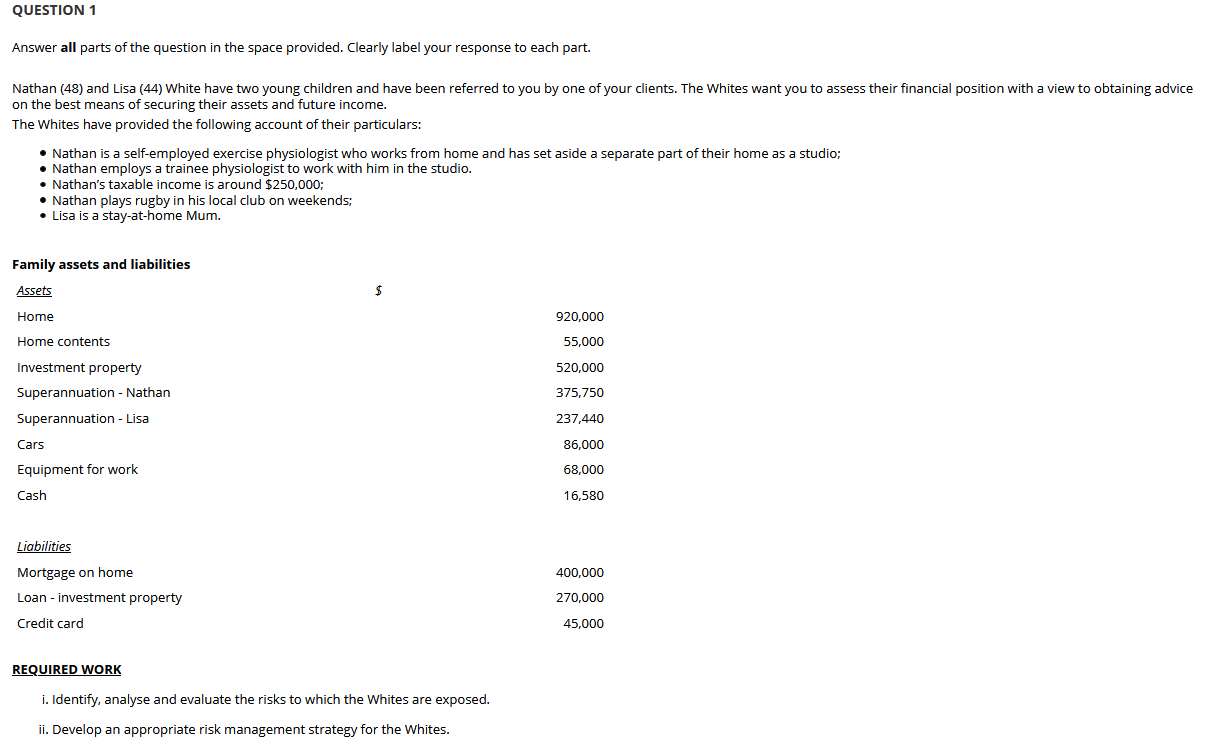

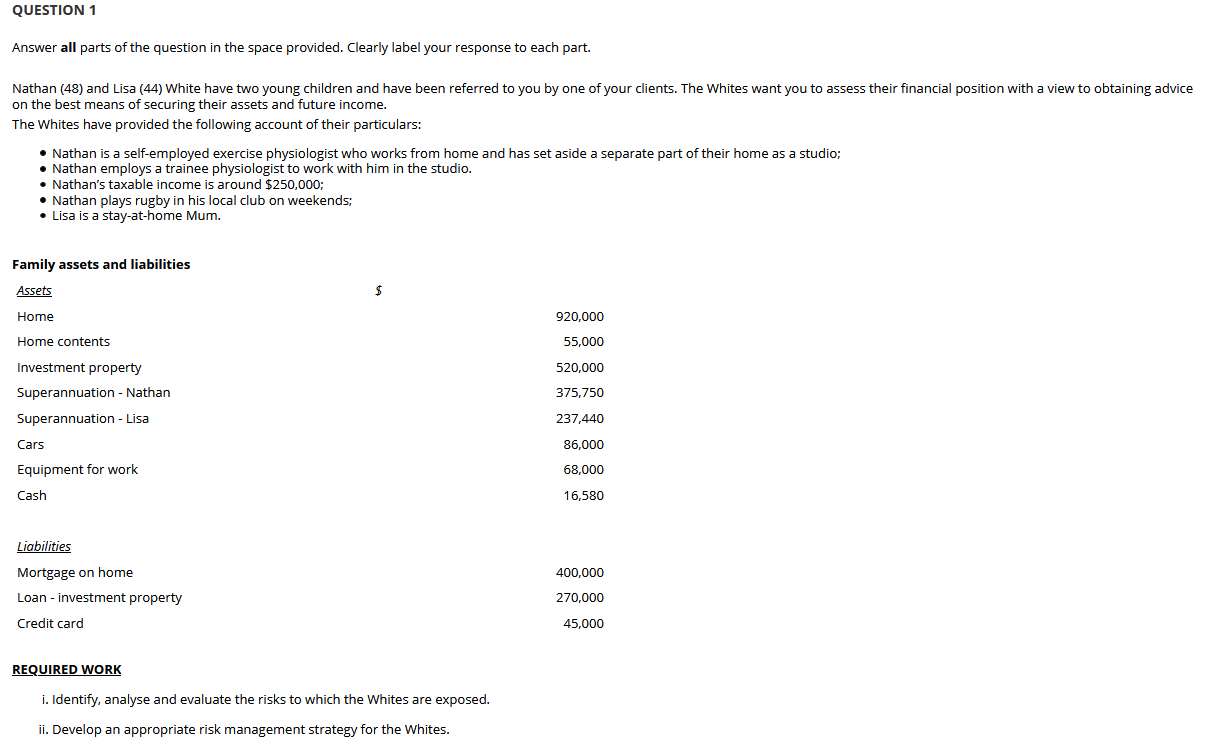

QUESTION 1 Answer all parts of the question in the space provided. Clearly label your response to each part. Nathan (48) and Lisa (44) White have two young children and have been referred to you by one of your clients. The Whites want you to assess their financial position with a view to obtaining advice on the best means of securing their assets and future income. The Whites have provided the following account of their particulars: Nathan is a self-employed exercise physiologist who works from home and has set aside a separate part of their home as a studio; Nathan employs a trainee physiologist to work with him in the studio. Nathan's taxable income is around $250,000; Nathan plays rugby in his local club on weekends: Lisa is a stay-at-home Mum. Family assets and liabilities Assets $ Home 920,000 Home contents 55,000 Investment property 520,000 Superannuation - Nathan 375,750 Superannuation - Lisa 237,440 Cars 86,000 Equipment for work 68,000 Cash 16,580 Liabilities Mortgage on home 400,000 Loan - investment property 270,000 Credit card 45,000 REQUIRED WORK i. Identify, analyse and evaluate the risks to which the Whites are exposed. ii. Develop an appropriate risk management strategy for the Whites. and Usa White to your children and have been referred to you by you the young on the best means of secuestrado The Witwe provided the fact the parti na med sept who were the per an employs the work with 't com 12.B Nathan play ruchy i local club on wed as a home home Family and lates estment property Superannuation Nathan Supon 177 Cars qument for work 1.000 00.000 Moon home Lowest property crest card 270.000 1.000 REQUIRED WORK dennity, are and water to