Question #1:

Choices(for Question #1):

1.income bond, foreign bond, potable bond

2. general obligation bond, revenue bond, indexed bond

3. subordinated debenture, zero coupon bond, junior mortgage bond

4.income bond, foreign bond, purchasing power bond

Question #2

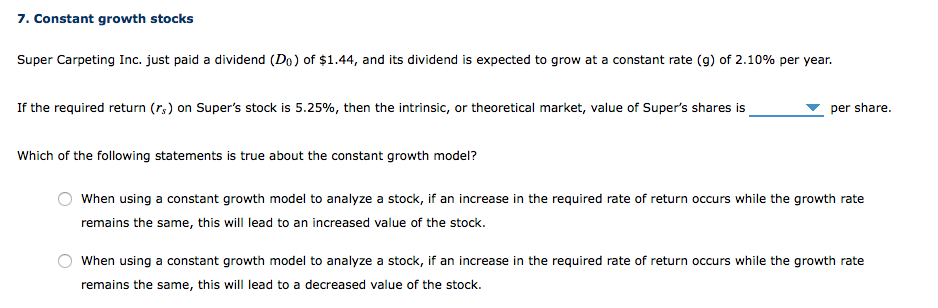

Question #3: (just answer which of the ff is try about constant growth model)

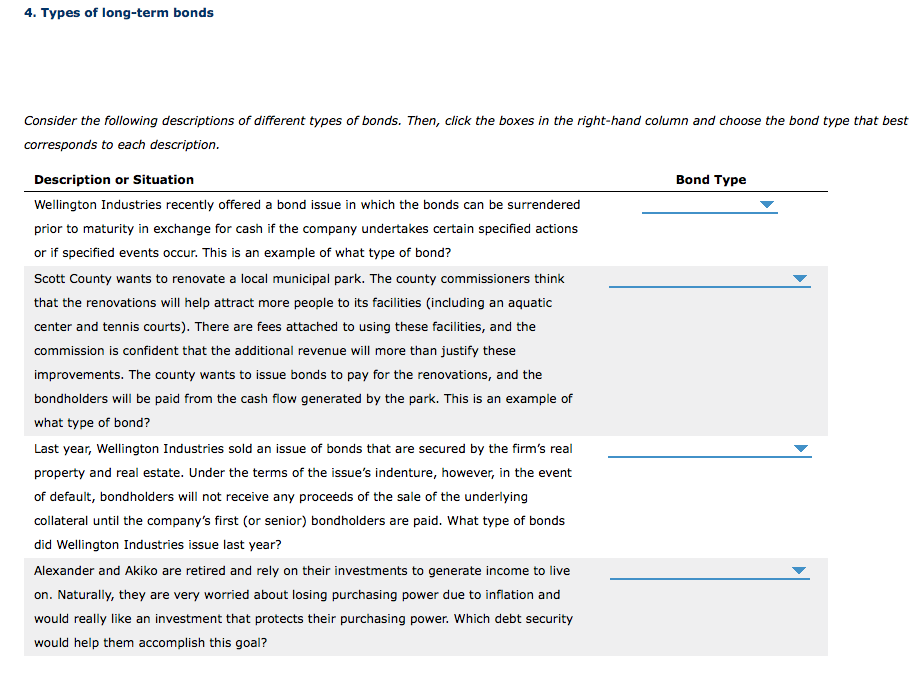

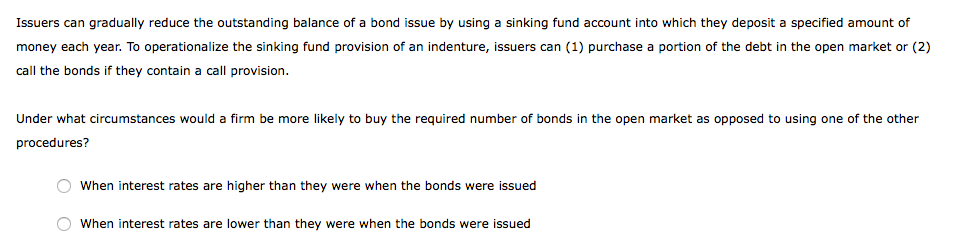

