Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 BLACKMORES Bhd. has requested an additional loan from your bank. The loan will be used to finance working capital. The company has

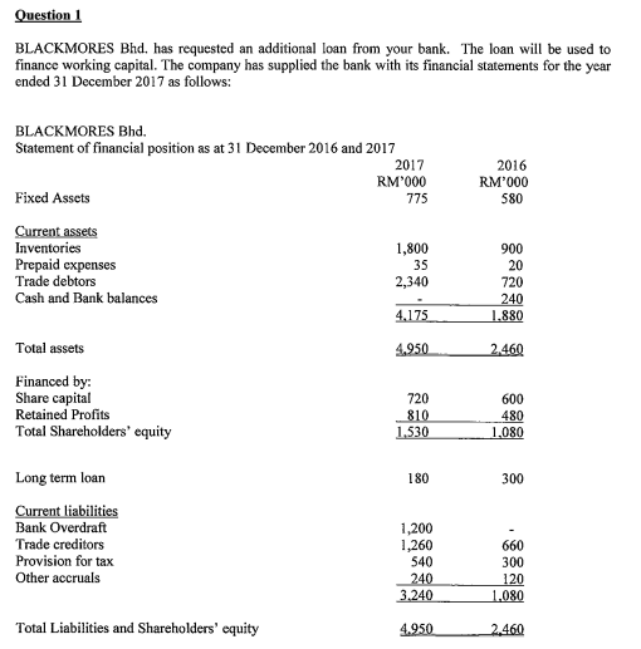

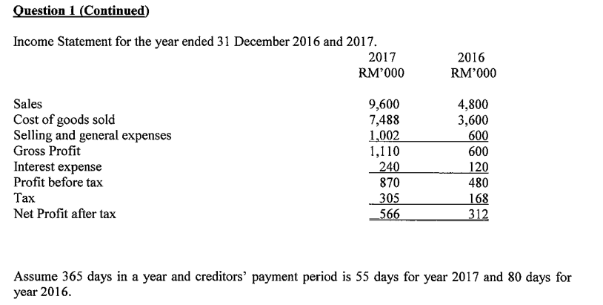

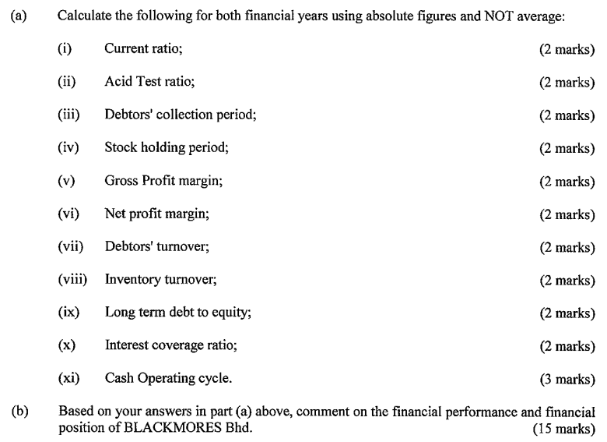

Question 1 BLACKMORES Bhd. has requested an additional loan from your bank. The loan will be used to finance working capital. The company has supplied the bank with its financial statements for the year ended 31 December 2017 as follows: BLACKMORES Bhd. Statement of financial position as at 31 December 2016 and 2017 Fixed Assets Current assets Inventories Prepaid expenses Trade debtors Cash and Bank balances Total assets Financed by: Share capital Retained Profits Total Shareholders' equity Long term loan Current liabilities Bank Overdraft Trade creditors Provision for tax Other accruals Total Liabilities and Shareholders' equity 2017 RM'000 775 1,800 35 2,340 4.175 4.950 720 810 1.530 180 1,200 1,260 540 240 3.240 4.950 2016 RM'000 580 900 20 720 240 1,880 2,460 600 480 1,080 300 660 300 120 1,080 2,460 Question 1 (Continued) Income Statement for the year ended 31 December 2016 and 2017. 2017 RM'000 Sales Cost of goods sold Selling and general expenses Gross Profit Interest expense Profit before tax Tax Net Profit after tax 9,600 7,488 1,002 1,110 240 870 305 566 2016 RM'000 4,800 3,600 600 600 120 480 168 312 Assume 365 days in a year and creditors' payment period is 55 days for year 2017 and 80 days for year 2016. (a) (b) Calculate the following for both financial years using absolute figures and NOT average: (i) Current ratio; (2 marks) (ii) Acid Test ratio; (2 marks) (iii) Debtors' collection period; (2 marks) (iv) Stock holding period; (2 marks) (v) Gross Profit margin; (2 marks) (vi) Net profit margin; (2 marks) (vii) Debtors' turnover; (2 marks) (viii) Inventory turnover; (2 marks) (ix) Long term debt to equity; (2 marks) (x) Interest coverage ratio; (2 marks) (xi) Cash Operating cycle. (3 marks) Based on your answers in part (a) above, comment on the financial performance and financial position of BLACKMORES Bhd. (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a i Current ratio 2017 1800 2340 240 41751200 1260 300 209 2016 900 720 4 18801080 300 177 ii Acid t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started