Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 CASE ANALYSIS Terrence and Mary Tan are both 40 years old, and they have two children, Jane and Joe. Terence is employed as

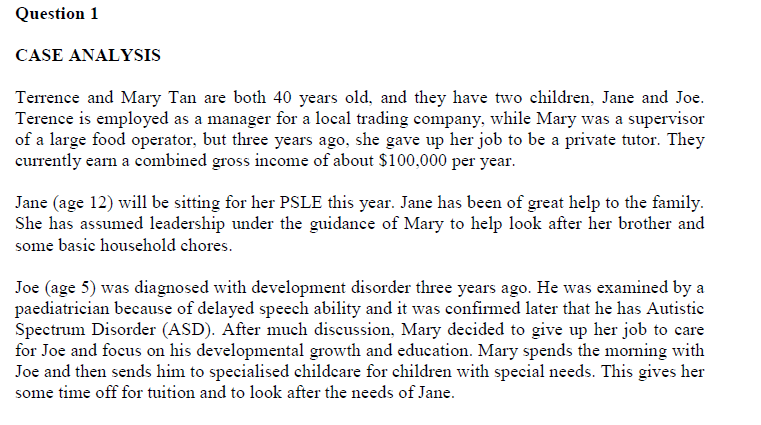

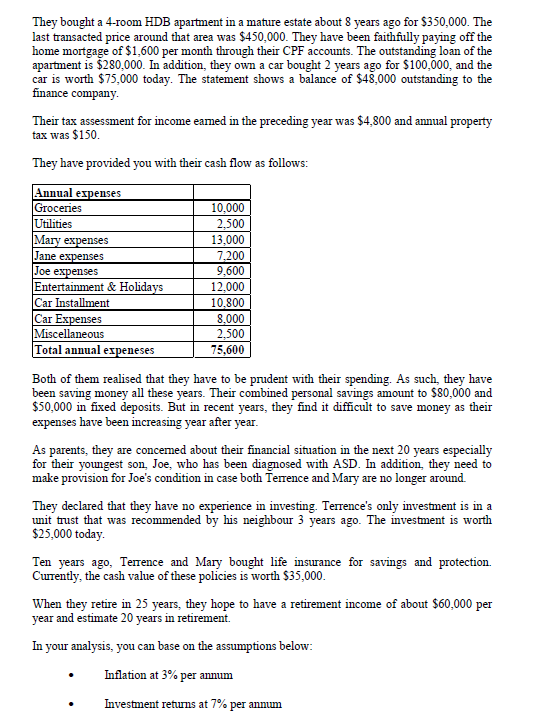

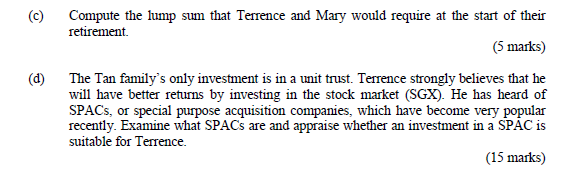

Question 1 CASE ANALYSIS Terrence and Mary Tan are both 40 years old, and they have two children, Jane and Joe. Terence is employed as a manager for a local trading company, while Mary was a supervisor of a large food operator, but three years ago, she gave up her job to be a private tutor. They currently earn a combined gross income of about $100,000 per year. Jane (age 12) will be sitting for her PSLE this year. Jane has been of great help to the family. She has assumed leadership under the guidance of Mary to help look after her brother and some basic household chores. Joe (age 5) was diagnosed with development disorder three years ago. He was examined by a paediatrician because of delayed speech ability and it was confirmed later that he has Autistic Spectrum Disorder (ASD). After much discussion, Mary decided to give up her job to care for Joe and focus on his developmental growth and education. Mary spends the morning with Joe and then sends him to specialised childcare for children with special needs. This gives her some time off for tuition and to look after the needs of Jane. They bought a 4-room HDB apartment in a mature estate about 8 years ago for $350,000. The last transacted price around that area was $450,000. They have been faithfully paying off the home mortgage of $1,600 per month through their CPF accounts. The outstanding loan of the apartment is $280,000. In addition, they own a car bought 2 years ago for $100,000, and the car is worth $75,000 today. The statement shows a balance of $48.000 outstanding to the finance company. Their tax assessment for income eamed in the preceding year was $4,800 and annual property tax was $150. They have provided you with their cash flow as follows: Annual expenses Groceries Utilities Mary expenses Jane expenses Joe expenses Entertainment & Holidays Car Installment Car Expenses Miscellaneous Total annual expeneses 10.000 2,500 13,000 7,200 9,600 12,000 10.800 8.000 2,500 75,600 Both of them realised that they have to be prudent with their spending. As such, they have been saving money all these years. Their combined personal savings amount to $80,000 and $50,000 in fixed deposits. But in recent years, they find it difficult to save money as their expenses have been increasing year after year. As parents, they are concemed about their financial situation in the next 20 years especially for their youngest son, Joe, who has been diagnosed with ASD. In addition, they need to make provision for Joe's condition in case both Terrence and Mary are no longer around. They declared that they have no experience in investing. Terrence's only investment is in a unit trust that was recommended by his neighbour 3 years ago. The investment is worth $25,000 today. Ten years ago, Terrence and Mary bought life insurance for savings and protection. Currently, the cash value of these policies is worth $35,000. When they retire in 25 years, they hope to have a retirement income of about $60,000 per year and estimate 20 years in retirement. In your analysis, you can base on the assumptions below: Inflation at 3% per annum Investment returns at 7% per annum (c) (d) Compute the lump sum that Terrence and Mary would require at the start of their retirement. (5 marks) The Tan family's only investment is in a unit trust. Terrence strongly believes that he will have better returns by investing in the stock market (SGX). He has heard of SPACs, or special purpose acquisition companies, which have become