Answered step by step

Verified Expert Solution

Question

1 Approved Answer

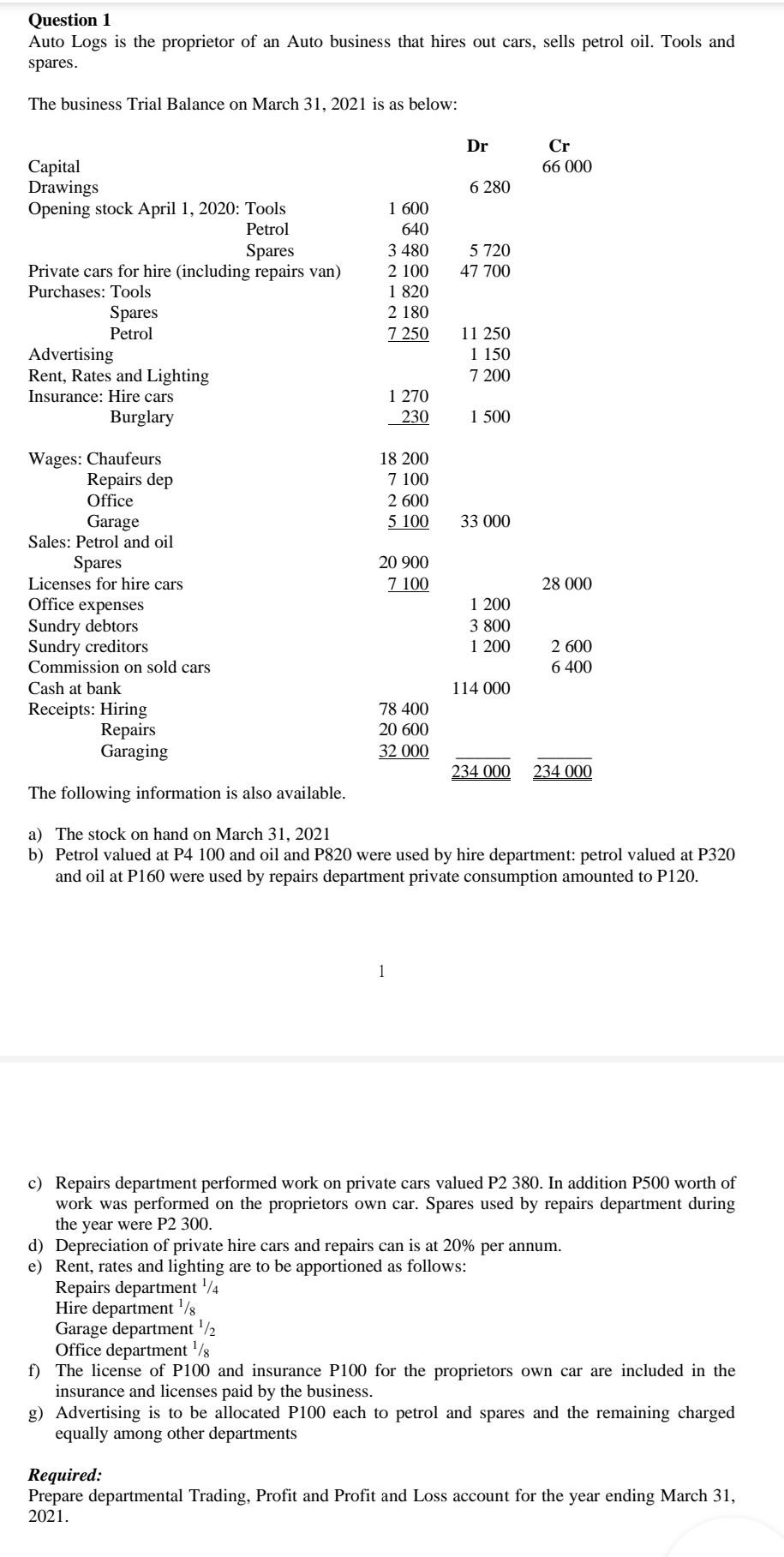

Question 1 Auto Logs is the proprietor of an Auto business that hires out cars, sells petrol oil. Tools and spares. The business Trial Balance

