Question 1.

Calculate the Cash-on-Cash Return (Show your work):

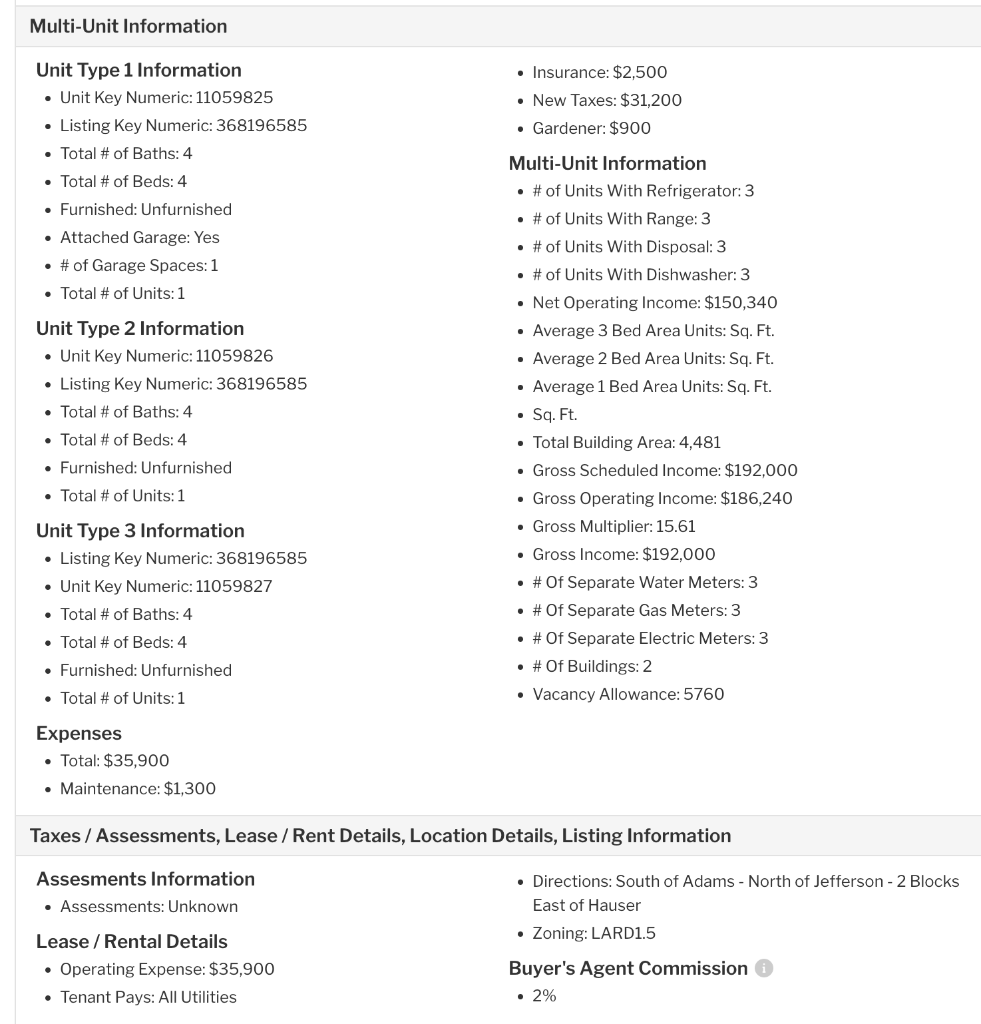

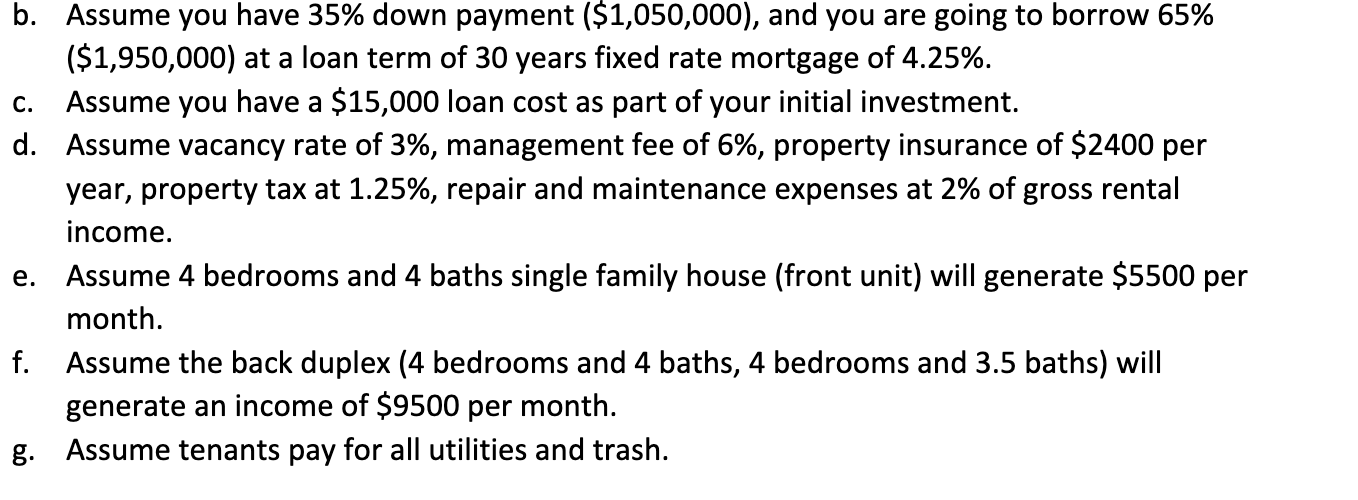

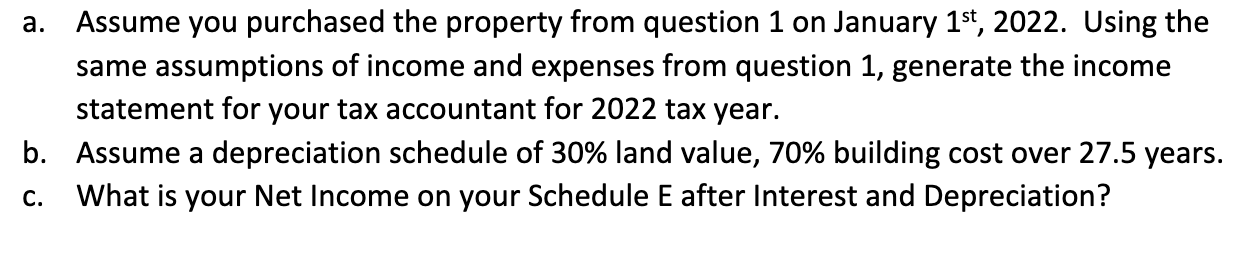

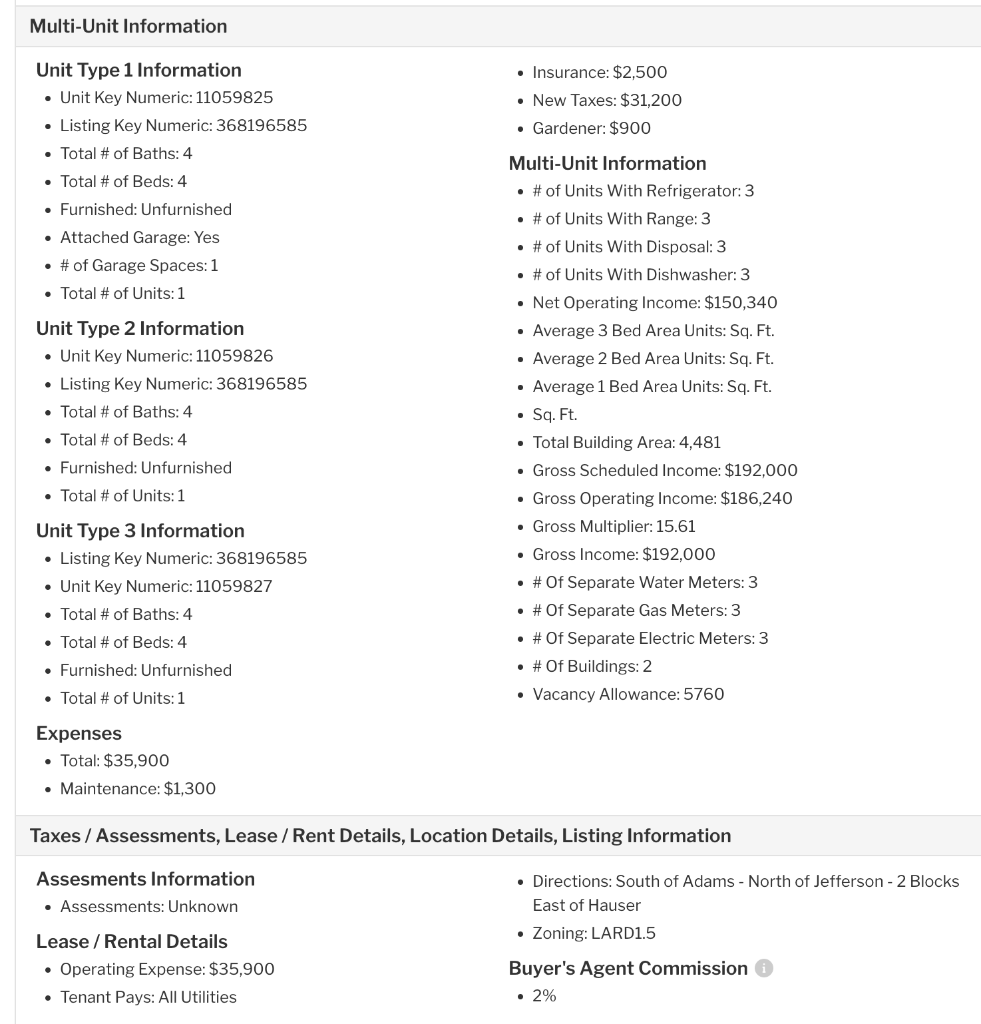

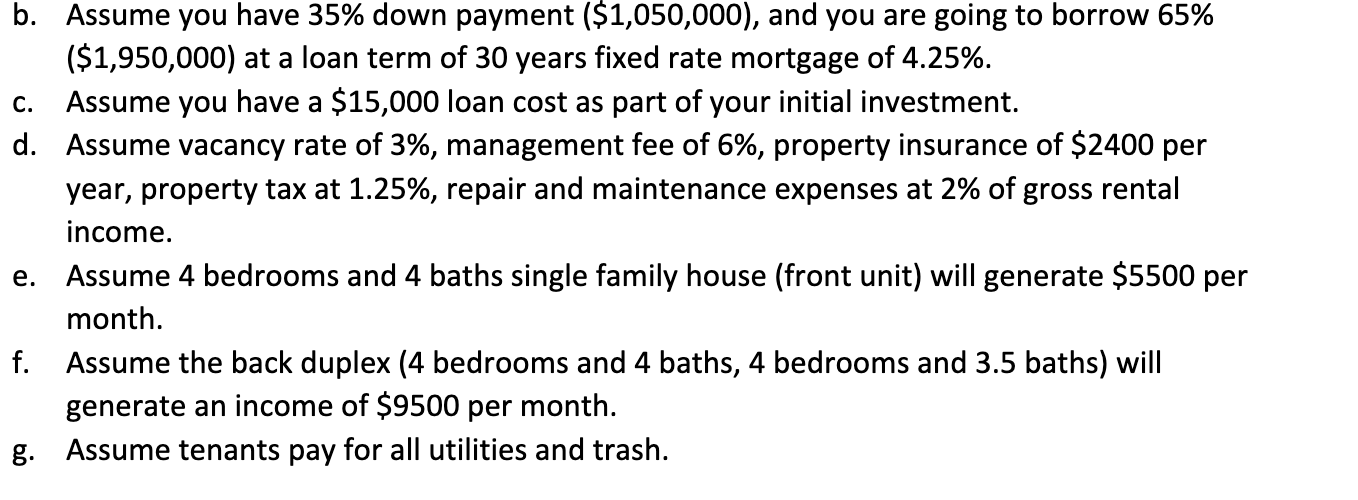

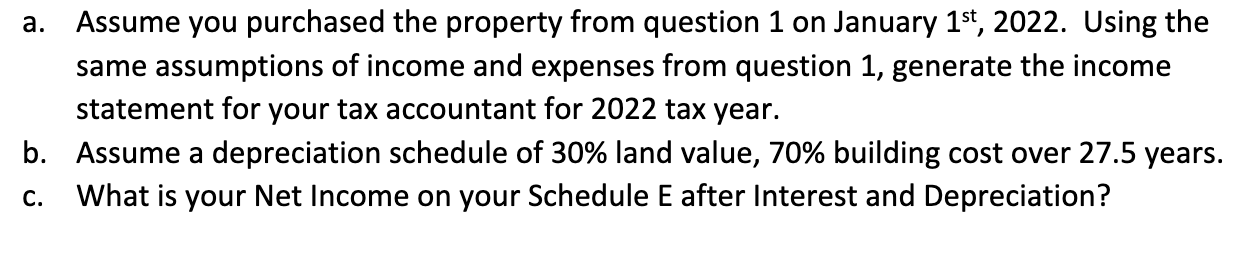

Multi-Unit Information Insurance: $2,500 New Taxes: $31,200 Gardener: $900 Unit Type 1 Information Unit Key Numeric: 11059825 Listing Key Numeric: 368196585 Total # of Baths: 4 Total # of Beds: 4 Furnished: Unfurnished Attached Garage: Yes # of Garage Spaces: 1 Total # of Units: 1 Unit Type 2 Information Unit Key Numeric: 11059826 Listing Key Numeric: 368196585 Total # of Baths: 4 Total # of Beds: 4 Furnished: Unfurnished Total # of Units: 1 Multi-Unit Information # of Units With Refrigerator: 3 # of Units With Range: 3 # of Units With Disposal: 3 # of Units With Dishwasher: 3 Net Operating Income: $150,340 Average 3 Bed Area Units: Sq. Ft. Average 2 Bed Area Units: Sq. Ft. Average 1 Bed Area Units: Sq. Ft. Sq. Ft. Total Building Area: 4,481 Gross Scheduled Income: $192,000 Gross Operating Income: $186,240 Gross Multiplier: 15.61 Gross Income: $192,000 #Of Separate Water Meters: 3 # Of Separate Gas Meters: 3 # Of Separate Electric Meters: 3 #Of Buildings: 2 Vacancy Allowance: 5760 Unit Type 3 Information Listing Key Numeric: 368196585 Unit Key Numeric: 11059827 Total # of Baths: 4 Total # of Beds: 4 Furnished: Unfurnished Total # of Units: 1 . Expenses Total: $35,900 Maintenance: $1,300 Taxes / Assessments, Lease/Rent Details, Location Details, Listing Information Assesments Information Assessments: Unknown Directions: South of Adams - North of Jefferson - 2 Blocks East of Hauser Zoning: LARD1.5 Lease/Rental Details Operating Expense: $35,900 Tenant Pays: All Utilities Buyer's Agent Commission 2% b. Assume you have 35% down payment ($1,050,000), and you are going to borrow 65% ($1,950,000) at a loan term of 30 years fixed rate mortgage of 4.25%. c. Assume you have a $15,000 loan cost as part of your initial investment. d. Assume vacancy rate of 3%, management fee of 6%, property insurance of $2400 per year, property tax at 1.25%, repair and maintenance expenses at 2% of gross rental income. Assume 4 bedrooms and 4 baths single family house (front unit) will generate $5500 per month. f. Assume the back duplex (4 bedrooms and 4 baths, 4 bedrooms and 3.5 baths) will generate an income of $9500 per month. g. Assume tenants pay for all utilities and trash. e. a. Assume you purchased the property from question 1 on January 1st, 2022. Using the same assumptions of income and expenses from question 1, generate the income statement for your tax accountant for 2022 tax year. b. Assume a depreciation schedule of 30% land value, 70% building cost over 27.5 years. What is your Net Income on your Schedule E after Interest and Depreciation? c. Multi-Unit Information Insurance: $2,500 New Taxes: $31,200 Gardener: $900 Unit Type 1 Information Unit Key Numeric: 11059825 Listing Key Numeric: 368196585 Total # of Baths: 4 Total # of Beds: 4 Furnished: Unfurnished Attached Garage: Yes # of Garage Spaces: 1 Total # of Units: 1 Unit Type 2 Information Unit Key Numeric: 11059826 Listing Key Numeric: 368196585 Total # of Baths: 4 