Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 Assume the current exchange rate is $1.20 per Euro and the interest rate in the United States is 2% while the interest

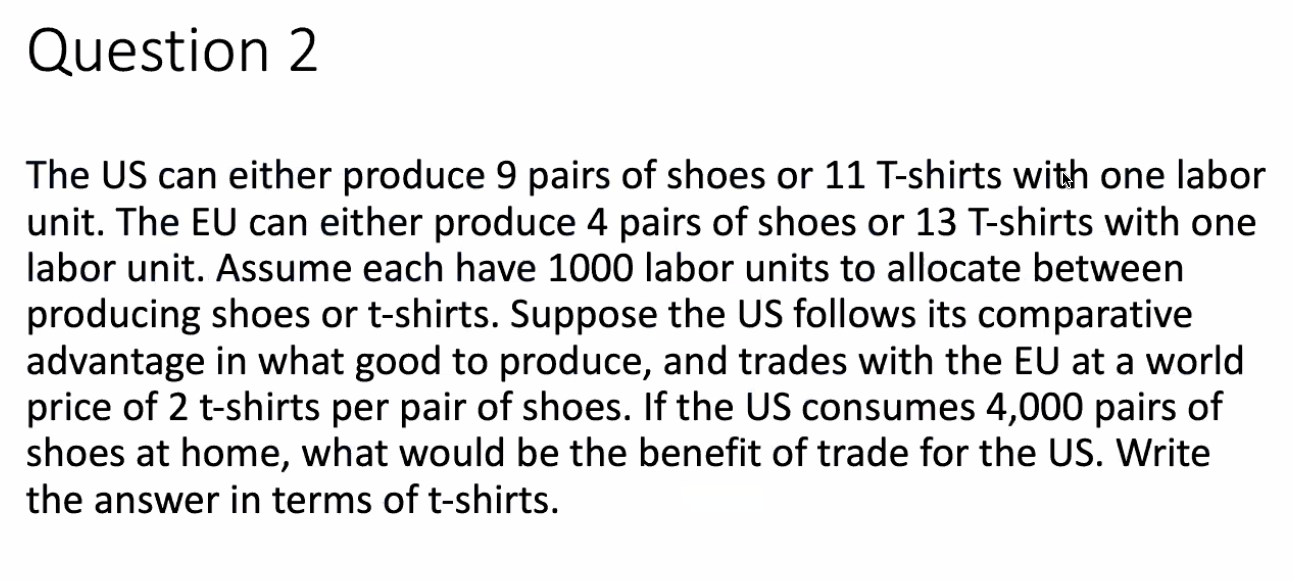

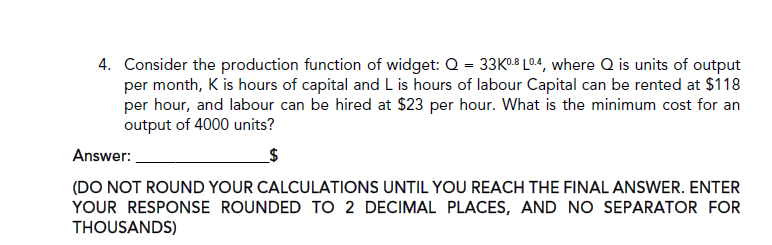

Question 1 Assume the current exchange rate is $1.20 per Euro and the interest rate in the United States is 2% while the interest rate in Europe is 1%. The one-year forward exchange rate is $1.19 per Euro. Does this situation provide for an arbitrage opportunity? What arbitrage profit can be achieved with 100,000 euros? Question 2 The US can either produce 9 pairs of shoes or 11 T-shirts with one labor unit. The EU can either produce 4 pairs of shoes or 13 T-shirts with one labor unit. Assume each have 1000 labor units to allocate between producing shoes or t-shirts. Suppose the US follows its comparative advantage in what good to produce, and trades with the EU at a world price of 2 t-shirts per pair of shoes. If the US consumes 4,000 pairs of shoes at home, what would be the benefit of trade for the US. Write the answer in terms of t-shirts. 4. Consider the production function of widget: Q = 33K 0.8 0.4, where Q is units of output per month, K is hours of capital and L is hours of labour Capital can be rented at $118 per hour, and labour can be hired at $23 per hour. What is the minimum cost for an output of 4000 units? Answer: (DO NOT ROUND YOUR CALCULATIONS UNTIL YOU REACH THE FINAL ANSWER. ENTER YOUR RESPONSE ROUNDED TO 2 DECIMAL PLACES, AND NO SEPARATOR FOR THOUSANDS)

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

135907647 1 Calculate the return on investment in the US and Europe In the US 2 i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started