very popular recently. Examine what SPACs are and appraise whether an investment in a SPAC is suitable for Terrence. (15 marks) Question 1 CASE ANALYSIS Terrence and Mary Tan are both 40 years old, and they have two children, Jane and Joe. Terence is employed as a manager for a local trading company, while Mary was a supervisor of a large food operator, but three years ago, she gave up her job to be a private tutor. They currently earn a combined gross income of about $100,000 per year. Jane (age 12) will be sitting for her PSLE this year. Jane has been of great help to the family. She has assumed leadership under the guidance of Mary to help look after her brother and some basic household chores. Joe (age 5) was diagnosed with development disorder three years ago. He was examined by a paediatrician because of delayed speech ability and it was confirmed later that he has Autistic Spectrum Disorder (ASD). After much discussion, Mary decided to give up her job to care for Joe and focus on his developmental growth and education. Mary spends the morning with Joe and then sends him to specialised childcare for children with special needs. This gives her some time off for tuition and to look after the needs of Jane. They bought a 4-room HDB apartment in a mature estate about 8 years ago for $350,000. The last transacted price around that area was $450,000. They have been faithfully paying off the home mortgage of $1,600 per month through their CPF accounts. The outstanding loan of the apartment is $280,000. In addition, they own a car bought 2 years ago for $100,000, and the car is worth $75,000 today. The statement shows a balance of $48.000 outstanding to the finance company. Their tax assessment for income eamed in the preceding year was $4,800 and annual property tax was $150. They have provided you with their cash flow as follows: Annual expenses Groceries Utilities Mary expenses Jane expenses Joe expenses Entertainment & Holidays Car Installment Car Expenses Miscellaneous Total annual expeneses 10.000 2,500 13,000 7,200 9,600 12,000 10.800 8.000 2,500 75,600 Both of them realised that they have to be prudent with their spending. As such, they have been saving money all these years. Their combined personal savings amount to $80,000 and $50,000 in fixed deposits. But in recent years, they find it difficult to save money as their expenses have been increasing year after year. As parents, they are concemed about their financial situation in the next 20 years especially for their youngest son, Joe, who has been diagnosed with ASD. In addition, they need to make provision for Joe's condition in case both Terrence and Mary are no longer around. They declared that they have no experience in investing. Terrence's only investment is in a unit trust that was recommended by his neighbour 3 years ago. The investment is worth $25,000 today. Ten years ago, Terrence and Mary bought life insurance for savings and protection. Currently, the cash value of these policies is worth $35,000. When they retire in 25 years, they hope to have a retirement income of about $60,000 per year and estimate 20 years in retirement. In your analysis, you can base on the assumptions below: Inflation at 3% per annum Investment returns at 7% per annum (c) (d) Compute the lump sum that Terrence and Mary would require at the start of their retirement. (5 marks) The Tan family's only investment is in a unit trust. Terrence strongly believes that he will have better returns by investing in the stock market (SGX). He has heard of SPACs, or special purpose acquisition companies, which have become very popular recently. Examine what SPACs are and appraise whether an investment in a SPAC is suitable for Terrence. (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started