Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 AIO Limited uses a job-order costing system. The company applies manufacturing overhead to jobs using a predetermined overhead rate based on direct

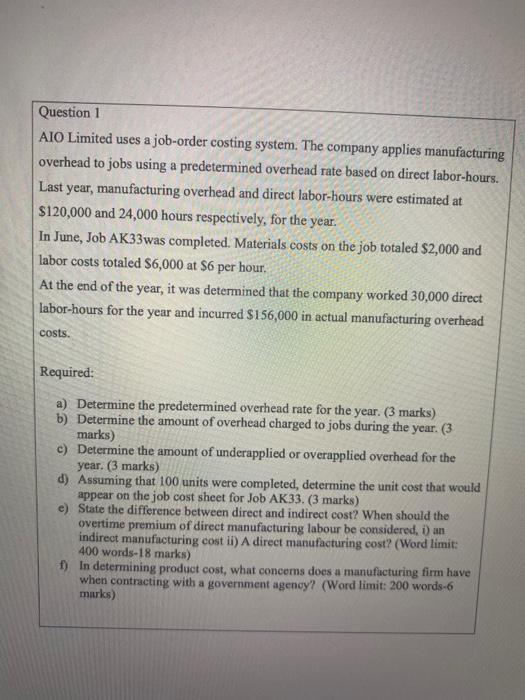

Question 1 AIO Limited uses a job-order costing system. The company applies manufacturing overhead to jobs using a predetermined overhead rate based on direct labor-hours. Last year, manufacturing overhead and direct labor-hours were estimated at $120,000 and 24,000 hours respectively, for the year. In June, Job AK33 was completed. Materials costs on the job totaled $2,000 and labor costs totaled $6,000 at $6 per hour. At the end of the year, it was determined that the company worked 30,000 direct labor-hours for the year and incurred $156,000 in actual manufacturing overhead costs. Required: a) Determine the predetermined overhead rate for the year. (3 marks) b) Determine the amount of overhead charged to jobs during the year. (3 marks) c) Determine the amount of underapplied or overapplied overhead for the year. (3 marks) d) Assuming that 100 units were completed, determine the unit cost that would appear on the job cost sheet for Job AK33. (3 marks) e) State the difference between direct and indirect cost? When should the overtime premium of direct manufacturing labour be considered, i) an indirect manufacturing cost ii) A direct manufacturing cost? (Word limit: 400 words-18 marks) f) In determining product cost, what concerns does a manufacturing firm have when contracting with a government agency? (Word limit: 200 words-6 marks)

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a Predetermined ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started