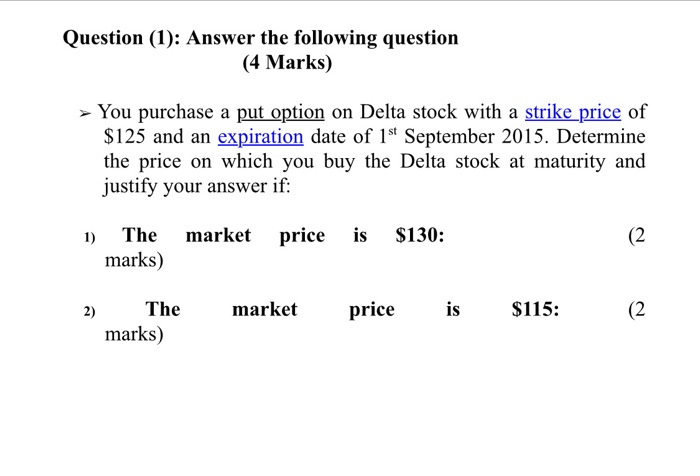

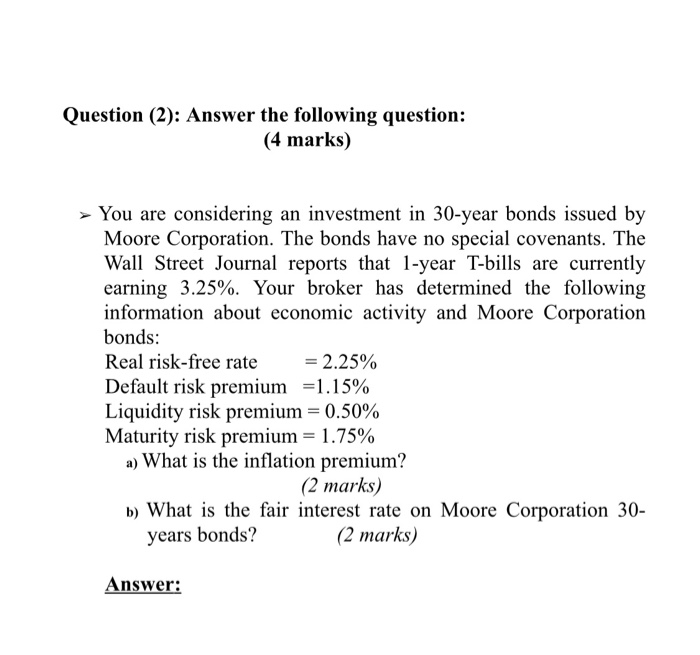

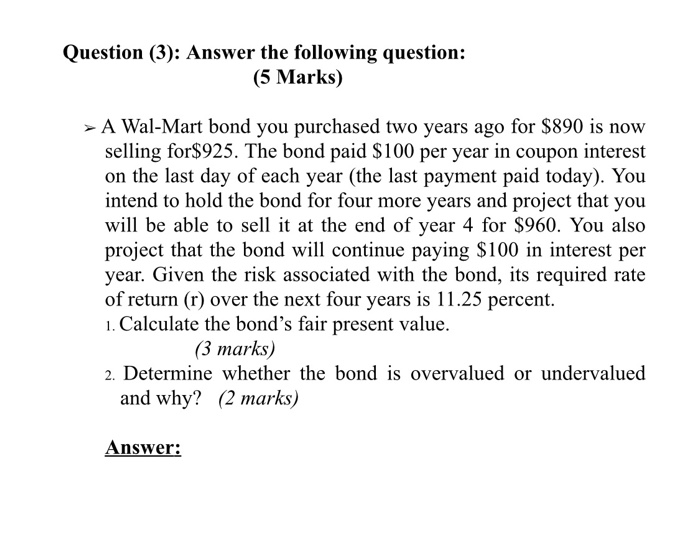

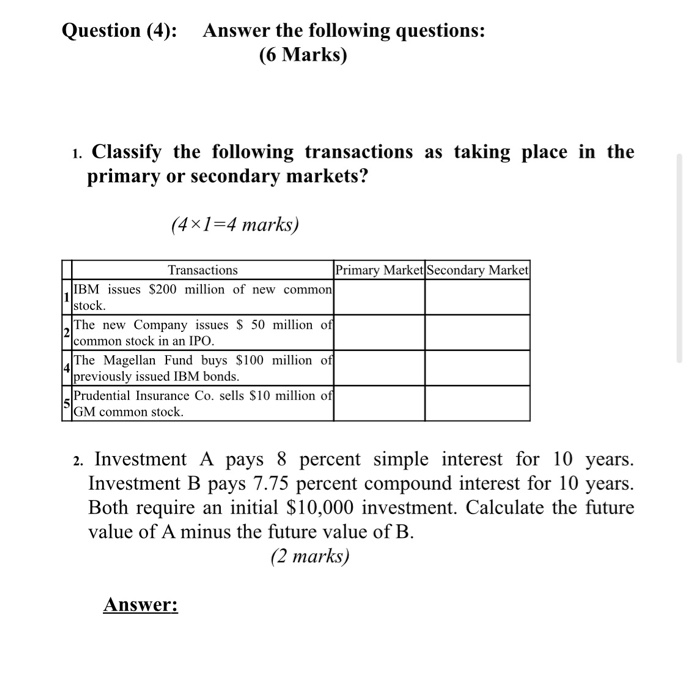

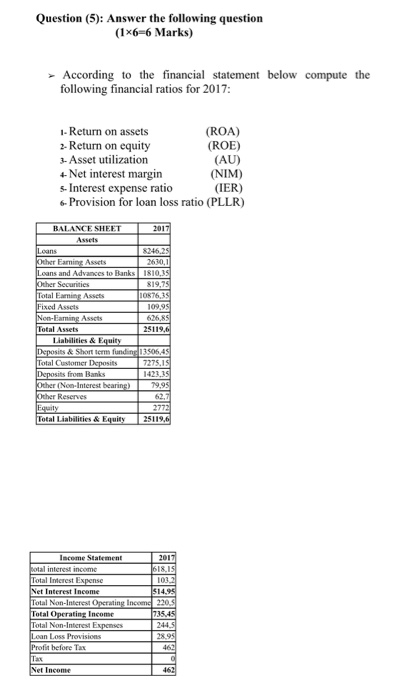

Question (1): Answer the following question (4 Marks) > You purchase a put option on Delta stock with a strike price of $125 and an expiration date of 1st September 2015. Determine the price on which you buy the Delta stock at maturity and justify your answer if: price is $130: (2 1) The market marks) 2) The marks) market price is $115: (2 Question (2): Answer the following question: (4 marks) > You are considering an investment in 30-year bonds issued by Moore Corporation. The bonds have no special covenants. The Wall Street Journal reports that 1-year T-bills are currently earning 3.25%. Your broker has determined the following information about economic activity and Moore Corporation bonds: Real risk-free rate = 2.25% Default risk premium =1.15% Liquidity risk premium = 0.50% Maturity risk premium = 1.75% a) What is the inflation premium? (2 marks) b) What is the fair interest rate on Moore Corporation 30- years bonds? (2 marks) Answer: Question (3): Answer the following question: (5 Marks) > A Wal-Mart bond you purchased two years ago for $890 is now selling for$925. The bond paid $100 per year in coupon interest on the last day of each year (the last payment paid today). You intend to hold the bond for four more years and project that you will be able to sell it at the end of year 4 for $960. You also project that the bond will continue paying $100 in interest per year. Given the risk associated with the bond, its required rate of return (r) over the next four years is 11.25 percent. 