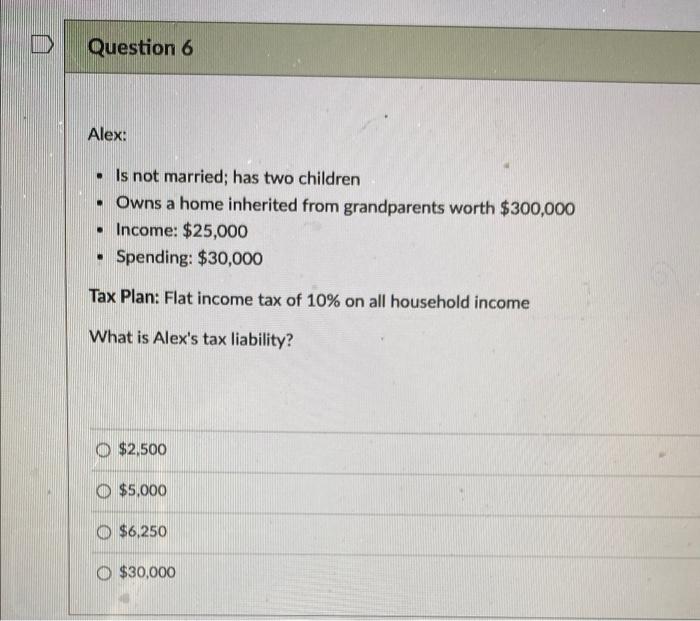

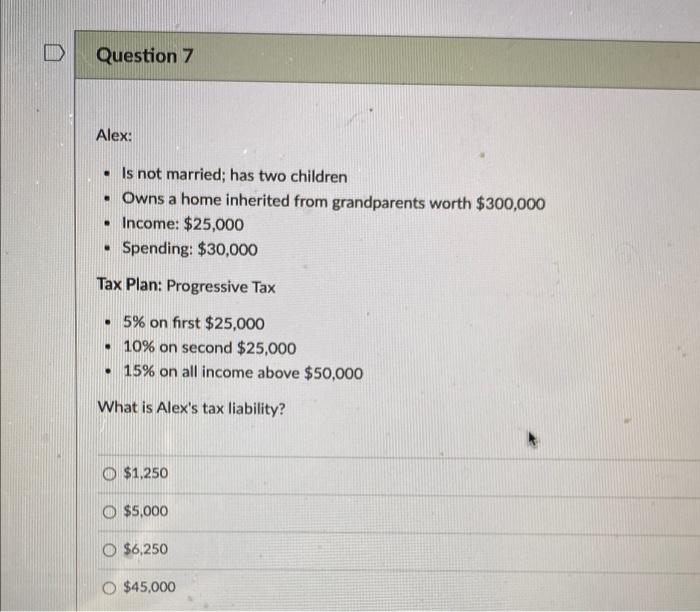

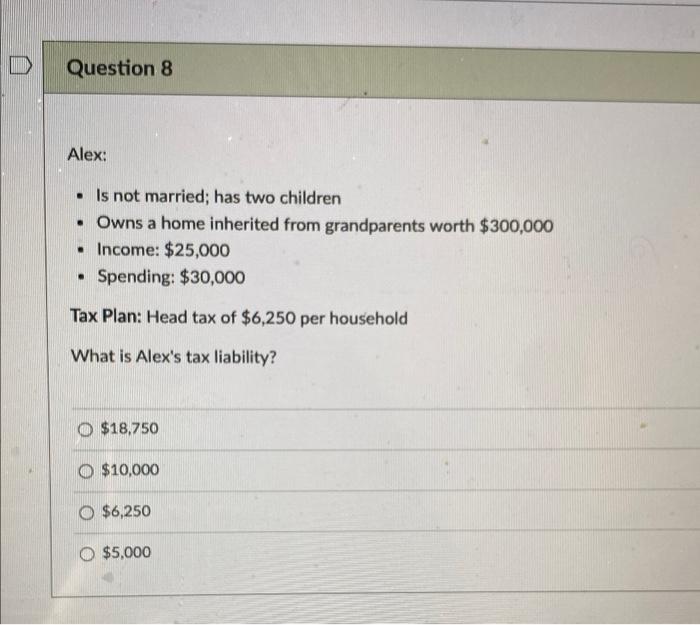

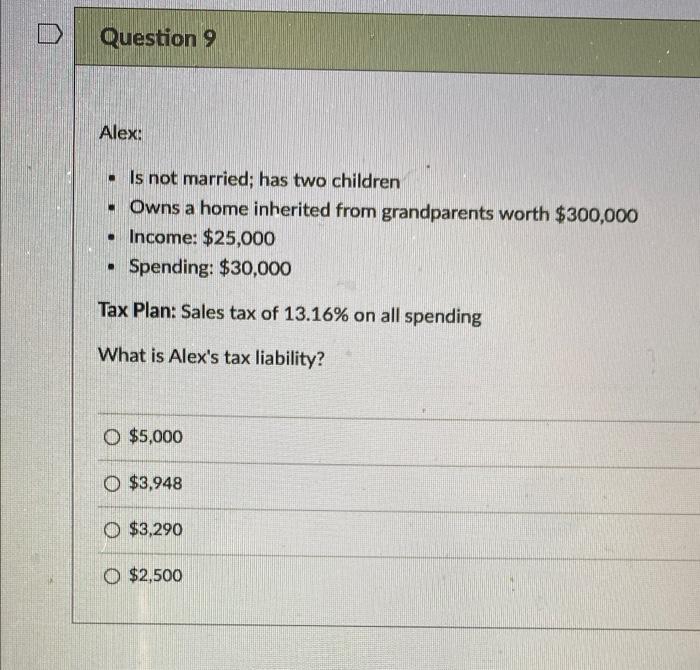

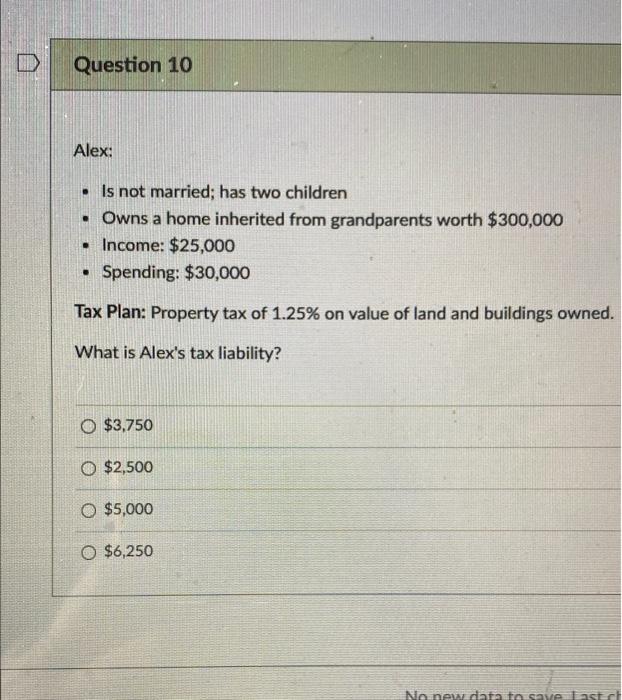

Question 1 Cam's income is $50,000. If the flat tax is 10%, what is his tax liability? ID Question 2 1 pts Cam's income is $50,000. Under the progressive tax plan outlined here, what is his tax liability? 5% on first $25,000 10% on second $25,000 15% on all income above $50,000 0 $20,000 $5,000 O $6,250 $3,750 Question 3 1 pts Cam's income is $50,000. Under the Head Tax, what is his tax liability? O $5,000 0 $3,750 O $6,250 0 $20,000 D Question 4 1 pts Cam's income is $50,000 and he spends $45,000. Under the sales tax of 13.16%, what is his tax liability? O $6,580 O $6,250 O $5.922 O $5,000 D Question 5 1 pts Cam's income is $50,000 and he owns a home valued at $200,000. Under the property tax of 1.25%, what is Cam's tax liability? O $625 O $2,500 O $5,000 O $6,250 D Question 6 Alex: Is not married; has two children Owns a home inherited from grandparents worth $300,000 Income: $25,000 Spending: $30,000 Tax Plan: Flat income tax of 10% on all household income