Question 1 Auto Logs is the proprietor of an Auto business that hires out cars, sells petrol oil. Tools and spares. The business Trial Balance on March 31, 2021 is as below: Dr Cr 66 000 6 280 Capital Drawings Opening stock April 1, 2020: Tools Petrol Spares Private cars for hire (including repairs van) Purchases: Tools Spares Petrol Advertising Rent, Rates and Lighting Insurance: Hire cars Burglary 1 600 640 3 480 2 100 1 820 2 180 7 250 5 720 47 700 11 250 1 150 7 200 1 270 230 1 500 18 200 7 100 2 600 5 100 33 000 20 900 7 100 28 000 Wages: Chaufeurs Repairs dep Office Garage Sales: Petrol and oil Spares Licenses for hire cars Office expenses Sundry debtors Sundry creditors Commission on sold cars Cash at bank Receipts: Hiring Repairs Garaging 1 200 3 800 1 200 2 600 6 400 114 000 78 400 20 600 32 000 234 000 234 000 The following information is also available. a) The stock on hand on March 31, 2021 b) Petrol valued at P4 100 and oil and P820 were used by hire department: petrol valued at P320 and oil at P160 were used by repairs department private consumption amounted to P120. 1 c) Repairs department performed work on private cars valued P2 380. In addition P500 worth of work was performed on the proprietors own car. Spares used by repairs department during the year were P2 300. d) Depreciation of private hire cars and repairs can is at 20% per annum. e) Rent, rates and lighting are to be apportioned as follows: Repairs department /4 Hire department / Garage department 1/2 Office departments f) The license of P100 and insurance P100 for the proprietors own car are included in the insurance and licenses paid by the business. g) Advertising is to be allocated P100 each to petrol and spares and the remaining charged equally among other departments Required: Prepare departmental Trading, Profit and Profit and Loss account for the year ending March 31, 2021. Question 1 Auto Logs is the proprietor of an Auto business that hires out cars, sells petrol oil. Tools and spares. The business Trial Balance on March 31, 2021 is as below: Dr Cr 66 000 6 280 Capital Drawings Opening stock April 1, 2020: Tools Petrol Spares Private cars for hire (including repairs van) Purchases: Tools Spares Petrol Advertising Rent, Rates and Lighting Insurance: Hire cars Burglary 1 600 640 3 480 2 100 1 820 2 180 7 250 5 720 47 700 11 250 1 150 7 200 1 270 230 1 500 18 200 7 100 2 600 5 100 33 000 20 900 7 100 28 000 Wages: Chaufeurs Repairs dep Office Garage Sales: Petrol and oil Spares Licenses for hire cars Office expenses Sundry debtors Sundry creditors Commission on sold cars Cash at bank Receipts: Hiring Repairs Garaging 1 200 3 800 1 200 2 600 6 400 114 000 78 400 20 600 32 000 234 000 234 000 The following information is also available. a) The stock on hand on March 31, 2021 b) Petrol valued at P4 100 and oil and P820 were used by hire department: petrol valued at P320 and oil at P160 were used by repairs department private consumption amounted to P120. 1 c) Repairs department performed work on private cars valued P2 380. In addition P500 worth of work was performed on the proprietors own car. Spares used by repairs department during the year were P2 300. d) Depreciation of private hire cars and repairs can is at 20% per annum. e) Rent, rates and lighting are to be apportioned as follows: Repairs department /4 Hire department / Garage department 1/2 Office departments f) The license of P100 and insurance P100 for the proprietors own car are included in the insurance and licenses paid by the business. g) Advertising is to be allocated P100 each to petrol and spares and the remaining charged equally among other departments Required: Prepare departmental Trading, Profit and Profit and Loss account for the year ending March 31, 2021

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started