Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An increase in the cost of heating and cooling a building may not reduce NOI if these costs can be passed along to the

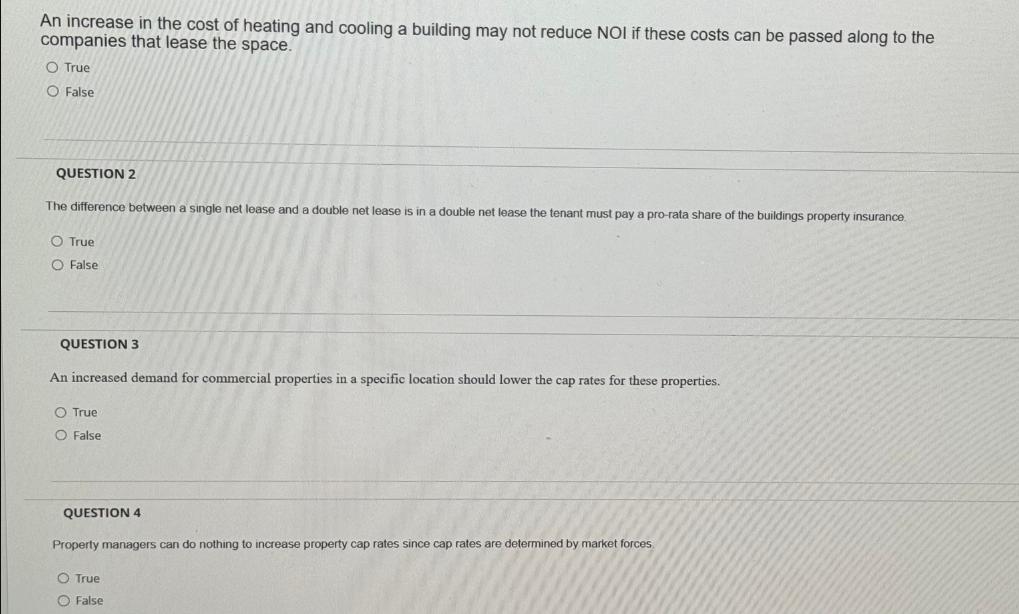

An increase in the cost of heating and cooling a building may not reduce NOI if these costs can be passed along to the companies that lease the space. O True O False QUESTION 2 The difference between a single net lease and a double net lease is in a double net lease the tenant must pay a pro-rata share of the buildings property insurance O True O False QUESTION 3 An increased demand for commercial properties in a specific location should lower the cap rates for these properties. O True O False QUESTION 4 Property managers can do nothing to increase property cap rates since cap rates are determined by market forces True False QUESTION 5 A triple net lease shifts more cost uncertainty to a tenant than a gross lease. O True O False QUESTION 6 Your investment rule is to only buy triple net lease properties that offer a positive NPV when the net operating income and sale of property is discounted back to the present at a 10% cost of capital. In other words, the discount rate you use in your calculations is 10%. Assume that you will pay the asking price. Your investment horizon is 15 years. At the end of 15 years you expect to sell the property for 30% more than you paid. Ignore taxes on capital gains. The price is $5 million. NOI is $300,000 per year for 15 years. You should invest in the following property? O True O False QUESTION 7 In a single net lease, the tenant pays base rent plus a pro-rata share of the building's property tax and a pro-rata share of utilities and janitorial services. O True O False 3.3333 points Save Answ 3.3333 points Save Answer 3.3333 points Save Answer QUESTION 8 An investor is trying to decide between two almost identical commercial properties, property A and property B. Property A has a cap rate of 10 and property B has a cap rate of 5. The investor should absolutely choose property A over property B. O True O False 3.3333 points Save Answer QUESTION 9 3.3333 points Save Answer If an investor/manager believes she can increase the net operating income of a building then she would probably view the current cap rate on the building as low and a potentially good investment. While other investors might see the property as overvalued. O True O False QUESTION 10 Base your answer on the following commercial real estate listing https://www.bouldergroup.com/media/pdf/CVS%20Pharmacy%20-%20Mobile,%20AL%20-%20OM.pdf If you believe the Cap Rate for this property should be at least 8, you would offer no more than $3,760,050.00 O True O False 3.3333 points Save Answer QUESTION 11 When considering an investment in a property that has a single tenant that credit rating of the tenant is fundamental to the value of the lease and therefore the property. O True O False QUESTION 12 A benefit of a gross lease is that it is easy for the tenant to forecast expenses related to the use of the property. O True O False 3.3333 points Save Answer 3.3333 points Save Answer QUESTION 13 3.3333 points Save Answer In a net lease, the landlord charges a lower base rent for the commercial space and then makes an additional charge to the tenant to cover expenses associated with operations, maintenance, and insurance that the landlord must pay. O True O False QUESTION 14 3.3333 points Save Ar A tenant who signs a triple net lease will pay three times for the space than a tenant who signs a single net lease for the same space. O True O False QUESTION 15 3.3333 points Save Answ Commercial properties with stable tenants should have lower cap rates than if these same buildings had very risk tenants. A risky tenant is one who is likely to default on lease payments. O True O False QUESTION 16 3.3333 points Save Answer In gross lease the tenant does not have to even think about electricity consumption, property insurance, taxes, or janitorial services. All of these are covered without limits in the tenant's gross lease payments. O True O False QUESTION 17 The risk associated with a property's net income will affect its cap