What is Alex's tax liability? $2,500 O $5,000 O $6,250 O $30,000 D Question 7 Alex: a Is not married; has two children Owns a home inherited from grandparents worth $300,000 Income: $25,000 Spending: $30,000 Tax Plan: Progressive Tax 5% on first $25,000 10% on second $25,000 15% on all income above $50,000 What is Alex's tax liability? O $1,250 $5,000 O $6,250 O $45,000 D Question 8 Alex: Is not married; has two children Owns a home inherited from grandparents worth $300,000 Income: $25,000 Spending: $30,000 Tax Plan: Head tax of $6,250 per household What is Alex's tax liability? $18,750 O $10,000 O $6,250 O $5,000 D Question 9 Alex: - Is not married; has two children - Owns a home inherited from grandparents worth $300,000 Income: $25,000 Spending: $30,000 . Tax Plan: Sales tax of 13.16% on all spending What is Alex's tax liability? O $5,000 O $3,948 O $3,290 O $2,500 D Question 10 Alex: Is not married; has two children Owns a home inherited from grandparents worth $300,000 Income: $25,000 Spending: $30,000 Tax Plan: Property tax of 1.25% on value of land and buildings owned. What is Alex's tax liability? O $3,750 O $2,500 O $5,000 O $6,250 No new data to save Tastech