Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1: Barni Ltd a UK company that sells various items falling under Standard Rated, Zero-rated, and Exempt goods in UK and exports overseas.

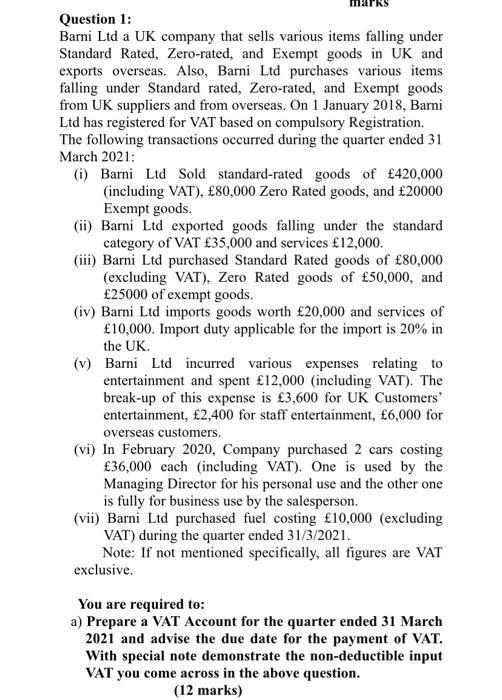

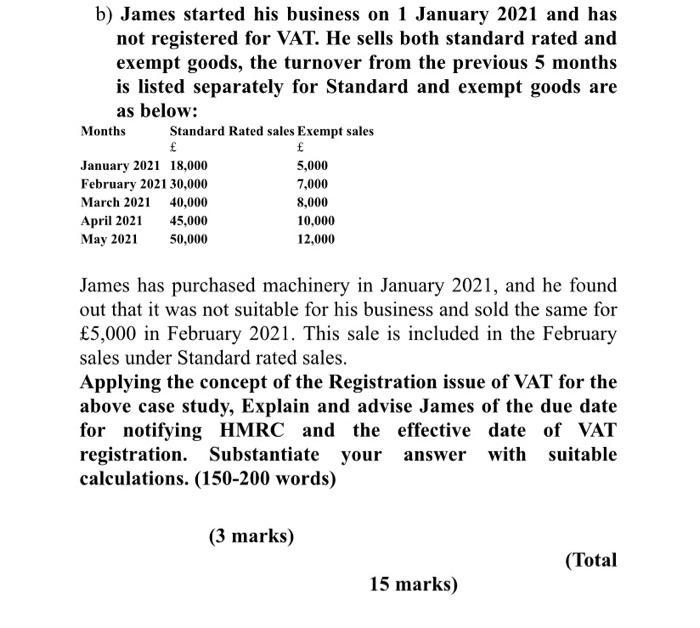

Question 1: Barni Ltd a UK company that sells various items falling under Standard Rated, Zero-rated, and Exempt goods in UK and exports overseas. Also, Barni Ltd purchases various items falling under Standard rated, Zero-rated, and Exempt goods. from UK suppliers and from overseas. On 1 January 2018, Barni Ltd has registered for VAT based on compulsory Registration. The following transactions occurred during the quarter ended 31 March 2021: (i) Barni Ltd Sold standard-rated goods of 420,000 (including VAT), 80,000 Zero Rated goods, and 20000 Exempt goods. (ii) Barni Ltd exported goods falling under the standard category of VAT 35,000 and services 12,000. (iii) Barni Ltd purchased Standard Rated goods of 80,000 (excluding VAT). Zero Rated goods of 50,000, and 25000 of exempt goods. (iv) Barni Ltd imports goods worth 20,000 and services of 10,000. Import duty applicable for the import is 20% in the UK. (v) Barni Ltd incurred various expenses relating to entertainment and spent 12,000 (including VAT). The break-up of this expense is 3,600 for UK Customers' entertainment, 2,400 for staff entertainment, 6,000 for overseas customers. (vi) In February 2020, Company purchased 2 cars costing 36,000 each (including VAT). One is used by the Managing Director for his personal use and the other one is fully for business use by the salesperson. (vii) Barni Ltd purchased fuel costing 10,000 (excluding VAT) during the quarter ended 31/3/2021. Note: If not mentioned specifically, all figures are VAT exclusive. You are required to: a) Prepare a VAT Account for the quarter ended 31 March 2021 and advise the due date for the payment of VAT. With special note demonstrate the non-deductible input VAT you come across in the above question. (12 marks) b) James started his business on 1 January 2021 and has not registered for VAT. He sells both standard rated and exempt goods, the turnover from the previous 5 months is listed separately for Standard and exempt goods are as below: Months Standard Rated sales Exempt sales 5,000 7,000 8,000 10,000 12,000 January 2021 18,000 February 2021 30,000 March 2021 40,000 April 2021 May 2021 45,000 50,000 James has purchased machinery in January 2021, and he found out that it was not suitable for his business and sold the same for 5,000 in February 2021. This sale is included in the February sales under Standard rated sales. Applying the concept of the Registration issue of VAT for the above case study, Explain and advise James of the due date for notifying HMRC and the effective date of VAT registration. Substantiate your answer with suitable calculations. (150-200 words) (3 marks) 15 marks) (Total

Step by Step Solution

★★★★★

3.28 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a VAT Account for the quarter ended 31 March 2021 Debit Standard Rated Output VAT 420000 x 20 84000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started