Answered step by step

Verified Expert Solution

Question

1 Approved Answer

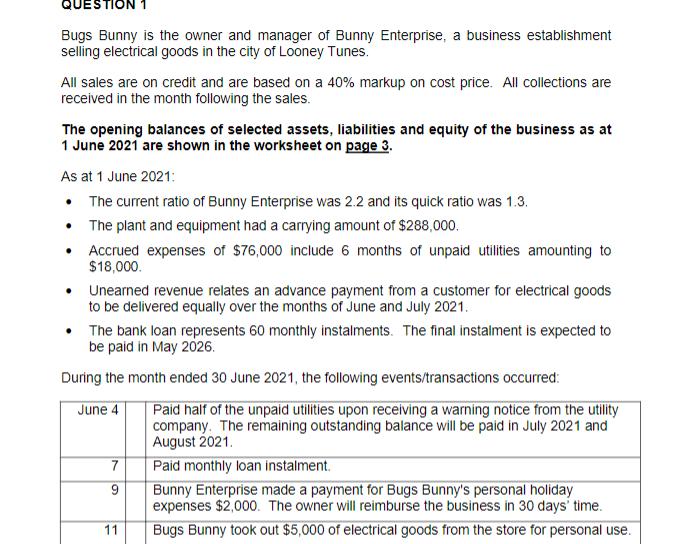

QUESTION 1 Bugs Bunny is the owner and manager of Bunny Enterprise, a business establishment selling electrical goods in the city of Looney Tunes.

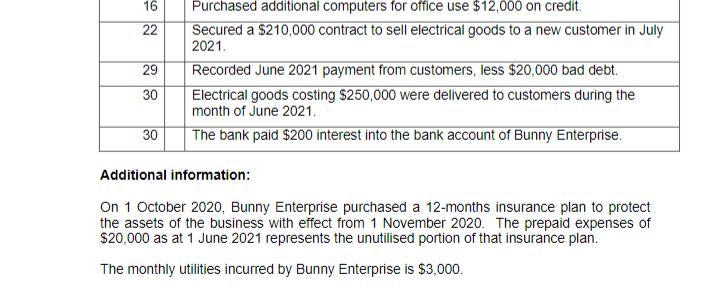

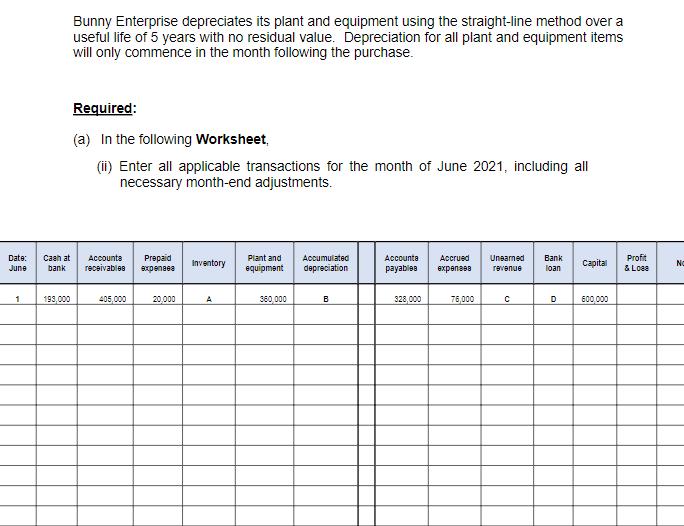

QUESTION 1 Bugs Bunny is the owner and manager of Bunny Enterprise, a business establishment selling electrical goods in the city of Looney Tunes. All sales are on credit and are based on a 40% markup on cost price. All collections are received in the month following the sales. The opening balances of selected assets, liabilities and equity of the business as at 1 June 2021 are shown in the worksheet on page 3. As at 1 June 2021: The current ratio of Bunny Enterprise was 2.2 and its quick ratio was 1.3. The plant and equipment had a carrying amount of $288,000. . Accrued expenses of $76,000 include 6 months of unpaid utilities amounting to $18,000. Unearned revenue relates an advance payment from a customer for electrical goods to be delivered equally over the months of June and July 2021. The bank loan represents 60 monthly instalments. The final instalment is expected to be paid in May 2026. During the month ended 30 June 2021, the following events/transactions occurred: June 4 7 9 11 Paid half of the unpaid utilities upon receiving a warning notice from the utility company. The remaining outstanding balance will be paid in July 2021 and August 2021. Paid monthly loan instalment. Bunny Enterprise made a payment for Bugs Bunny's personal holiday expenses $2,000. The owner will reimburse the business in 30 days' time. Bugs Bunny took out $5,000 of electrical goods from the store for personal use. 16 22 29 30 30 Purchased additional computers for office use $12,000 on credit. Secured a $210,000 contract to sell electrical goods to a new customer in July 2021. Recorded June 2021 payment from customers, less $20,000 bad debt. Electrical goods costing $250,000 were delivered to customers during the month of June 2021. The bank paid $200 interest into the bank account of Bunny Enterprise. Additional information: On 1 October 2020, Bunny Enterprise purchased a 12-months insurance plan to protect the assets of the business with effect from 1 November 2020. The prepaid expenses of $20,000 as at 1 June 2021 represents the unutilised portion of that insurance plan. The monthly utilities incurred by Bunny Enterprise is $3,000. Date: June 1 Cash at bank 199,000 Bunny Enterprise depreciates its plant and equipment using the straight-line method over a useful life of 5 years with no residual value. Depreciation for all plant and equipment items will only commence in the month following the purchase. Required: (a) In the following Worksheet. (ii) Enter all applicable transactions for the month of June 2021, including all necessary month-end adjustments. Accounts Prepaid receivables expenses 405,000 20,000 Inventory A Plant and equipment 360,000 Accumulated depreciation B Accounta Accrued Unearned Bank payables expenses revenue loan 328,000 76,000 C D Capital 600,000 Profit & Loss No

Step by Step Solution

★★★★★

3.43 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

Formula for quick Quick Assets corrent liabilities to given Quick Ra...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started