rate. O True False QUESTION 18 When leases expire on major tenants in a shopping center the loss in rent will have a negative impact on both net operating income and net cash flow. O True O False QUESTION 19 Lease payments are a source of revenue to the landlord. O True O False QUESTION 20 A gross lease is always preferable to a triple net lease. O True O False 3.3333 points Save Answ 3.3333 points Save Answe 3.3333 points Save Answer 3.3333 points Save Answer QUESTION 21 An investor is trying to decide between two almost identical commercial properties, property A and property B. Property A has a cap rate of 10 and property B has a cap rate of 5. She must consider the possibility that the annual net operating income of property A is less certain or that the asking price for property B is too high or both. O True O False QUESTION 22 https://www.sec.gov/ix?doc=/Archives/edgar/data/1040971/000104097121000007/slg-20201231.htm According to the 10-K filed by SL Green Realty Corp for the fiscal year ended December 31st, 2020, 73% of One Vanderbilt was leased as of January 2021. O True O False QUESTION 23 Your investment rule is to only buy triple net lease properties that offer a positive NPV when the net operating income and sale of property is discounted back to the present at a 15% cost of capital. In other words, the discount rate you use in your calculations is 15%. Assume that you will pay the asking price. Your investment horizon is 15 years. At the end of 15 years you expect to sell the property for 30% more than you paid. Ignore taxes on capital gains. The price is $2 million. NOI is $400,000 per year for 15 years. You should invest in the following property? O True O False 3.3333 points Save A 3.3333 points Save Ans 3.3333 points Save Answe QUESTION 24 Based on the following press release SL Green Realty Corp., Manhattan's largest office landlord, is a fully integrated real estate investment trust, or REIT, that is focused primarily on acquiring, managing and maximizing value of Manhattan commercial properties. https://slgreen.com/sl-green-inks-three-leases-covering-81304-square-feet-at-one-vanderbilt-avenue/ O True O False 3.3333 points Sa QUESTION 25 Based on the following press release, 11 new leases were signed for One Vanderbilt over the course of the COVID Pandemic. This indicates that companies are looking beyond the pandemic and planning for a return to in office work. https://slgreen.com/sl-green-inks-three-leases-covering-81304-square-feet-at-one-vanderbilt-avenue/ O True O False QUESTION 26 Base your answers on the following real estate listings: http://www.bouldergroup.com/media/pdf/Bank%20of%20America%20-%20Buffalo%20Grove,%20IL%20-%20OM.pdf http://www.bouldergroup.com/media/pdf/Walgreens%20-%20Franklin,%20WI%20-%20OM.pdf 9909 W Loomis Road Franklin, WI 53132 is better investment than 1355 W Dundee Road, Buffalo Grove, IL 60089 because it has a lower cap rate. True False 3.3333 points Save 3.3333 points Save A QUESTION 27 A tenant should carefully negotiate with the landlord the terms of a net lease before signing the lease. O True O False QUESTION 28 The capitalization rate, "cap rate" measures the annual net operating income of a commercial property relative to its market value. O True O False QUESTION 29 You should never buy an income producing property that has a cap rate that is low relative to other properties in the neighborhood. O True O False. 3.3333 po 3.3333 poin 3.3333 points QUESTION 30 You are searching for a commercial property to buy in Brooklyn. You have narrowed your search down to three properties. Property (1) has a cap rate of 7, property (2) has a cap rate of 8, and (property (3) has a cap rate of 6. Property (3) must be the better choice because the cap rate implies that property (3) has the highest net income of the three properties. O True O False 3.3333 points Save Answ

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the answers to the questions Question 1 True An increase in the cost of heating and cooling a building may not reduce NOI if these costs can be passed along to the tenants Question 2 False Th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started