1. Calculate the bond's fair present value. (3 marks) 2. Determine whether the bond is overvalued or undervalued and why? (2 marks) Answer: Question (4): Answer the following questions: (6 Marks) 1. Classify the following transactions as taking place in the primary or secondary markets? (4x1=4 marks) Transactions Primary Market Secondary Market IBM issues $200 million of new common stock. The new Company issues $ 50 million of common stock in an IPO. The Magellan Fund buys $100 million of previously issued IBM bonds. [Prudential Insurance Co. sells $10 million of IGM common stock 2. Investment A pays 8 percent simple interest for 10 years. Investment B pays 7.75 percent compound interest for 10 years. Both require an initial $10,000 investment. Calculate the future value of A minus the future value of B. (2 marks) Answer: Question (5): Answer the following question (1x6-6 Marks) According to the financial statement below compute the following financial ratios for 2017: 1- Return on assets (ROA) 2- Return on equity (ROE) 3- Asset utilization (AU) +-Net interest margin (NIM) s Interest expense ratio (IER) 6- Provision for loan loss ratio (PLLR) BALANCE SHEET 2017 $19.95 8246.25 Other Earning Assets 2630,1 Loans and Advances to anks ISO 15 Other Securities Totalwing Assets Fixed Assets Nonaming Assets 626,85 Total Assets 25119.6 Liabilities & Equity Deposits & Short term funding 13506,45 Total Customer Deposits 7 275.15 Deposits from Banks 1423.35 Other (Non-Interest bearing) 79,99 Other Reserves Equity 2772 Total Liabilities & Equity 25119,6 lace 2017 Focal interest income ISIS Total Interest Expense 101 Net Interest Income $14.95 Total No O rating Inced 2205 Total Operating Income 35.45 Tel Non-interest Loan Loss Provisions Profit before Tax Net Income