Answered step by step

Verified Expert Solution

Question

1 Approved Answer

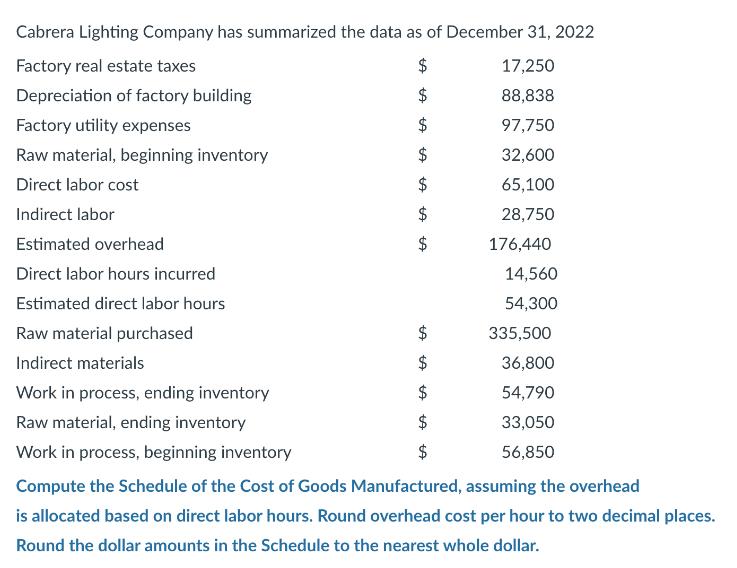

+A 17,250 Cabrera Lighting Company has summarized the data as of December 31, 2022 Factory real estate taxes Depreciation of factory building Factory utility

+A 17,250 Cabrera Lighting Company has summarized the data as of December 31, 2022 Factory real estate taxes Depreciation of factory building Factory utility expenses Raw material, beginning inventory Direct labor cost Indirect labor Estimated overhead Direct labor hours incurred Estimated direct labor hours Raw material purchased Indirect materials +A 88,838 97,750 32,600 65,100 28,750 176,440 14,560 54,300 335,500 36,800 54,790 33,050 +A +A +A +A +A +A +A A ta Work in process, beginning inventory +A 56,850 Compute the Schedule of the Cost of Goods Manufactured, assuming the overhead is allocated based on direct labor hours. Round overhead cost per hour to two decimal places. Round the dollar amounts in the Schedule to the nearest whole dollar. Work in process, ending inventory Raw material, ending inventory

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Total Manufacturing Costs Factory Real Estate Taxes 17250 Depreciation of Factory Building 88838 F...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started