Answered step by step

Verified Expert Solution

Question

1 Approved Answer

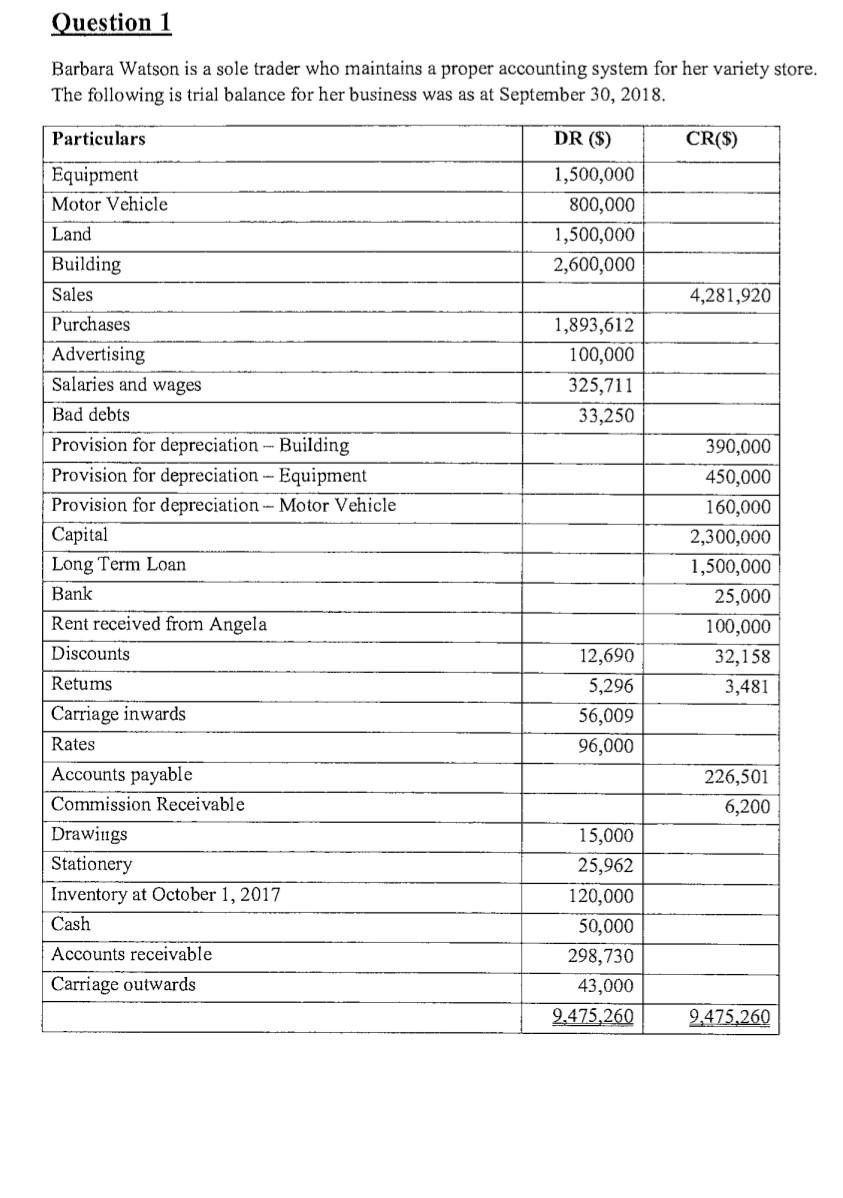

Question 1 Barbara Watson is a sole trader who maintains a proper accounting system for her variety store. The following is trial balance for her

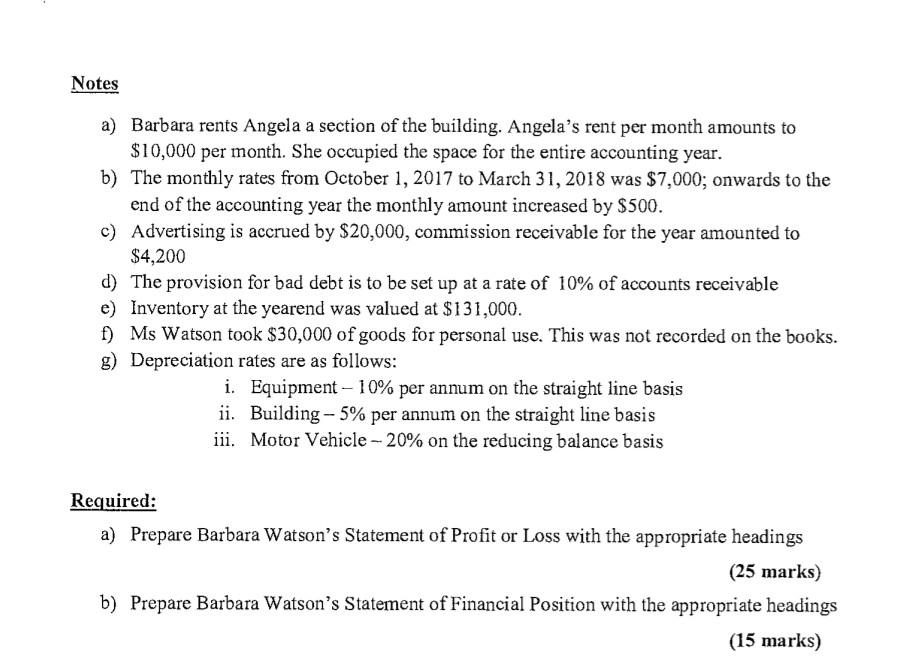

Question 1 Barbara Watson is a sole trader who maintains a proper accounting system for her variety store. The following is trial balance for her business was as at September 30, 2018. Particulars DR ($) CR(S) Equipment Motor Vehicle 1,500,000 800,000 1,500,000 2,600,000 Land Building Sales 4,281,920 Purchases 1,893,612 100,000 325,711 33,250 Advertising Salaries and wages Bad debts Provision for depreciation - Building Provision for depreciation - Equipment Provision for depreciation - Motor Vehicle Capital Long Term Loan Bank Rent received from Angela Discounts Retums Carriage inwards Rates Accounts payable Commission Receivable Drawings Stationery Inventory at October 1, 2017 Cash Accounts receivable Carriage outwards 390,000 450,000 160,000 2,300,000 1,500,000 25,000 100,000 32,158 3,481 12,690 5,296 56,009 96,000 226,501 6,200 15,000 25,962 120,000 50,000 298,730 43,000 9,475,260 9,475.260 Notes a) Barbara rents Angela a section of the building. Angela's rent per month amounts to $10,000 per month. She occupied the space for the entire accounting year. b) The monthly rates from October 1, 2017 to March 31, 2018 was $7,000; onwards to the end of the accounting year the monthly amount increased by $500. c) Advertising is accrued by $20,000, commission receivable for the year amounted to $4,200 d) The provision for bad debt is to be set up at a rate of 10% of accounts receivable e) Inventory at the yearend was valued at $131,000. f) Ms Watson took $30,000 of goods for personal use. This was not recorded on the books. g) Depreciation rates are as follows: i. Equipment 10% per annum on the straight line basis ii. Building - 5% per annum on the straight line basis iii. Motor Vehicle - 20% on the reducing balance basis Required: a) Prepare Barbara Watson's Statement of Profit or Loss with the appropriate headings (25 marks) b) Prepare Barbara Watson's Statement of Financial Position with the appropriate headings (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started