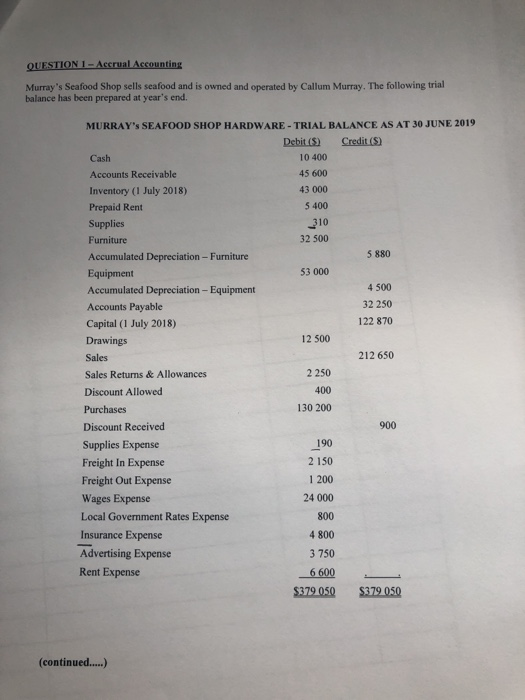

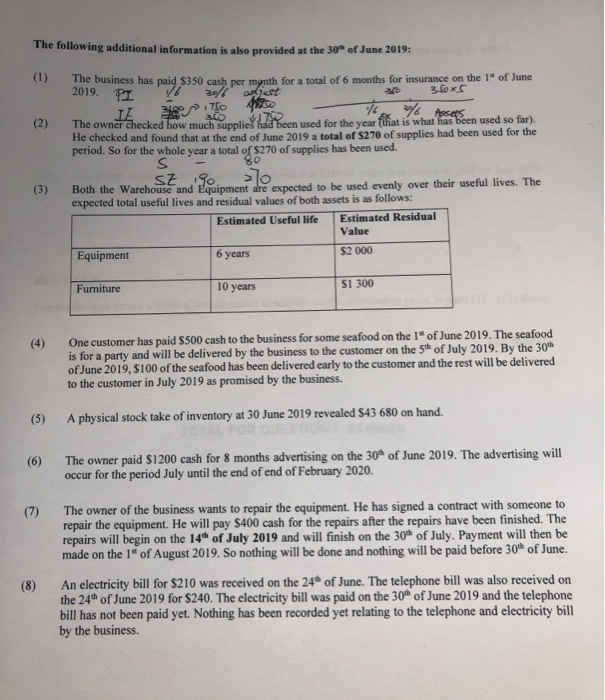

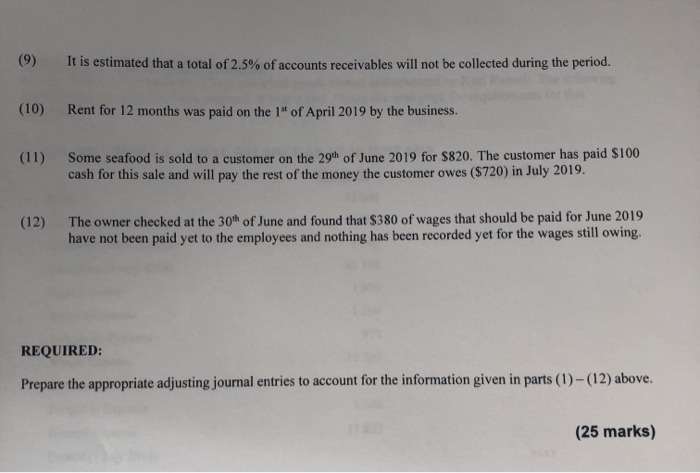

QUESTION 1 - Accrual Accounting Murray's Seafood Shop sells seafood and is owned and operated by Callum Murray. The following trial balance has been prepared at year's end. MURRAY'S SEAFOOD SHOP HARDWARE - TRIAL BALANCE AS AT 30 JUNE 2019 Debit (8) Credit (5) Cash 10 400 Accounts Receivable 45 600 Inventory (1 July 2018) 43 000 Prepaid Rent 5 400 Supplies 310 Furniture 32 500 Accumulated Depreciation - Furniture 5880 Equipment 53 000 Accumulated Depreciation - Equipment 4 500 Accounts Payable 32 250 Capital (1 July 2018) 122 870 Drawings 12 500 Sales 212 650 Sales Returns & Allowances 2 250 Discount Allowed Purchases 130 200 Discount Received Supplies Expense 190 Freight In Expense 2 150 Freight Out Expense 1 200 Wages Expense 24 000 Local Government Rates Expense 800 Insurance Expense 4800 Advertising Expense 3 750 Rent Expense 6 600 $379 050 $379 050 400 900 (continued.....) The following additional information is also provided at the 30 of June 2019: (1) The business has paid 5350 cash per month for a total of 6 months for insurance on the 1 of June 2019. PI 1 Belaust 3 [oxs Zoo (2) 6. posten used so (3) The owner checked how much supplies had been used for the year (that is what has been used so far). He checked and found that at the end of June 2019 a total of $270 of supplies had been used for the period. So for the whole year a total of $270 of supplies has been used. S 80 SZ 90 zlo Both the Warehouse and Equipment are expected to be used evenly over their useful lives. The expected total useful lives and residual values of both assets is as follows: Estimated Useful life Estimated Residual Value Equipment 6 years S2 000 Furniture 10 years SI 300 (4) One customer has paid $500 cash to the business for some seafood on the 1" of June 2019. The seafood is for a party and will be delivered by the business to the customer on the 5 of July 2019. By the 30 of June 2019, $100 of the seafood has been delivered early to the customer and the rest will be delivered to the customer in July 2019 as promised by the business. (5) A physical stock take of inventory at 30 June 2019 revealed $43 680 on hand. (6) The owner paid $1200 cash for 8 months advertising on the 30 of June 2019. The advertising will occur for the period July until the end of end of February 2020. (7) The owner of the business wants to repair the equipment. He has signed a contract with someone to repair the equipment. He will pay $400 cash for the repairs after the repairs have been finished. The repairs will begin on the 14 of July 2019 and will finish on the 30% of July. Payment will then be made on the 1" of August 2019. So nothing will be done and nothing will be paid before 30 of June. (8) An electricity bill for $210 was received on the 24 of June. The telephone bill was also received on the 24 of June 2019 for $240. The electricity bill was paid on the 30 of June 2019 and the telephone bill has not been paid yet. Nothing has been recorded yet relating to the telephone and electricity bill by the business (9) It is estimated that a total of 2.5% of accounts receivables will not be collected during the period. (10) Rent for 12 months was paid on the 1" of April 2019 by the business. (11) Some seafood is sold to a customer on the 29th of June 2019 for $820. The customer has paid $100 cash for this sale and will pay the rest of the money the customer owes ($720) in July 2019. (12) The owner checked at the 30th of June and found that $380 of wages that should be paid for June 2019 have not been paid yet to the employees and nothing has been recorded yet for the wages still owing. REQUIRED: Prepare the appropriate adjusting journal entries to account for the information given in parts (1)-(12) above. (25 marks)