Answered step by step

Verified Expert Solution

Question

1 Approved Answer

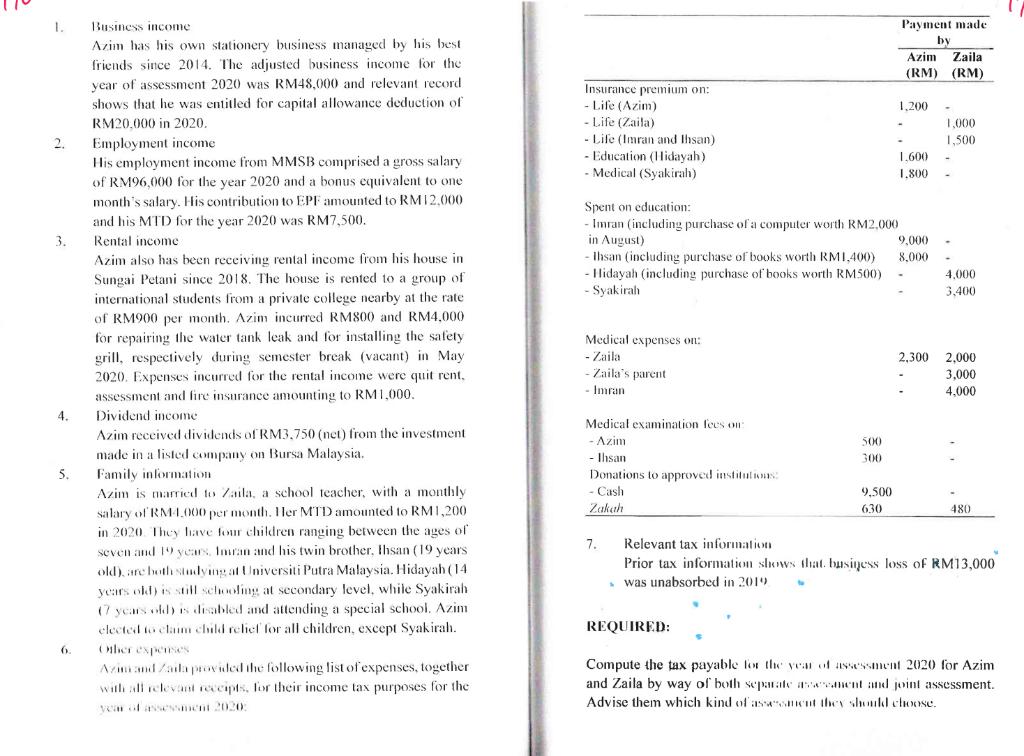

Azim, is a junior architcet at Menara Maju Sdn. Bhd. (MMSB) for the past five ycars. Besides emploVment mcome, he also derives income from

Azim, is a junior architcet at Menara Maju Sdn. Bhd. (MMSB) for the past five ycars. Besides emploVment mcome, he also derives income from investment and business activities. Below are the summary of key information regarding hss mcomes and expenses for the year 2020: 1. Business income Payment made by Azim has his own stationery business managed by his best Azim Zaila friends since 2014. The adjusted business income for the (RM) (RM) year of assessment 2020 was RM48,000 and relevant record Insurance premium on: - Life (Azim) - Life (Zaila) - Life (Imran and Ihsan) shows that he was entitled for capital allowance deduction of 1,200 RM20.000 in 2020. 1,000 1,500 Employment income His employment income from MMSB comprised a gross salary of RM96,000 for the year 2020 and a bonus equivalent to one 2. - Education (Hidayah) - Medical (Syakirah) 1,600 1,800 month's salary. His contribution to EPF amounted to RM12,000 Spent on education: - Imran (including purchase of a computer worth RM2,000 in August) Ihsan (including purchase of books worth RMI,400) - Ilidayah (including purchase of books worth RM500) - Syakirah and his MTD for the year 2020 was RM7,500. 3. Rental income 9,000 Azim also has been receiving rental income from his house in Sungai Petani since 2018. The house is rented to a group of international students from a private college nearby at the rate 8,000 4,000 3,400 of RM900 per month. Azim incurred RM800 and RM4,000 for repairing the water tank leak and for installing the safety grill, respectively during semester break (vacant) in May 2020. Expenses incurred for the rental income were quit rent, Medical expenses on: - Zaila - Zaila's parent 2,300 2,000 3,000 - Imran 4,000 assessment and fire insurance amounting to RM1,000. Dividend income 4. Medical examination fees on Azim received dividends of RM3,750 (net) from the investment - Azim - Ilisan Donations to approved institutis: - Cash 500 made in a listed company on Bursa Malaysia. 5. Azim is marricd to Zaila, a sehool teacher, with a monthly salary of RM4.000 per montdh. I ler MTD amounted to RM1,200 in 2020. They lave four children ranging between the ages of 300 Family information 9,500 Zakah 630 480 7. Relevant tax information seven and 19) years, Inran and his twin brother, thsan (19 vears Prior tax information showss that. busiyess loss of RM13,000 old), are hoth studying at Universiti Putra Malaysia. Hidayah (14 was unabsorbed in 2019 to years old) is still schooling at secondary level, while Syakirah (7 years old) is disabled and attending a special school, Azim elected to elaimm child relief for all children, except Syakirah. REQUIRED: 6. Otber espenses Aziniand Zaila provided the following list of expenses, together wilh all relevant reccipts, for their income tax purposes for the Compute the tax payable lor the year of assessment 2020 for Azim and Zaila by way of both separate aament and joint assessment. Advise them which kind of ass nent tihey should choose. y l aeNent 2020:

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

COMPUTATION OF TAX PAYABLE BY AZIM AND ZAILA FOR THE ASSESSMENT YEAR 201920 PARTICULARS AZIM AMOUNT ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started