Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question #1: Alison & Co is a car manufacturing company and has made following transactions for the Month of August 2019. Aug 1: Issued

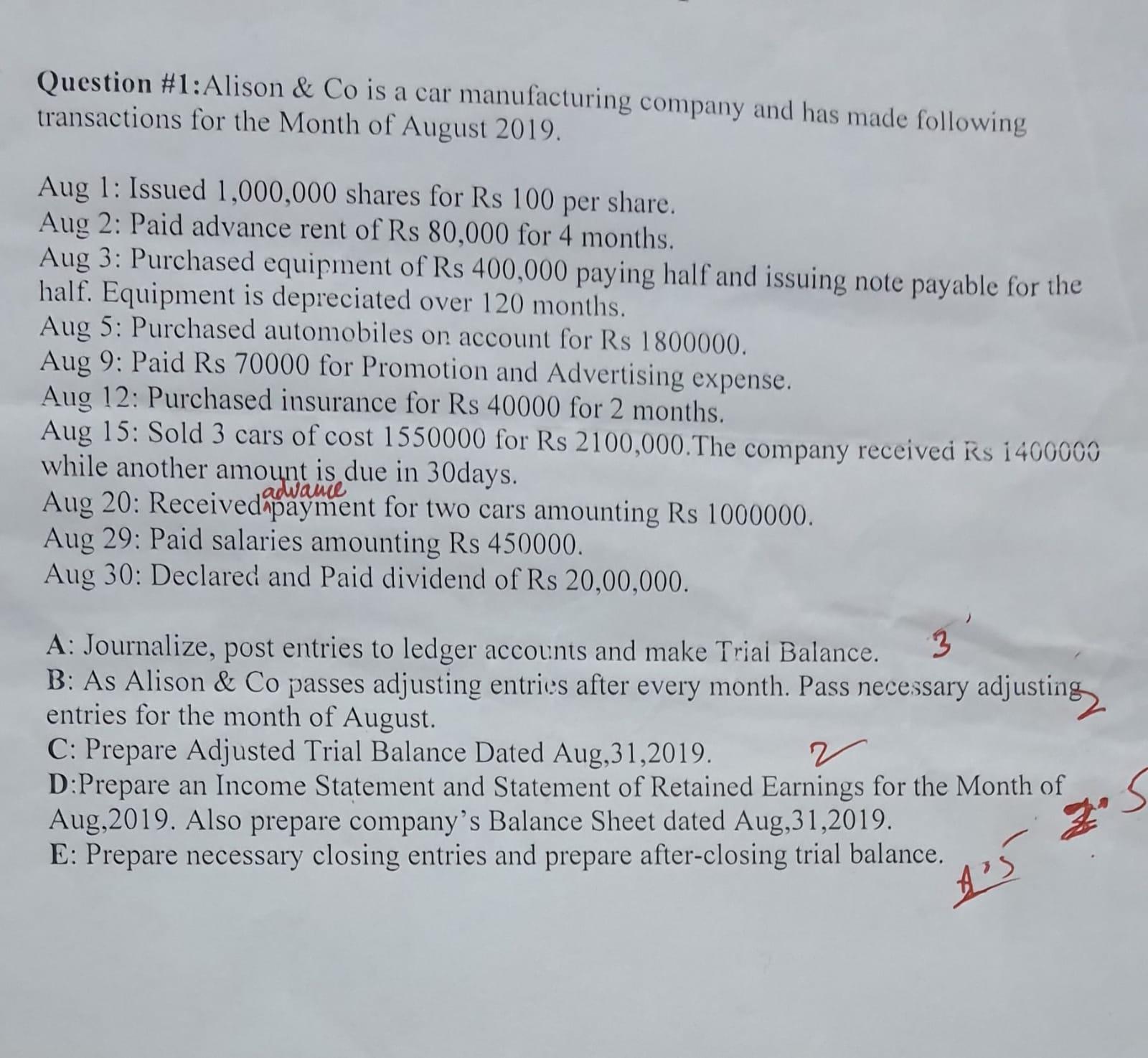

Question #1: Alison & Co is a car manufacturing company and has made following transactions for the Month of August 2019. Aug 1: Issued 1,000,000 shares for Rs 100 per share. Aug 2: Paid advance rent of Rs 80,000 for 4 months. Aug 3: Purchased equipment of Rs 400,000 paying half and issuing note payable for the half. Equipment is depreciated over 120 months. Aug 5: Purchased automobiles on account for Rs 1800000. Aug 9: Paid Rs 70000 for Promotion and Advertising expense. Aug 12: Purchased insurance for Rs 40000 for 2 months. Aug 15: Sold 3 cars of cost 1550000 for Rs 2100,000. The company received Rs 1400000 while another amount is due in 30days. advance Aug 20: Received payment for two cars amounting Rs 1000000. Aug 29: Paid salaries amounting Rs 450000. Aug 30: Declared and Paid dividend of Rs 20,00,000. A: Journalize, post entries to ledger accounts and make Trial Balance. 3 B: As Alison & Co passes adjusting entries after every month. Pass necessary adjusting entries for the month of August. C: Prepare Adjusted Trial Balance Dated Aug,31,2019. D:Prepare an Income Statement and Statement of Retained Earnings for the Month of Aug,2019. Also prepare company's Balance Sheet dated Aug,31,2019. E: Prepare necessary closing entries and prepare after-closing trial balance. r Z A's S

Step by Step Solution

★★★★★

3.61 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

A Journalize Aug 1 Issued 1000000 shares for Rs 100 per share Cash 1000000 Common Stock 1000000 Aug 2 Paid advance rent of Rs 80000 for 4 months Cash 80000 Prepaid Rent 80000 Aug 3 Purchased equipment ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started