Total current assets Non current assets Investment- associated compar Investments Land Buildings Accumulated depreciation-bui Plant and equipment Accumulated depreciation-pla Deferred tax asset Total non-current assets Total Assets 135 2774 115 2897 -150 5771 1050 1216 1500 800 -200 1025 -100 312 5603 11374 274 2486 0 2654 -120 5294 0 948 1750 800 -160 768 -548 302 3860 9154 Current liabilities Trade creditors Accurals Lease liability Income tax payable Provision for employee entitle Provision for deferred paymen Provision for warranty Total current liabilities Non Current liabilities Lease liability Deferred tax liabiltity Borrowings Total non- current liabilities Total liabilities Net assets Shareholders equity Share capital Retained earnings Revaluation surplus Total shareholders equity 1637 1575 5 243 205 50 314 4029 15 240 3.500 3755 7784 3590 2750 280 560 3590 1483 1110 O 83 298 O O 2974 O 75 3800 3875 6849 2305 2000 130 175 2305 Statement of comprehensive income ( extract) for i 2013 ($000) Income Sales Dividends Expense Bad debts Cost of sales Doubtful debt Inventory written off Provision for warranty Depreciation -Buildings -Plant and equipment Interest Rent Salaries and wages Finance charges Profit before tax Income tax Profit after tax 31394 51 -90 -28205 -35 -50 -314 -40 -100 -315 -600 -1324 -7 365 -215 150 2012 ($000) 27346 47 -85 -24611 -40 0 0 -40 -60 -418 -600 -1231 -90 218 -90 128 Statement of changes in equity for the year ended 2013 2012 ($000) 2380 150 Equity at the beginning of the y Profit Asset revaluation Contributions from owners Equity at the end of the year . . 550 750 3830 . Additional Information An additional investment of $80000 is acquired for consideration of tennis equipment costing $80000 Land is devalued against a previous increment in the revaluation reserve. The previous increment is fully reversed. Plant and equipment with a cost of $700000 and accumulated depreciation of $500000 are revalued to $1000000 during the year. Plant and equipment with a fair value of $25000 is acquired under finance lease. The residual is guaranteed by the lessee. Plant and equipment is sold for $20000 cash. Cost is $68000 and no profit or loss is made on the sale. During the year, one line of wooden tennis equipment is scrapped at a loss of $50000, as there is little demand for this range. ($000) 2002 128 250 2380 During the year, an investment is made in an associated company, Squash Pty Ltd. Consideration is $1000000, funded by cash of $250000 and the balance by the issue of 500000 shares at $1.50 per share. The purchase agreement includes a clause stating that if profits exceed $110000 in the first financial year after purchase, additional amount are payable amounting to $50000 Rent expense of $600000 is accrued within accruals Interest expense is paid during the year, and dividends are received Salaries and wages expense includes the expense for employee entitlements The tax rate is 30% Required: Prepare the statement of cash flow in accordance with IAS7 for the year ending 30th June 2013. Comparatives are not required.

Step by Step Solution

★★★★★

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Statement of Cashflows of ABC Limited for the year ending 30th June 2013 Description A CASH FLOW FRO...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started