Answered step by step

Verified Expert Solution

Question

1 Approved Answer

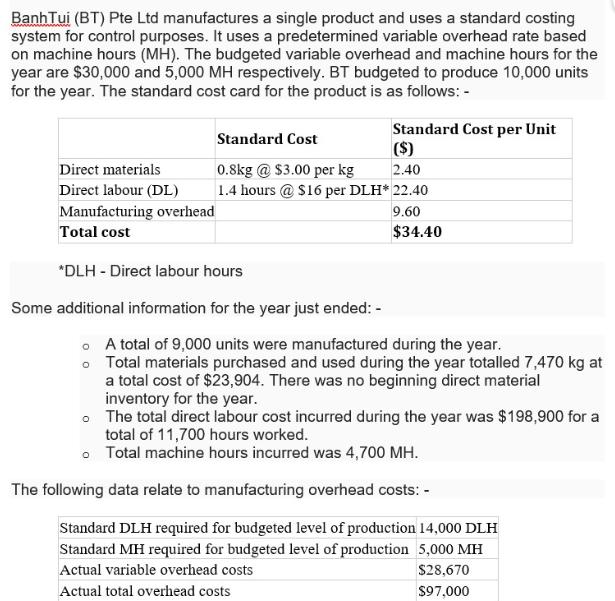

BanhTui (BT) Pte Ltd manufactures a single product and uses a standard costing system for control purposes. It uses a predetermined variable overhead rate

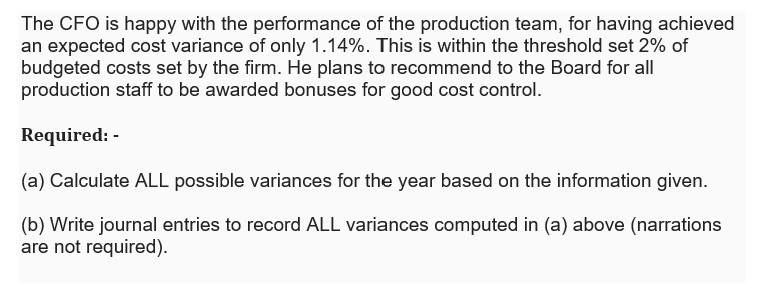

BanhTui (BT) Pte Ltd manufactures a single product and uses a standard costing system for control purposes. It uses a predetermined variable overhead rate based on machine hours (MH). The budgeted variable overhead and machine hours for the year are $30,000 and 5,000 MH respectively. BT budgeted to produce 10,000 units for the year. The standard cost card for the product is as follows:- Direct materials Standard Cost 0.8kg @ $3.00 per kg Standard Cost per Unit ($) 2.40 1.4 hours @ $16 per DLH* 22.40 Direct labour (DL) Manufacturing overhead Total cost *DLH - Direct labour hours 9.60 $34.40 Some additional information for the year just ended: - A total of 9,000 units were manufactured during the year. Total materials purchased and used during the year totalled 7,470 kg at a total cost of $23,904. There was no beginning direct material inventory for the year. The total direct labour cost incurred during the year was $198,900 for a total of 11,700 hours worked. Total machine hours incurred was 4,700 MH. The following data relate to manufacturing overhead costs: - Standard DLH required for budgeted level of production 14,000 DLH Standard MH required for budgeted level of production 5,000 MH Actual variable overhead costs Actual total overhead costs $28,670 $97,000 The CFO is happy with the performance of the production team, for having achieved an expected cost variance of only 1.14%. This is within the threshold set 2% of budgeted costs set by the firm. He plans to recommend to the Board for all production staff to be awarded bonuses for good cost control. Required: - (a) Calculate ALL possible variances for the year based on the information given. (b) Write journal entries to record ALL variances computed in (a) above (narrations are not required). (c) Explain by showing clear computations how the CFO arrived at a cost variance percentage of 1.14%. Discuss and explain if you agree with the CFO's assessment that bonuses should be given to all production staff for achieving good cost control during the year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started