Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 and 2 Given information for questions 1 and 2 The following balances were presented to you from the accounting records of Mageza Transport

Question 1 and 2

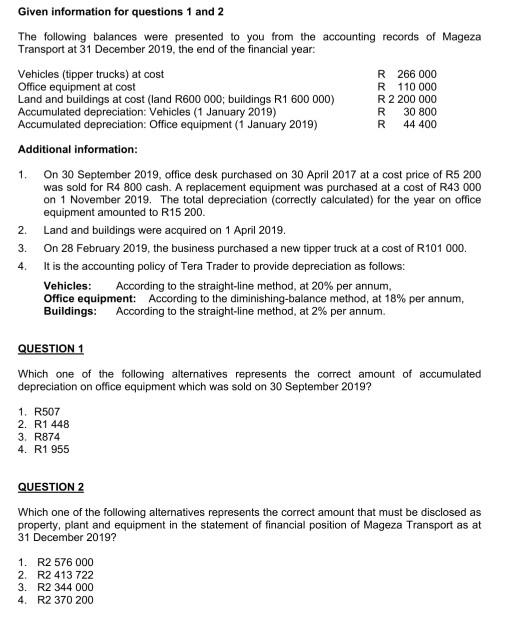

Given information for questions 1 and 2 The following balances were presented to you from the accounting records of Mageza Transport at 31 December 2019, the end of the financial year. Vehicles (tipper trucks) at cost Office equipment at cost Land and buildings at cost (land R600 000; buildings R1 600 000) Accumulated depreciation: Vehicles (1 January 2019) Accumulated depreciation: Office equipment (1 January 2019) R 266 000 R 110 000 R 2 200 000 30 800 R 44 400 R Additional information: 1. 2. 3. 4. On 30 September 2019, office desk purchased on 30 April 2017 at a cost price of R5 200 was sold for R4 800 cash. A replacement equipment was purchased at a cost of R43 000 on 1 November 2019. The total depreciation (correctly calculated) for the year on office equipment amounted to R15 200. Land and buildings were acquired on 1 April 2019. On 28 February 2019, the business purchased a new tipper truck at a cost of R101 000. It is the accounting policy of Tera Trader to provide depreciation as follows: Vehicles: According to the straight-line method, at 20% per annum Office equipment: According to the diminishing-balance method, at 18% per annum, Buildings: According to the straight-line method, at 2% per annum. QUESTION 1 Which one of the following alternatives represents the correct amount of accumulated depreciation on office equipment which was sold on 30 September 2019? 1. R507 2. R1 448 3. R874 4. R1 955 QUESTION 2 Which one of the following alternatives represents the correct amount that must be disclosed as property, plant and equipment in the statement of financial position of Mageza Transport as at 31 December 2019? 1. R2 576 000 2. R2 413 722 3. R2 344 000 4. R2 370 200Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started