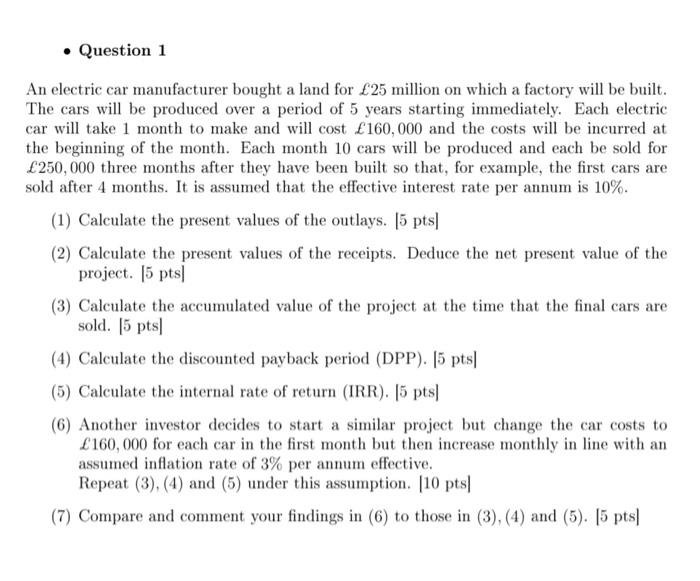

Question 1 An electric car manufacturer bought a land for 25 million on which a factory will be built. The cars will be produced over a period of 5 years starting immediately. Each electric car will take 1 month to make and will cost 160,000 and the costs will be incurred at the beginning of the month. Each month 10 cars will be produced and each be sold for 250,000 three months after they have been built so that, for example, the first cars are sold after 4 months. It is assumed that the effective interest rate per annum is 10%. (1) Calculate the present values of the outlays. (5 pts/ (2) Calculate the present values of the receipts. Deduce the net present value of the project. 5 pts (3) Calculate the accumulated value of the project at the time that the final cars are sold. 15 pts (4) Calculate the discounted payback period (DPP). 15 pts/ (5) Calculate the internal rate of return (IRR). 15 pts (6) Another investor decides to start a similar project but change the car costs to 160,000 for each car in the first month but then increase monthly in line with an assumed inflation rate of 3% per annum effective. Repeat (3), (4) and (5) under this assumption. [10 pts (7) Compare and comment your findings in (6) to those in (3), (4) and (5). 15 pts Question 1 An electric car manufacturer bought a land for 25 million on which a factory will be built. The cars will be produced over a period of 5 years starting immediately. Each electric car will take 1 month to make and will cost 160,000 and the costs will be incurred at the beginning of the month. Each month 10 cars will be produced and each be sold for 250,000 three months after they have been built so that, for example, the first cars are sold after 4 months. It is assumed that the effective interest rate per annum is 10%. (1) Calculate the present values of the outlays. (5 pts/ (2) Calculate the present values of the receipts. Deduce the net present value of the project. 5 pts (3) Calculate the accumulated value of the project at the time that the final cars are sold. 15 pts (4) Calculate the discounted payback period (DPP). 15 pts/ (5) Calculate the internal rate of return (IRR). 15 pts (6) Another investor decides to start a similar project but change the car costs to 160,000 for each car in the first month but then increase monthly in line with an assumed inflation rate of 3% per annum effective. Repeat (3), (4) and (5) under this assumption. [10 pts (7) Compare and comment your findings in (6) to those in (3), (4) and (5). 15 pts