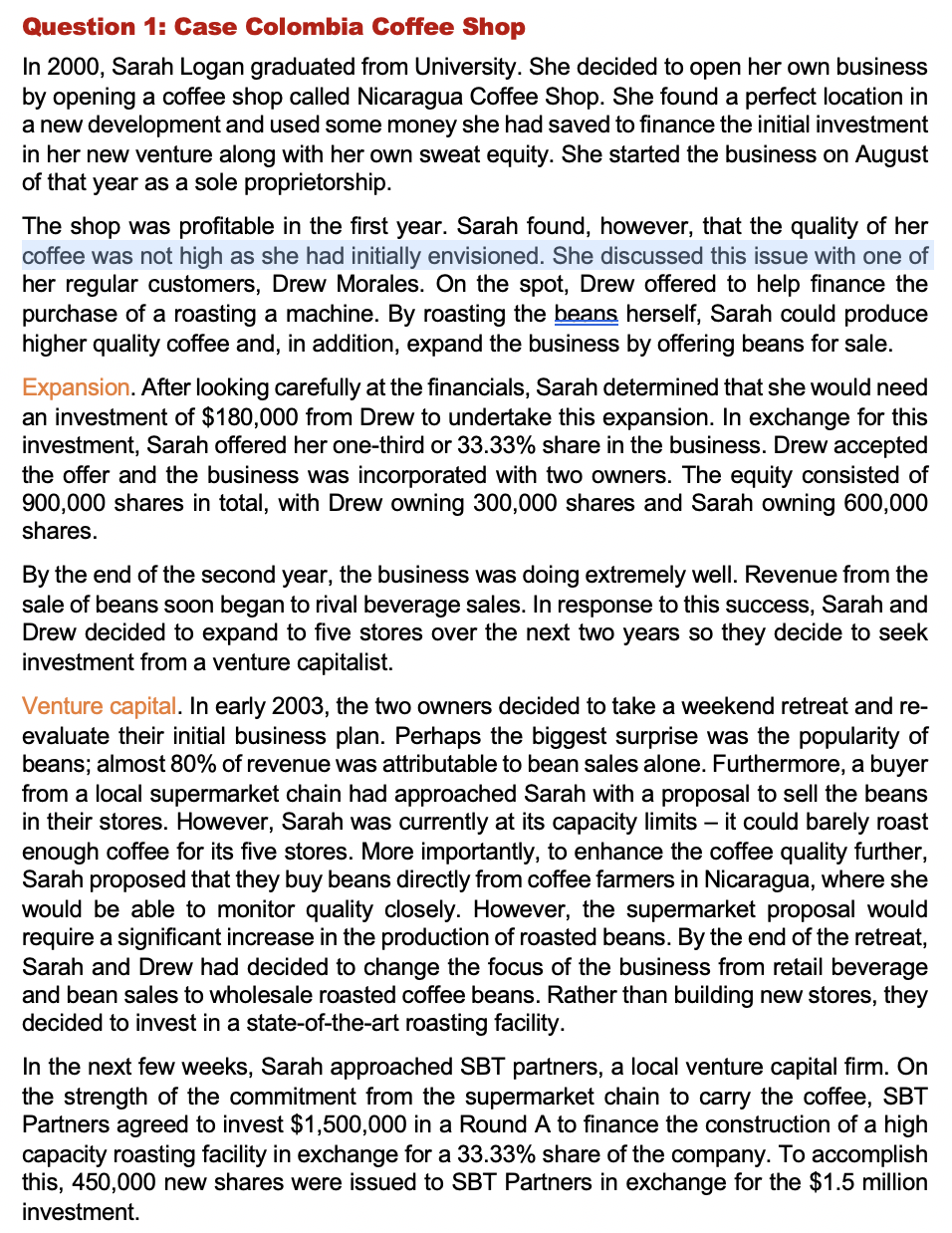

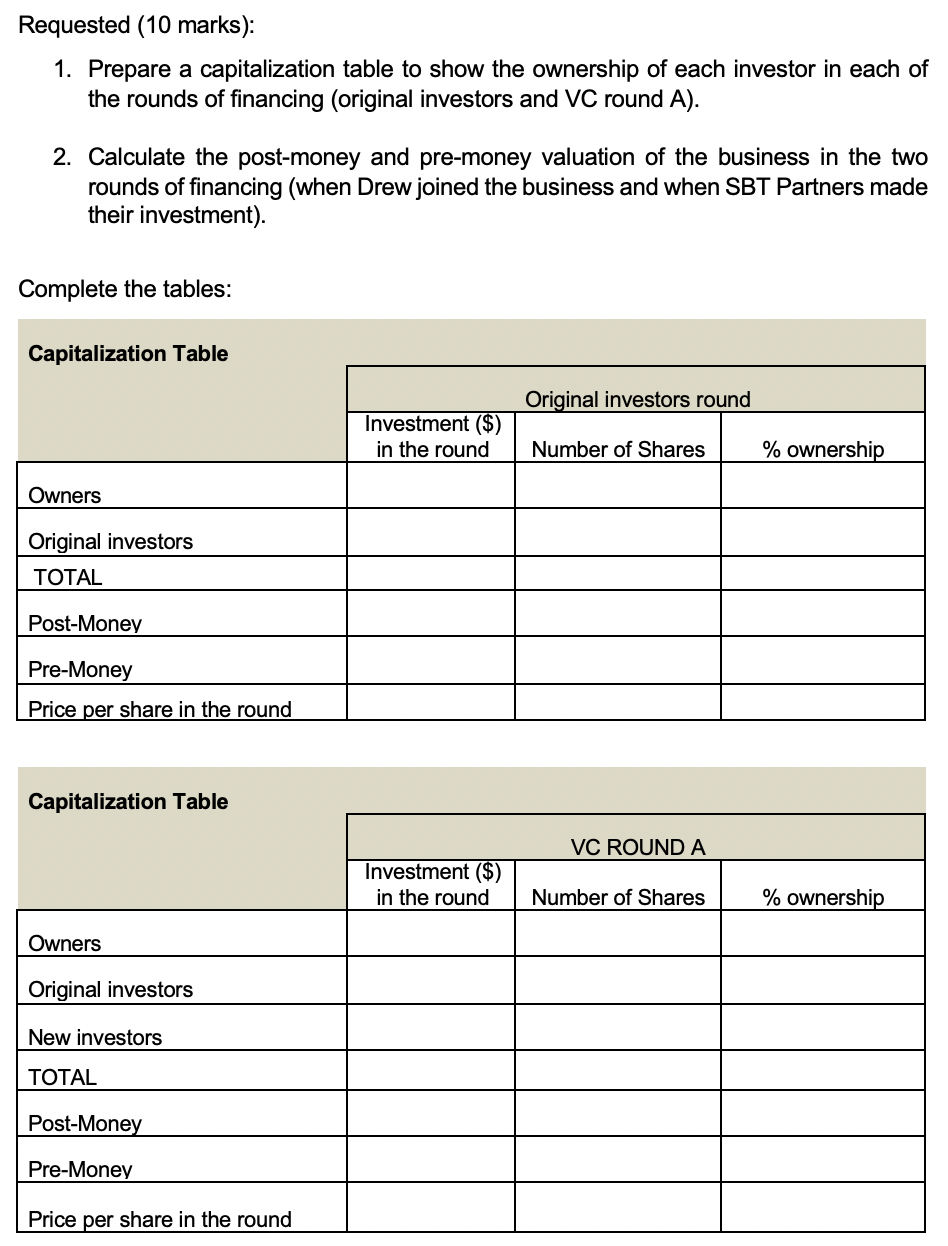

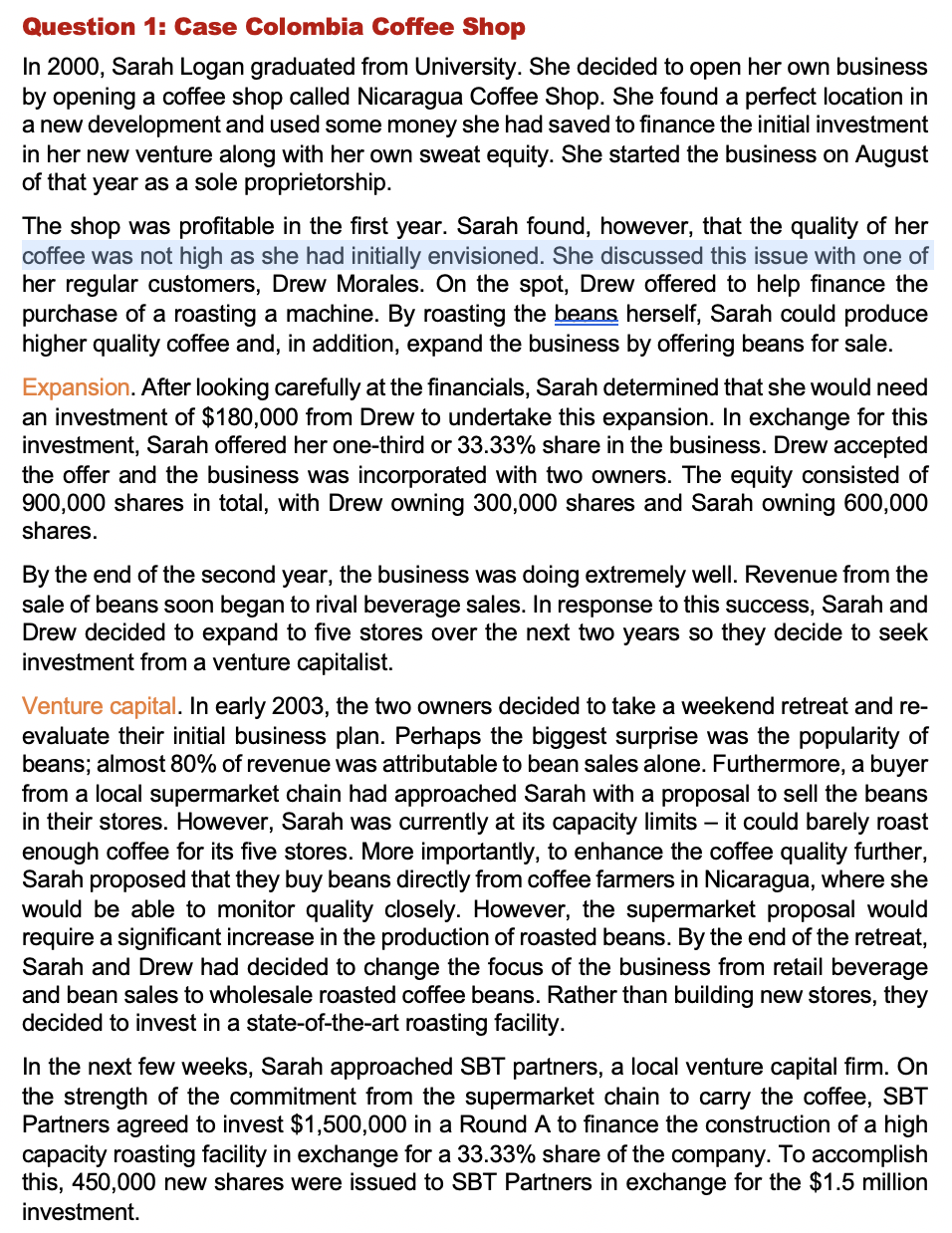

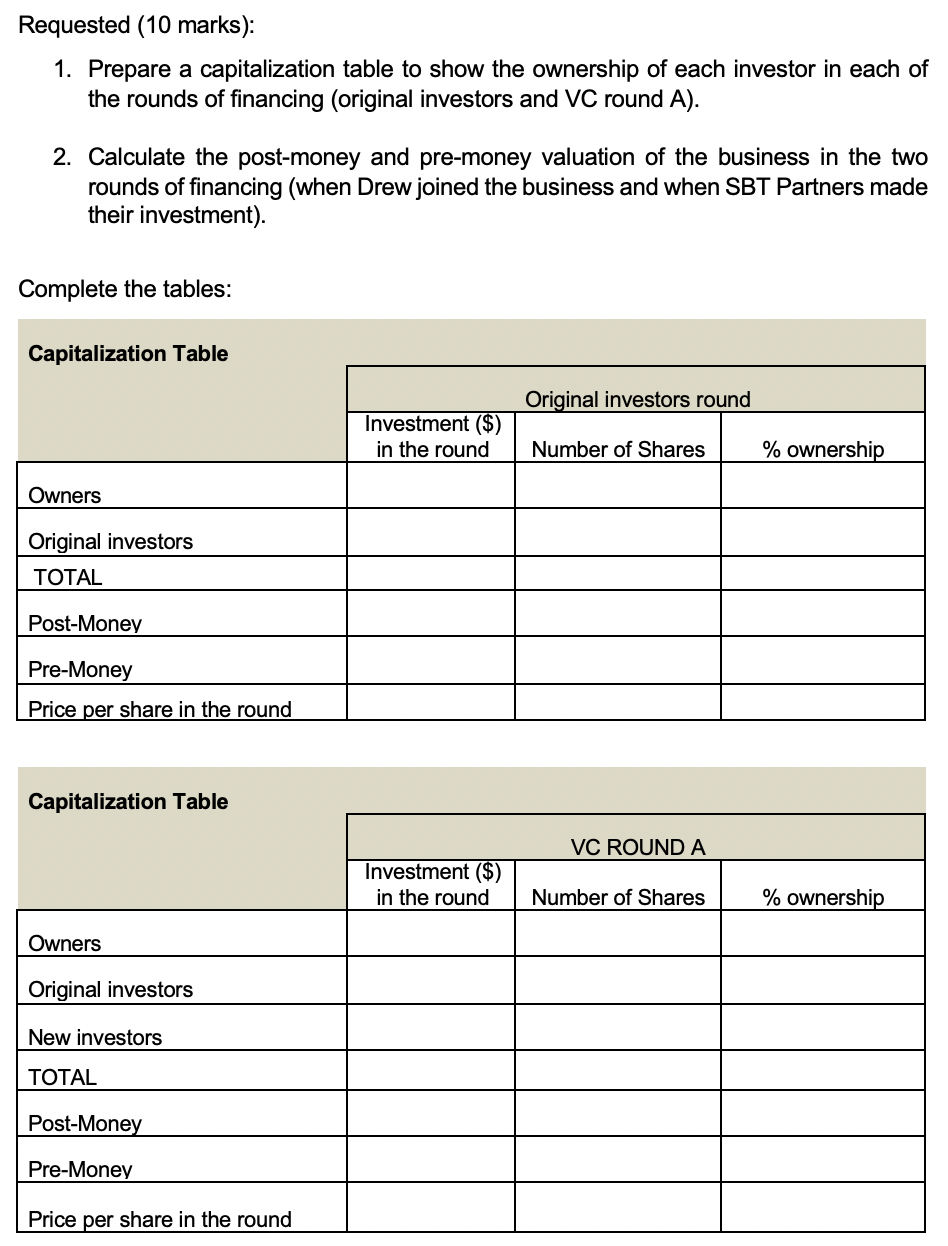

Question 1: Case Colombia Coffee Shop In 2000, Sarah Logan graduated from University. She decided to open her own business by opening a coffee shop called Nicaragua Coffee Shop. She found a perfect location in a new development and used some money she had saved to finance the initial investment in her new venture along with her own sweat equity. She started the business on August of that year as a sole proprietorship. The shop was profitable in the first year. Sarah found, however, that the quality of her coffee was not high as she had initially envisioned. She discussed this issue with one of her regular customers, Drew Morales. On the spot, Drew offered to help finance the purchase of a roasting a machine. By roasting the beans herself, Sarah could produce higher quality coffee and, in addition, expand the