Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 - Case Stem Kevin and Jill are in their 7 0 s . They are retired. They have done a good job of

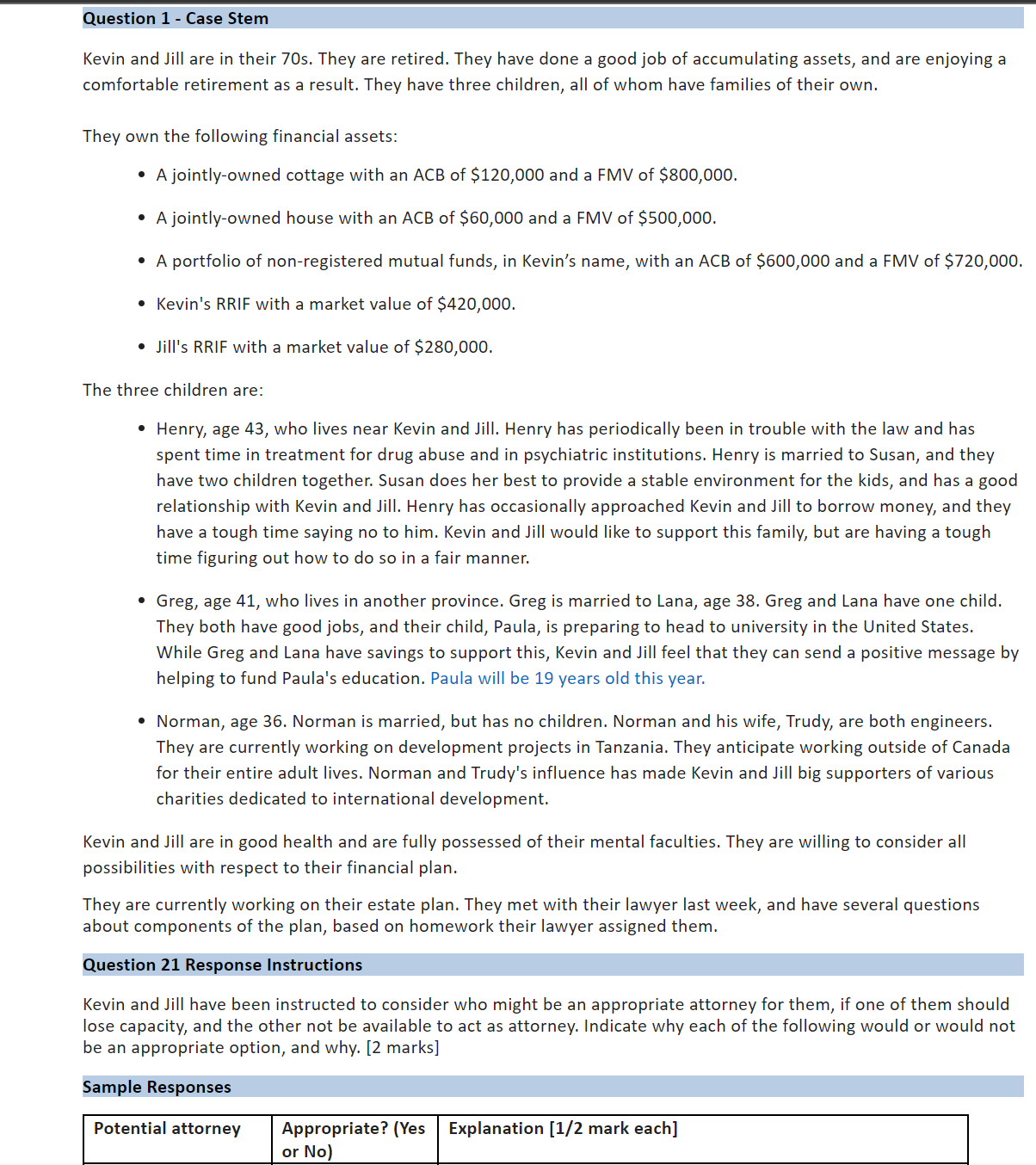

Question Case Stem

Kevin and Jill are in their s They are retired. They have done a good job of accumulating assets, and are enjoying a

comfortable retirement as a result. They have three children, all of whom have families of their own.

They own the following financial assets:

A jointlyowned cottage with an ACB of $ and a FMV of $

A jointlyowned house with an ACB of $ and a FMV of $

A portfolio of nonregistered mutual funds, in Kevin's name, with an ACB of $ and a FMV of $

Kevin's RRIF with a market value of $

Jill's RRIF with a market value of $

The three children are:

Henry, age who lives near Kevin and Jill. Henry has periodically been in trouble with the law and has

spent time in treatment for drug abuse and in psychiatric institutions. Henry is married to Susan, and they

have two children together. Susan does her best to provide a stable environment for the kids, and has a good

relationship with Kevin and Jill. Henry has occasionally approached Kevin and Jill to borrow money, and they

have a tough time saying no to him. Kevin and Jill would like to support this family, but are having a tough

time figuring out how to do so in a fair manner.

Greg, age who lives in another province. Greg is married to Lana, age Greg and Lana have one child.

They both have good jobs, and their child, Paula, is preparing to head to university in the United States.

While Greg and Lana have savings to support this, Kevin and Jill feel that they can send a positive message by

helping to fund Paula's education. Paula will be years old this year.

Norman, age Norman is married, but has no children. Norman and his wife, Trudy, are both engineers.

They are currently working on development projects in Tanzania. They anticipate working outside of Canada

for their entire adult lives. Norman and Trudy's influence has made Kevin and Jill big supporters of various

charities dedicated to international development.

Kevin and Jill are in good health and are fully possessed of their mental faculties. They are willing to consider all

possibilities with respect to their financial plan.

They are currently working on their estate plan. They met with their lawyer last week, and have several questions

about components of the plan, based on homework their lawyer assigned them.

Question Response Instructions

Kevin and Jill have been instructed to consider who might be an appropriate attorney for them, if one of them should

lose capacity, and the other not be available to act as attorney. Indicate why each of the following would or would not

be an appropriate option, and why. marks

Sample Responses

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started