Total # of Beds: 4 Furnished: Unfurnished Total # of Units: 1 Multi-Unit Information # of Units With Refrigerator: 3 # of Units With Range: 3 # of Units With Disposal: 3 # of Units With Dishwasher: 3 Net Operating Income: $150,340 Average 3 Bed Area Units: Sq. Ft. Average 2 Bed Area Units: Sq. Ft. Average 1 Bed Area Units: Sq. Ft. Sq. Ft. Total Building Area: 4,481 Gross Scheduled Income: $192,000 Gross Operating Income: $186,240 Gross Multiplier: 15.61 Gross Income: $192,000 #Of Separate Water Meters: 3 # Of Separate Gas Meters: 3 # Of Separate Electric Meters: 3 #Of Buildings: 2 Vacancy Allowance: 5760 Unit Type 3 Information Listing Key Numeric: 368196585 Unit Key Numeric: 11059827 Total # of Baths: 4 Total # of Beds: 4 Furnished: Unfurnished Total # of Units: 1 . Expenses Total: $35,900 Maintenance: $1,300 Taxes / Assessments, Lease/Rent Details, Location Details, Listing Information Assesments Information Assessments: Unknown Directions: South of Adams - North of Jefferson - 2 Blocks East of Hauser Zoning: LARD1.5 Lease/Rental Details Operating Expense: $35,900 Tenant Pays: All Utilities Buyer's Agent Commission 2% b. Assume you have 35% down payment ($1,050,000), and you are going to borrow 65% ($1,950,000) at a loan term of 30 years fixed rate mortgage of 4.25%. c. Assume you have a $15,000 loan cost as part of your initial investment. d. Assume vacancy rate of 3%, management fee of 6%, property insurance of $2400 per year, property tax at 1.25%, repair and maintenance expenses at 2% of gross rental income. Assume 4 bedrooms and 4 baths single family house (front unit) will generate $5500 per month. f. Assume the back duplex (4 bedrooms and 4 baths, 4 bedrooms and 3.5 baths) will generate an income of $9500 per month. g. Assume tenants pay for all utilities and trash. e. a. Assume you purchased the property from question 1 on January 1st, 2022. Using the same assumptions of income and expenses from question 1, generate the income statement for your tax accountant for 2022 tax year. b. Assume a depreciation schedule of 30% land value, 70% building cost over 27.5 years. What is your Net Income on your Schedule E after Interest and Depreciation? c