business by offering beans for sale. Expansion. After looking carefully at the financials, Sarah determined that she would need an investment of $180,000 from Drew to undertake this expansion. In exchange for this investment, Sarah offered her one-third or 33.33% share in the business. Drew accepted the offer and the business was incorporated with two owners. The equity consisted of 900,000 shares in total, with Drew owning 300,000 shares and Sarah owning 600,000 shares. By the end of the second year, the business was doing extremely well. Revenue from the sale of beans soon began to rival beverage sales. In response to this success, Sarah and Drew decided to expand to five stores over the next two years so they decide to seek investment from a venture capitalist. Venture capital. In early 2003, the two owners decided to take a weekend retreat and re- evaluate their initial business plan. Perhaps the biggest surprise was the popularity of beans; almost 80% of revenue was attributable to bean sales alone. Furthermore, a buyer from a local supermarket chain had approached Sarah with a proposal to sell the beans in their stores. However, Sarah was currently at its capacity limits it could barely roast enough coffee for its five stores. More importantly, to enhance the coffee quality further, Sarah proposed that they buy beans directly from coffee farmers in Nicaragua, where she would be able to monitor quality closely. However, the supermarket proposal would require a significant increase in the production of roasted beans. By the end of the retreat, Sarah and Drew had decided to change the focus of the business from retail beverage and bean sales to wholesale roasted coffee beans. Rather than building new stores, they decided to invest in a state-of-the-art roasting facility. In the next few weeks, Sarah approached SBT partners, a local venture capital firm. On the strength of the commitment from the supermarket chain to carry the coffee, SBT Partners agreed to invest $1,500,000 in a Round A to finance the construction of a high capacity roasting facility in exchange for a 33.33% share of the company. To accomplish this, 450,000 new shares were issued to SBT Partners in exchange for the $1.5 million investment. Requested (10 marks): 1. Prepare a capitalization table to show the ownership of each investor in each of the rounds of financing (original investors and VC round A). 2. Calculate the post-money and pre-money valuation of the business in the two rounds of financing (when Drew joined the business and when SBT Partners made their investment). Complete the tables: Capitalization Table Original investors round Investment ($) in the round Number of Shares % ownership Owners Original investors TOTAL Post-Money Pre-Money Price per share in the round Capitalization Table VC ROUND A Investment ($) in the round Number of Shares % ownership Owners Original investors New investors TOTAL Post-Money Pre-Money Price per share in the round