which the whole Device appropriate for the QUESTION 1 Answer all parts of the question in the space provided. Clearly label your response to each part. Nathan (48) and Lisa (44) White have two young children and have been referred to you by one of your clients. The Whites want you to assess their financial position with a view to obtaining advice on the best means of securing their assets and future income. The Whites have provided the following account of their particulars: Nathan is a self-employed exercise physiologist who works from home and has set aside a separate part of their home as a studio; Nathan employs a trainee physiologist to work with him in the studio. Nathan's taxable income is around $250,000; Nathan plays rugby in his local club on weekends: Lisa is a stay-at-home Mum. Family assets and liabilities Assets $ Home 920,000 Home contents 55,000 Investment property 520,000 Superannuation - Nathan 375,750 Superannuation - Lisa 237,440 Cars 86,000 Equipment for work 68,000 Cash 16,580 Liabilities Mortgage on home 400,000 Loan - investment property 270,000 Credit card 45,000 REQUIRED WORK i. Identify, analyse and evaluate the risks to which the Whites are exposed. ii. Develop an appropriate risk management strategy for the Whites. and Usa White to your children and have been referred to you by you the young on the best means of secuestrado The Witwe provided the fact the parti na med sept who were the per an employs the work with 't com 12.B Nathan play ruchy i local club on wed as a home home Family and lates estment property Superannuation Nathan Supon 177 Cars qument for work 1.000 00.000 Moon home Lowest property crest card 270.000 1.000 REQUIRED WORK dennity, are and water to which the whole Device appropriate for the