Answered step by step

Verified Expert Solution

Question

1 Approved Answer

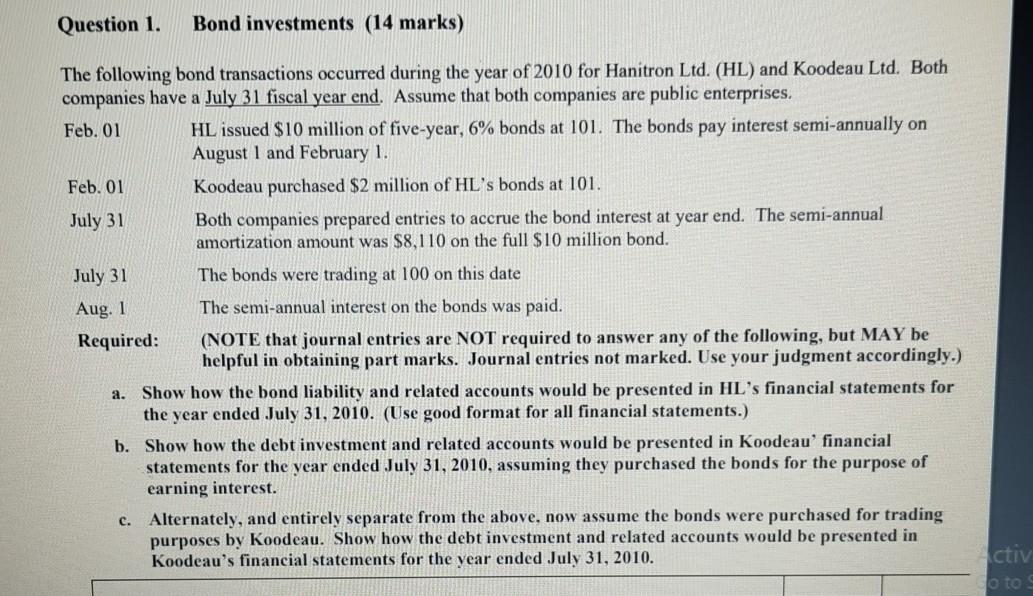

Question 1. Bond investments (14 marks) The following bond transactions occurred during the year of 2010 for Hanitron Ltd. (HL) and Koodeau Ltd. Both companies

Question 1. Bond investments (14 marks) The following bond transactions occurred during the year of 2010 for Hanitron Ltd. (HL) and Koodeau Ltd. Both companies have a July 31 fiscal year end. Assume that both companies are public enterprises. Feb. 01 HL issued $10 million of five-year, 6% bonds at 101. The bonds pay interest semi-annually on August 1 and February 1. Feb. 01 Koodeau purchased $2 million of HL's bonds at 101. July 31 Both companies prepared entries to accrue the bond interest at year end. The semi-annual amortization amount was $8,110 on the full $10 million bond. July 31 The bonds were trading at 100 on this date The semi-annual interest on the bonds was paid. Required: (NOTE that journal entries are NOT required to answer any of the following, but MAY be helpful in obtaining part marks. Journal entries not marked. Use your judgment accordingly.) Show how the bond liability and related accounts would be presented in HL's financial statements for the year ended July 31, 2010. (Use good format for all financial statements.) b. Show how the debt investment and related accounts would be presented in Koodeau' financial statements for the year ended July 31, 2010, assuming they purchased the bonds for the purpose of earning interest. Alternately, and entirely separate from the above, now assume the bonds were purchased for trading purposes by Koodeau. Show how the debt investment and related accounts would be presented in Koodeau's financial statements for the year ended July 31, 2010. Aug. 1 a. C. Activ Co to

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started