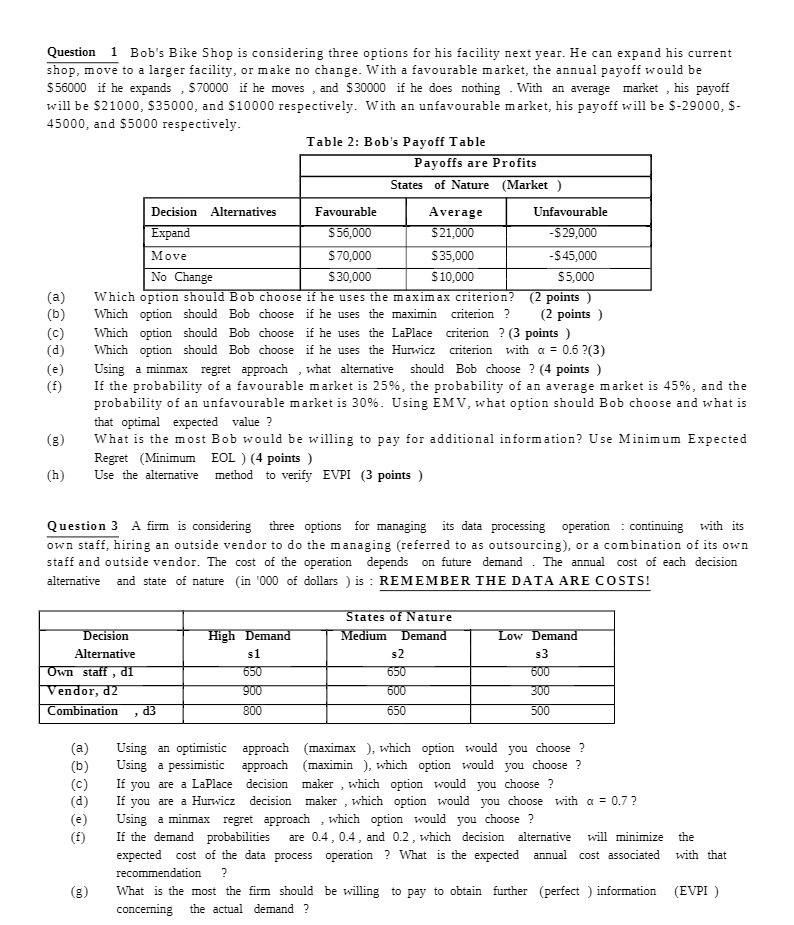

Question 1 Bob's Bike Shop is considering three options for his facility next year. He can expand his current shop, move to a larger facility, or make no change. With a favourable market, the annual payoff would be $56000 if he expands , $70000 if he moves , and $30000 if he does nothing . With an average market , his payoff will be $21000, $35000, and $10000 respectively. With an unfavourable market, his payoff will be $-29000, $- 45000, and $5000 respectively. Table 2: Bob's Payoff Table Payoffs are Profits States of Nature (Market ) Decision Alternatives Favourable Average Unfavourable Expand $56,000 $ 21,000 $29,000 Move $ 70,000 $35,000 $45,000 No Change $ 30,000 $ 10,000 $5,000 Which option should Bob choose if he uses the maximax criterion? (2 points Which option should Bob choose if he uses the maximin criterion ? (2 points ) Which option s should Bob choose if he uses the LaPlace criterion ? (3 points ) Which option should Bob choose if he uses the Hurwicz c criterion with a = 0.6 ?(3) Using a minmax regret approach , , what alternative should Bob choose ? (4 points ) If the probability of a favourable market is 25%, the probability of an average market is 45%, and the probability of an unfavourable market is 30%. Using EMV, what option should Bob choose and what is that optimal expected value ? What is the most Bob would be willing to pay for additional information? Use Minimum Expected Regret (Minimum EOL ) (4 points ) (h) Use the alternative method to verify EVPI (3 points ) Question 3 A firm is considering three options for managing its data processing operation : continuing with its own staff, hiring an outside vendor to do the managing (referred to as outsourcing), or a combination of its own staff and outside vendor. The cost of the operation depends on future demand . The annual cost of each decision alternative and state of nature (in '000 of dollars ) is : REMEMBER THE DATA ARE COSTS! States of Nature Decision High Demand Medium Demand Low Demand Alternative $2 Own staff , di 650 650 600 Vendor, d2 900 600 300 Combination , d3 800 650 500 (a) Using an optimistic approach (maximax ), which option would you choose ? (b) Using a pessimistic approach (maximin ), which option would you choose ? (c) If you are a LaPlace decision maker , which option would you choose ? (d) If you are a Hurwicz decision maker , which option would you choose with a = 0.7 ? (e ) Using a minmax regret approach , which option would you choose ? (f) If the demand probabilities are 0.4, 0.4, and 0.2 , which decision alternative will minimize the expected cost of the data process operation ? What is the expected annual cost associated with that recommendation (8) What is the most the firm should be willing to pay to obtain further (perfect ) information (EVPI ) concerning the actual demand