Question

Question 1: Calculate the nominal interest rate per annum in both the United States and the United Kingdom (U.K.), assuming that the Fisher effect holds,

| Question 1: Calculate the nominal interest rate per annum in both the United States and the United Kingdom (U.K.), assuming that the Fisher effect holds, based on the following information:

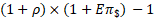

Tip: Nominal interest rate per annum is calculated by using this formula:

is the real interest rate expressed in decimals. E() is the expected value of inflation, also expressed in decimals. |

Question 1 Answers: Type in your answers to Question 1 below. Be sure to show your calculations

| Question 2: Calculate the expected future spot dollar-pound exchange rate in 3 years from now. Hint: Use the nominal interest rates you calculated in Question 1. Do not round intermediate calculations.

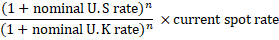

Expected future spot dollar-pound exchange rate in years from now is calculated using this formula:

|

Question 2 Answer: Type in your answer to Question 2 below. Round to 4 decimal places.

| Question 3: Calculate the forward dollar-pound exchange rate for one-year maturity, using the in the following formula. Hint: Since the maturity time is 1 year, replace with 1.

|

Question 3 Answer: Type in your answer to Question 3 below. Round to 4 decimal places.

(1+)(1+E)1 (1+nominalU.Krate)n(1+nominalU.Srate)n current spot rate (1+nominalU.Krate)n(1+nominalU.Srate)n current spot rateStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started