Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 An investment analyst has formulated two investment portfolios consisting of options, based on his market outlook in the coming one month. The

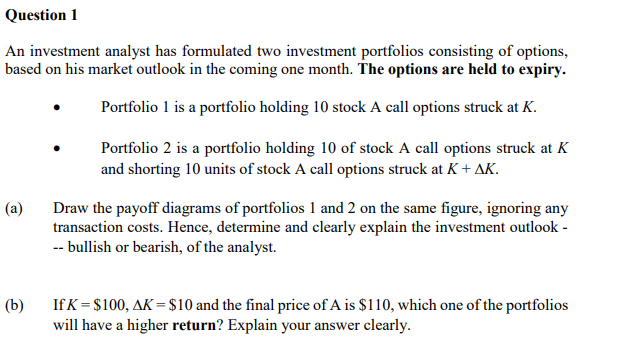

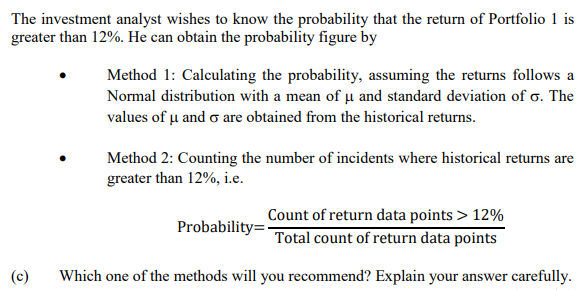

Question 1 An investment analyst has formulated two investment portfolios consisting of options, based on his market outlook in the coming one month. The options are held to expiry. (a) (b) Portfolio 1 is a portfolio holding 10 stock A call options struck at K. Portfolio 2 is a portfolio holding 10 of stock A call options struck at K and shorting 10 units of stock A call options struck at K + AK. Draw the payoff diagrams of portfolios 1 and 2 on the same figure, ignoring any transaction costs. Hence, determine and clearly explain the investment outlook - -- bullish or bearish, of the analyst. If K-$100, AK = $10 and the final price of A is $110, which one of the portfolios will have a higher return? Explain your answer clearly. The investment analyst wishes to know the probability that the return of Portfolio 1 is greater than 12%. He can obtain the probability figure by Method 1: Calculating the probability, assuming the returns follows a Normal distribution with a mean of and standard deviation of . The values of and are obtained from the historical returns. Method 2: Counting the number of incidents where historical returns are greater than 12%, i.e. Probability= Count of return data points > 12% Total count of return data points (c) Which one of the methods will you recommend? Explain your answer carefully.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started