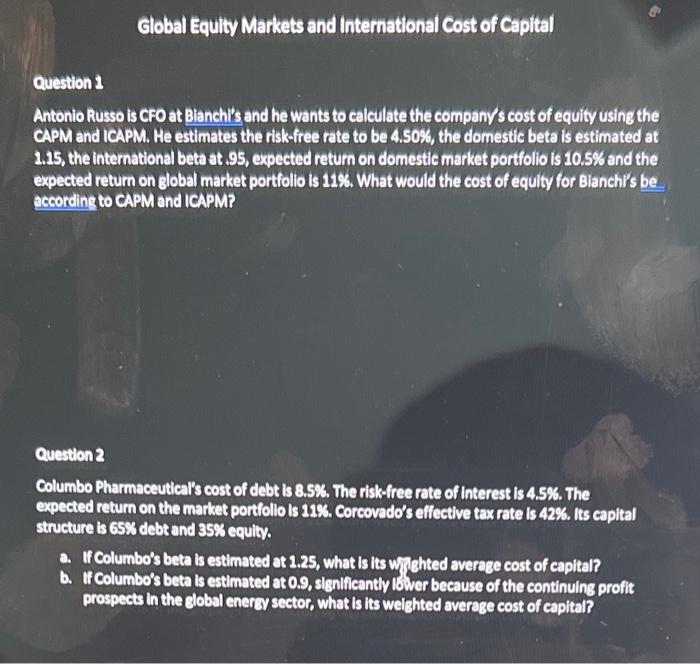

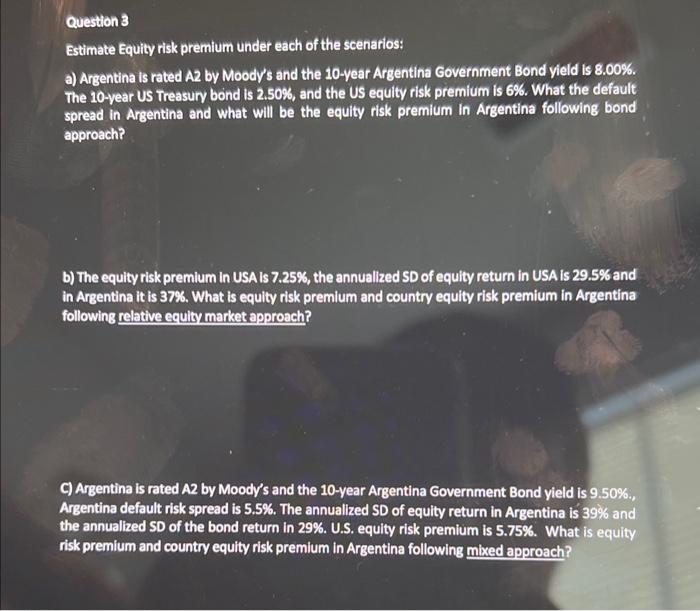

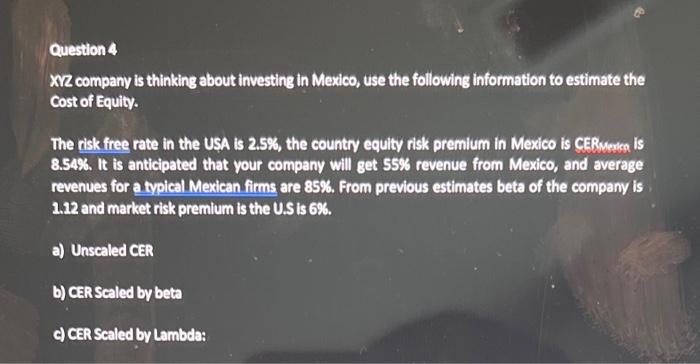

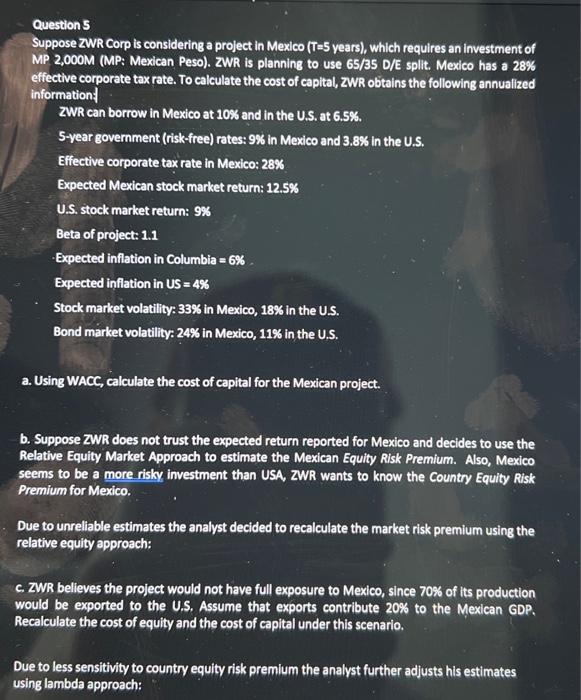

Question 1 Antonio Russo is CFO at Bianchi's and he wants to calculate the company's cost of equity using the CAPM and ICAPM. He estimates the risk-free rate to be 4.50%, the domestic beta is estimated at 1.15, the international beta at .95, expected return on domestic market portfolio is 10.5% and the expected retum on global market portfolio is 11%. What would the cost of equity for Bianchi's be according to CAPM and ICAPM? Question 2 Columbo Pharmaceutical's cost of debt is 8.5%. The risk-free rate of interest is 4.5%. The expected return on the market portiolio is 12\%. Corcovado's effective tax rate is 42%. Its capital structure is 65% debtand 35% equity. a. If Columbo's beta is estimated at 2.25 , what is its wishted average cost of capital? b. If Columbo's beta is estimated at 0.9 , significantly lower because of the continuing profit prospects in the global enerzy sector, what is its weighted average cost of capital? Question 3 Estimate Equity risk premium under each of the scenarios: a) Argentina is rated A2 by Moody's and the 10-year Argentina Government Bond yield is 8.00%. The 10-year US Treasury bond is 2.50%, and the US equity risk premium is 6%. What the default spread in Argentina and what will be the equity risk premium in Argentina following bond approach? b) The equity risk premium in USA Is 7.25%, the annualized SD of equity return in USA is 29.5% and in Argentina it is 37\%. What is equity risk premium and country equity risk premium in Argentina following relative equlty market approach? C) Argentina is rated A2 by Moody's and the 10-year Argentina Government Bond yield is 9.50%., Argentina default risk spread is 5.5\%. The annualized SD of equity return in Argentina is 39% and the annualized SD of the bond return in 29\%. U.S. equity risk premium is 5.75\%. What is equity risk premium and country equity risk premium in Argentina following mixed approach? Question 4 XZ company