Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 Assume you invested $25,000 into the stock market. How much would you have at the end of 45 years if you earned

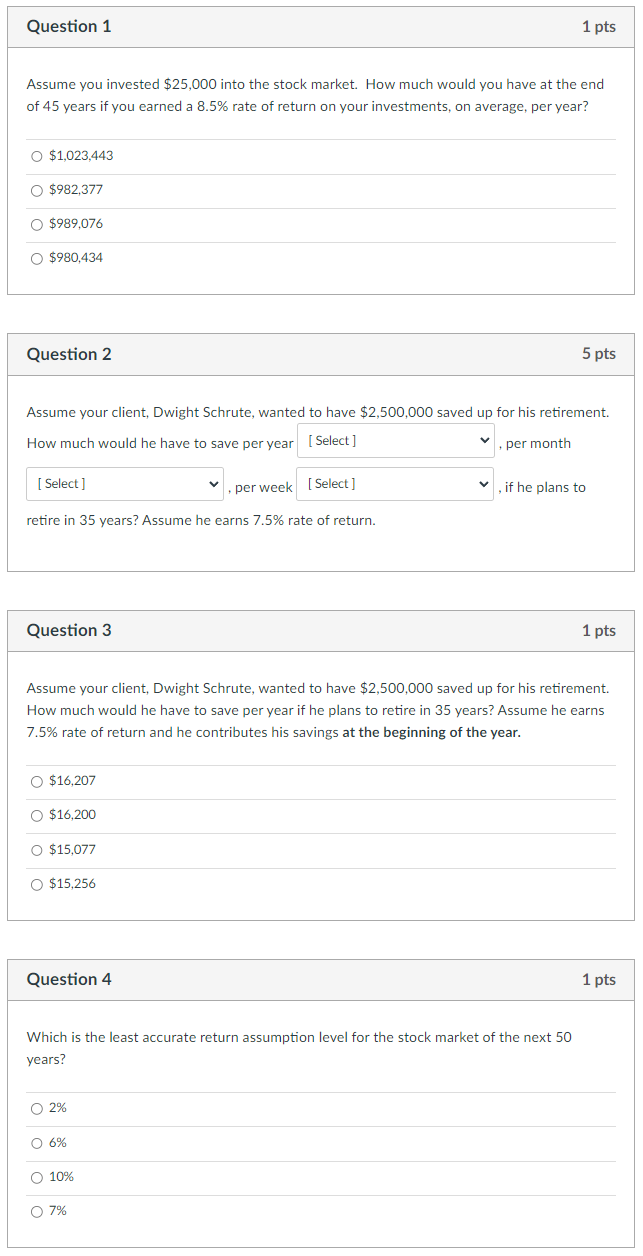

Question 1 Assume you invested $25,000 into the stock market. How much would you have at the end of 45 years if you earned a 8.5% rate of return on your investments, on average, per year? O $1,023,443 O $982,377 O $989,076 O $980,434 Question 2 [Select] Assume your client, Dwight Schrute, wanted to have $2,500,000 saved up for his retirement. How much would he have to save per year [Select] , per month per week [Select] retire in 35 years? Assume he earns 7.5% rate of return. Question 3 O $16,207 O $16,200 O $15.077 O $15,256 Question 4 Assume your client, Dwight Schrute, wanted to have $2,500,000 saved up for his retirement. How much would he have to save per year if he plans to retire in 35 years? Assume he earns 7.5% rate of return and he contributes his savings at the beginning of the year. Which is the least accurate return assumption level for the stock market of the next 50 years? O 2% O 6% 1 pts O 10% 5 pts O 7% , if he plans to 1 pts 1 pts

Step by Step Solution

★★★★★

3.35 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Based on the information provided in the sources here are the answers to the questions Questio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started