Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 Cherubin Inc. is currently expected to pay a dividend of $1m in exactly one year time, after which the dividend is expected

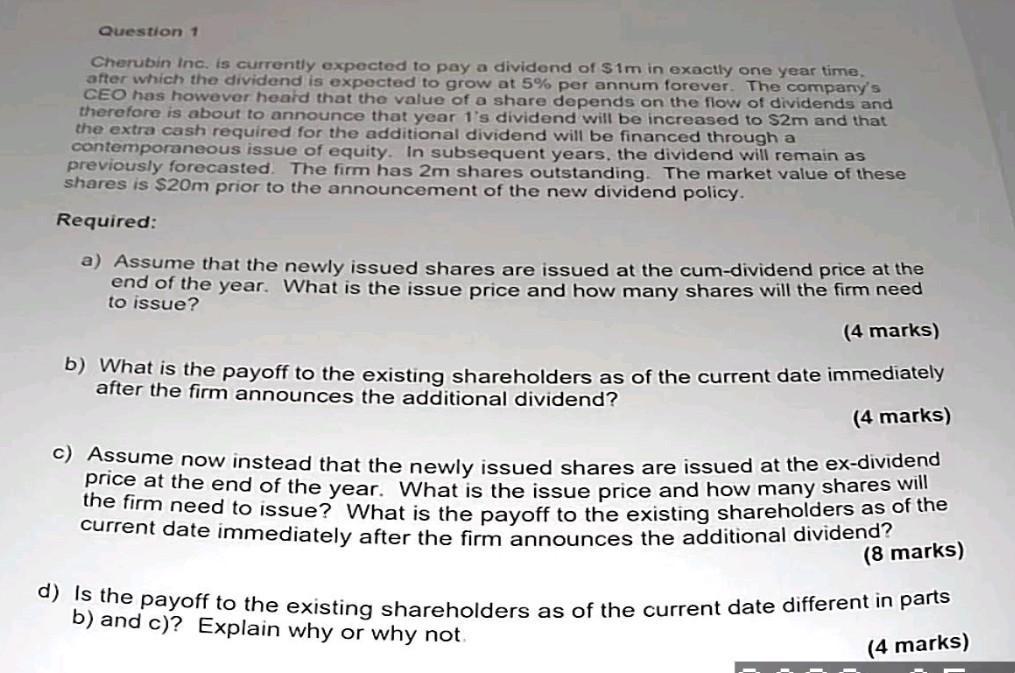

Question 1 Cherubin Inc. is currently expected to pay a dividend of $1m in exactly one year time, after which the dividend is expected to grow at 5% per annum forever. The company's CEO has however heard that the value of a share depends on the flow of dividends and therefore is about to announce that year 1's dividend will be increased to $2m and that the extra cash required for the additional dividend will be financed through a contemporaneous issue of equity. In subsequent years, the dividend will remain as previously forecasted. The firm has 2m shares outstanding. The market value of these shares is $20m prior to the announcement of the new dividend policy. Required: a) Assume that the newly issued shares are issued at the cum-dividend price at the end of the year. What is the issue price and how many shares will the firm need to issue? (4 marks) b) What is the payoff to the existing shareholders as of the current date immediately after the firm announces the additional dividend? (4 marks) c) Assume now instead that the newly issued shares are issued at the ex-dividend price at the end of the year. What is the issue price and how many shares will the firm need to issue? What is the payoff to the existing shareholders as of the current date immediately after the firm announces the additional dividend? (8 marks) d) Is the payoff to the existing shareholders as of the current date different in parts b) and c)? Explain why or why not. (4 marks)

Step by Step Solution

★★★★★

3.59 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

aThe firm will need to issue 100000 shares to finance the new dividend policy The shares will be issued at the cumdividend price of 200 per share The ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started