Question 1. Assume that you are a managing director of a company, generally instruct your accountants to

Fantastic news! We've Found the answer you've been seeking!

Question:

Question 1.

- Assume that you are a managing director of a company, generally instruct your accountants to prepare financial statements for the company's stakeholders. Who are the main stakeholders of the firm. Do these stakeholders really care about this information. Why or why not? How does stock market react to announce of accounting information including earnings and dividends?

- The company's credit officer recently approached a local bank for a loan arrangement. However, the credit department of the bank declined to sanction the loan. Critically explore at least three factors why such decision was made by the bank?

- As a managing director of the company, with the objective to improve shareholders' wealth, how does a firm improve shareholder equity with clear example? From Financial Accounting perspective, why does accounting equation is matter for firm's management and its stakeholders?

Question 2

| 2019 | 2020 | 2021 | |

| INCOME STATEMENT | in ('000) | in ('000) | in ('000) |

| Revenue | 102,007 | 118,086 | 131,345 |

| cost of goods sold | 39,023 | 48,004 | 49,123 |

| Gross Profit | ? | ? | ? |

| Salaries and benefit | 26,427 | 22,658 | 23,872 |

| Depreciation and Amortization | 19,500 | 18,150 | 17,205 |

| Rent and overhead | 10,963 | 10,125 | 10,087 |

| Interest expenses | 2,500 | 2,500 | 2,500 |

| total expenses | 59,390 | 53,433 | 53,664 |

| Earning Before Tax | ? | ? | ? |

| Taxes | 1,120 | 4,858 | 8,483 |

| Net earning | ? | ? | ? |

| BALANCE SHEET | |||

| Assets | |||

| Cash | 167,971 | 181,210 | 183,715 |

| Account Receivable | 5,100 | 5,904 | 6,567 |

| Inventory | 7,805 | 9,601 | 9,825 |

| net Plant property and equipment | 45,500 | 42,350 | 40,145 |

| Total asset | 226,376 | 239,065 | 240,252 |

| Liabilities | |||

| account payable | 3,902 | 4,800 | 4,912 |

| long term debt | 50,000 | 50,000 | 30,000 |

| total debt | 53,902 | 54,800 | 54,912 |

| equity capital | 170,000 | 170,000 | 170,000 |

| Retained earning (assume no dividend paid) | ? | ? | ? |

| Shareholders' equity | ? | ? | ? |

| Liability + Equipment | ? | ? | ? |

| CASH FLOW STATEMENT | |||

| Operating cash flow (Indirect method) | |||

| XXXX (?) | ? | ? | ? |

| Add XXXX | ? | ? | ? |

| change in net working capital (+, -) | 9003 | ? | ? |

| cash flow from operation | ? | ? | ? |

| Investing cash flow | |||

| Investment in Property and equipment | 15000 | 15000 | 15000 |

| Cash flow from investing activities | |||

| Financing Cashflow | |||

| Issuance (repayment) of debt | 0 | 0 | -20000 |

| issuance of equity | 170000 | 0 | 0 |

| cash flow from financing | ? | ? | ? |

| net increase in cash flow for the year end | ? | ? | ? |

| opening cash flow | 0 | 167,971 | 181,210 |

| closing cash balance for the end of the year | ? | ? | ? |

Requirements

- -Calculate earnings before taxes, Net earnings, Total Liability and Equity .

- -Using indirect method of cash flow calculation, determine the cash flow from operating activities, cash flow from financing activities, cash flow investing activities and ending cash balance for the financial year.

- -Why do you think it is important to understand interlinkage among cash flows statement, income statement and balance sheet? How would an increase in depreciation of $100, impact these three statements?

Question 3

- Discuss alternative ways companies uses ratios to measure the performance and their significance to different categories of stakeholders.

- Explain the use of ratios as threshold by banks in loan covenant?

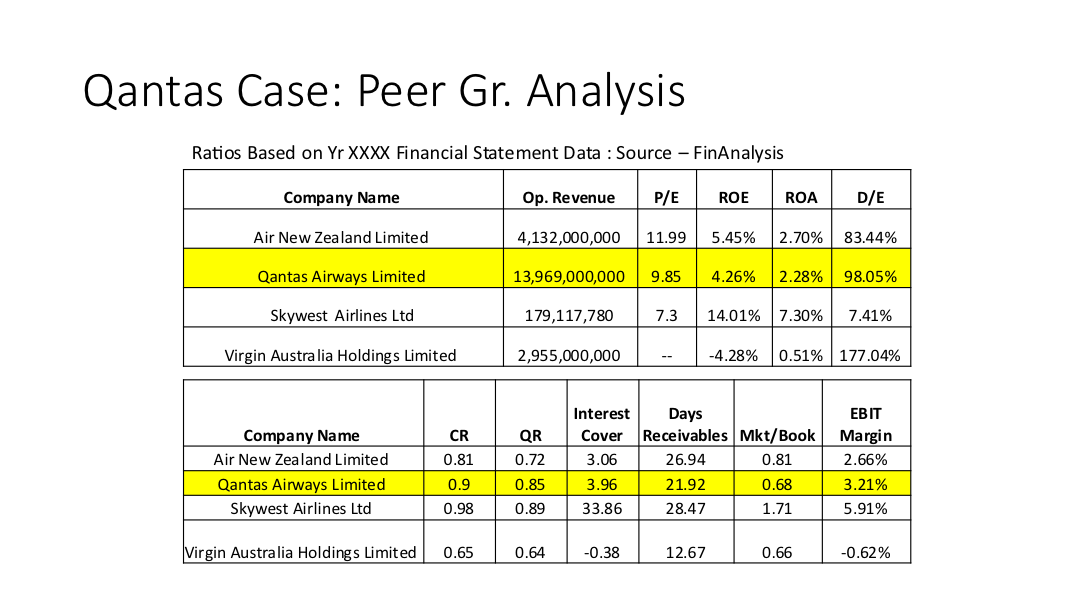

- Assum that you are tasked with the analysis airlines industry (see the table below) and require to evaluate and compare their performances from the perspective of a financial analyst. In particular you compare their performances in term of profitability, solvency, riskiness, marketability and growth prospect of the firm and comments appropriately.

Related Book For

Dynamic Business Law

ISBN: 9781260733976

6th Edition

Authors: Nancy Kubasek, M. Neil Browne, Daniel Herron, Lucien Dhooge, Linda Barkacs

Posted Date: