Answered step by step

Verified Expert Solution

Question

1 Approved Answer

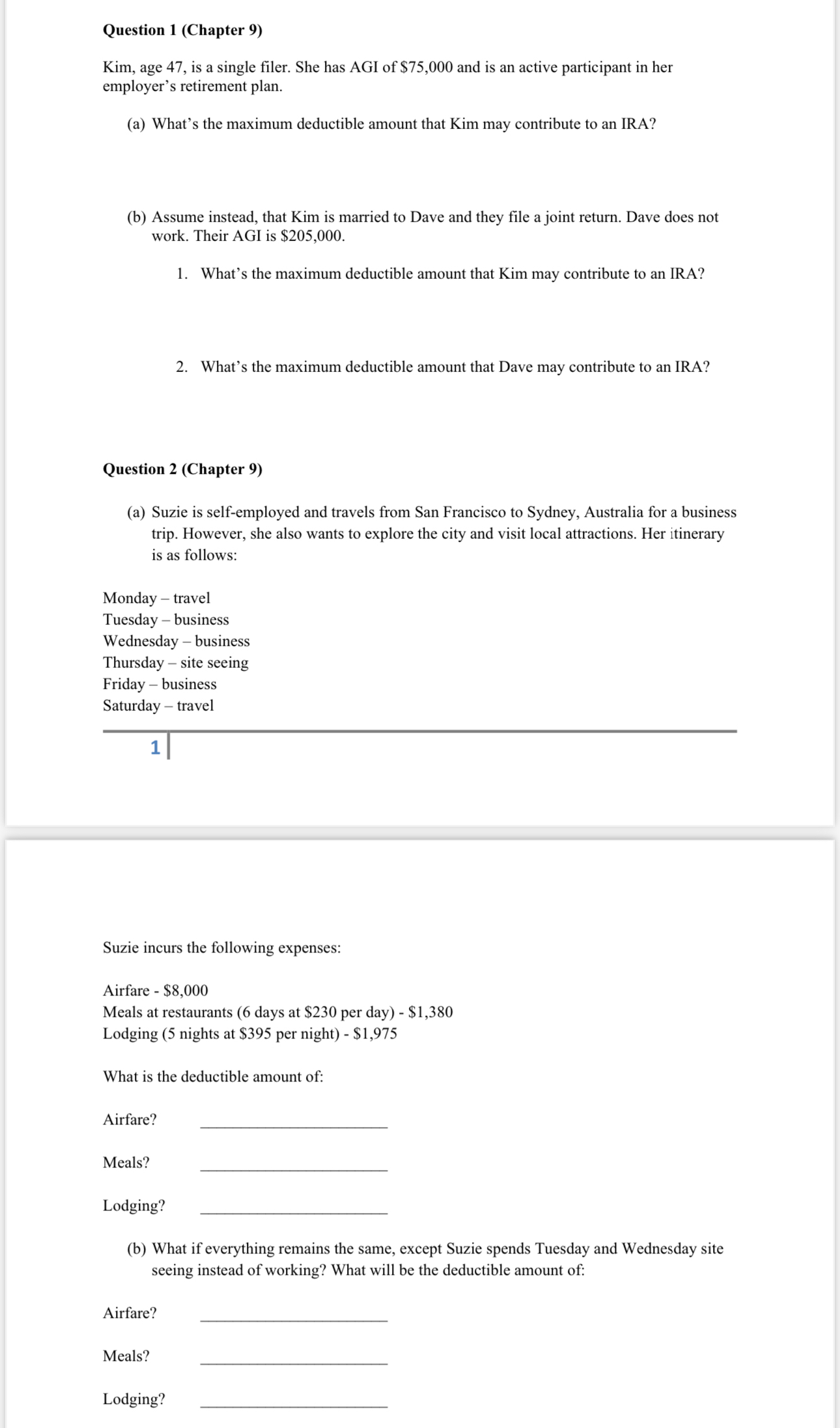

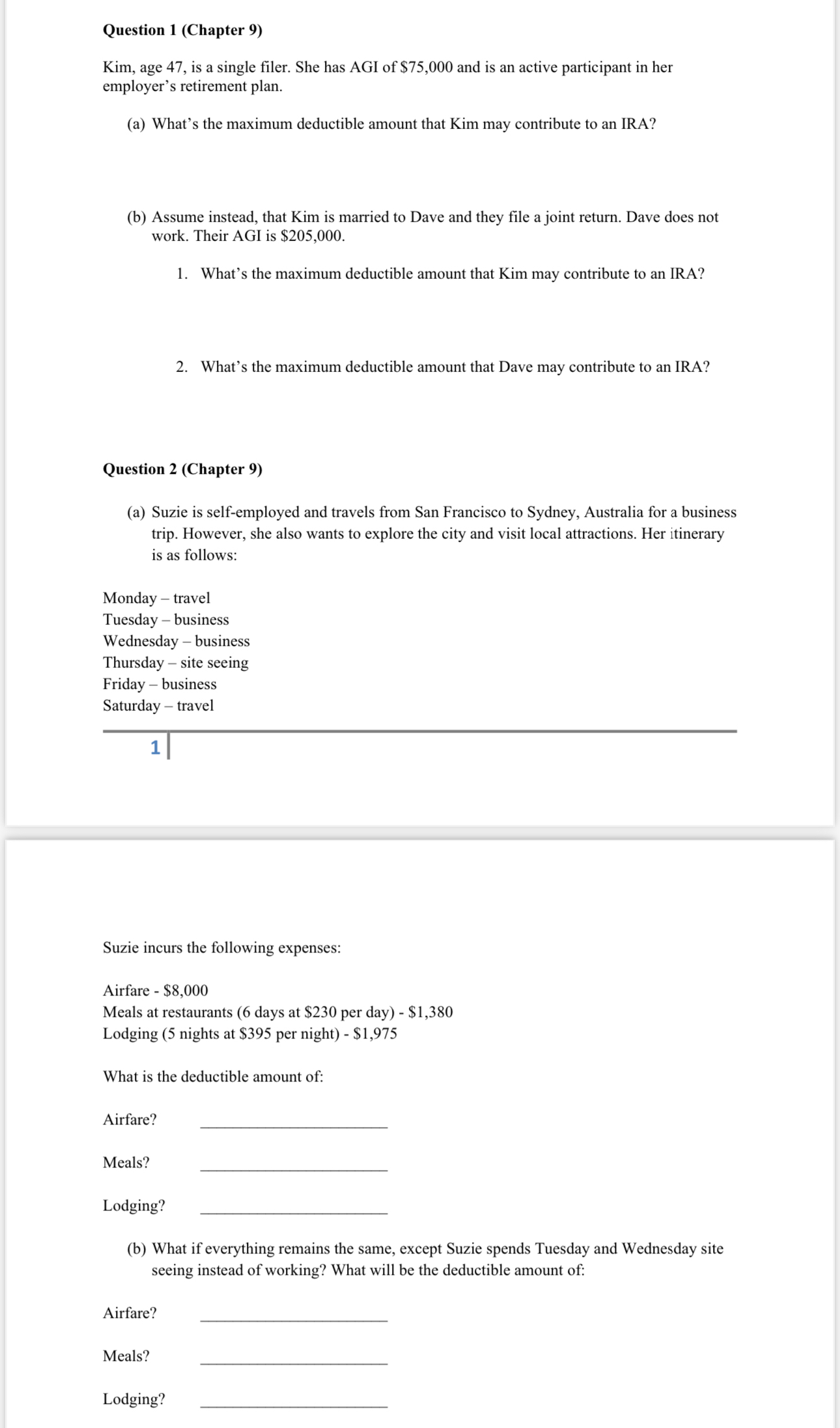

Question 1 ( Chapter 9 ) Kim, age 4 7 , is a single filer. She has AGI of $ 7 5 , 0 0

Question Chapter

Kim, age is a single filer. She has AGI of $ and is an active participant in her employer's retirement plan.

a What's the maximum deductible amount that Kim may contribute to an IRA?

b Assume instead, that Kim is married to Dave and they file a joint return. Dave does not work. Their AGI is $

What's the maximum deductible amount that Kim may contribute to an IRA?

What's the maximum deductible amount that Dave may contribute to an IRA?

Question Chapter

a Suzie is selfemployed and travels from San Francisco to Sydney, Australia for a business trip. However, she also wants to explore the city and visit local attractions. Her itinerary is as follows:

Monday travel

Tuesday business

Wednesday business

Thursday site seeing

Friday business

Saturday travel

Suzie incurs the following expenses:

Airfare $

Meals at restaurants days at $ per day $

Lodging nights at $ per night $

What is the deductible amount of:

Airfare?

Meals?

Lodging?

b What if everything remains the same, except Suzie spends Tuesday and Wednesday site seeing instead of working? What will be the deductible amount of:

Airfare?

Meals?

Lodging?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started