is thinking about investing in Mexico, use the following information to estimate the Cost of Equiby. The risk free rate in the USA is 2.5%, the country equity risk premium in Mexico is CERverka is 8.54\%. It is anticipated that your company will get 55% revenue from Mexico, and average revenues for a typical Mexican firms are 85%. From previous estimates beta of the company is 1.12 and market risk premium is the U.S is 6%. a) Unscaled CER b) CER Scaled by beta c) CER Scaled by Lambda: Question 5 Suppose ZWR Corp is considering a project in Mexico (T=5 years), which requires an investment of MP 2,000M (MP: Mexican Peso). ZWR is planning to use 65/35 D/E split. Mexico has a 28% effective corporate tax rate. To calculate the cost of capital, ZWR obtains the following annualized information: ZWR can borrow in Mexico at 10% and in the U.S. at 6.5%. 5-year government (risk-free) rates: 9% in Mexico and 3.8% in the U.S. Effective corporate tax rate in Mexico: 28% Expected Mexican stock market return: 12.5\% U.S. stock market return: 9% Beta of project: 1.1 - Expected inflation in Columbia =6% Expected inflation in US =4% Stock market volatility: 33% in Mexico, 18% in the U.S. Bond market volatility: 24% in Mexico, 11% in the U.S. a. Using WACC, calculate the cost of capital for the Mexican project. b. Suppose ZWR does not trust the expected return reported for Mexico and decides to use the Relative Equity Market Approach to estimate the Mexican Equity Risk Premium. Also, Mexico seems to be a more risky investment than USA, ZWR wants to know the Country Equity Risk Premium for Mexico. Due to unreliable estimates the analyst decided to recalculate the market risk premium using the relative equity approach: c. ZWR believes the project would not have full exposure to Mexico, since 70% of its production would be exported to the U.S. Assume that exports contribute 20% to the Mexican GDP. Recalculate the cost of equity and the cost of capital under this scenario. Due to less sensitivity to country equity risk premium the analyst further adjusts his estimates using lambda approach