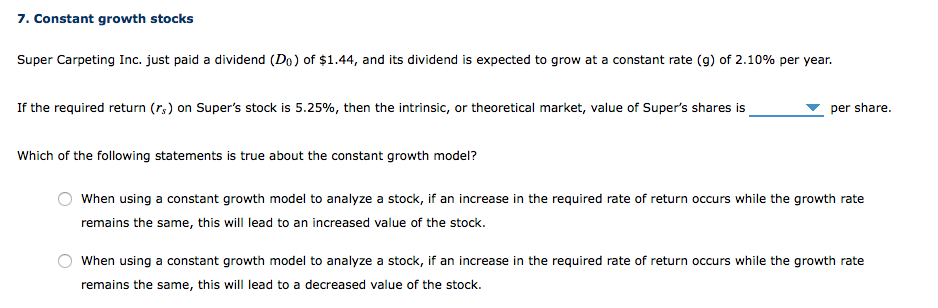

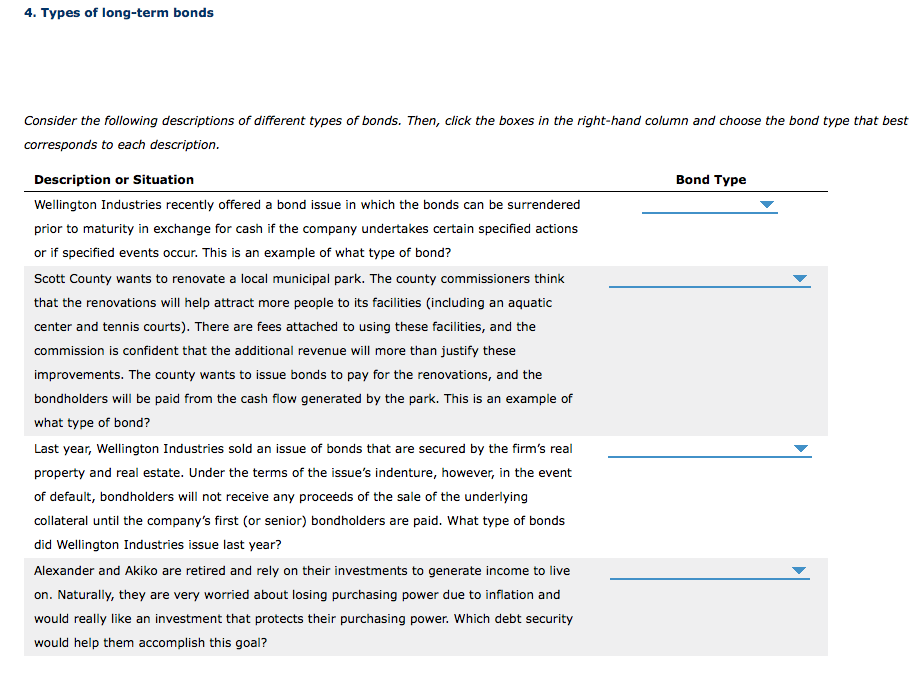

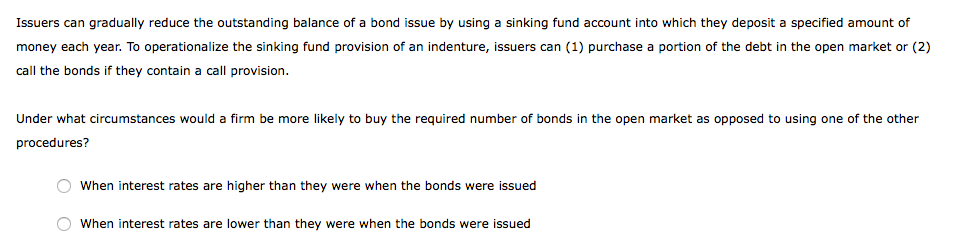

4. Types of long-term bonds Consider the following descriptions of different types of bonds. Then, click the boxes in the right-hand column and choose the bond type that best corresponds to each description. Bond Type Description or Situation Wellington Industries recently offered a bond issue in which the bonds can be surrendered prior to maturity in exchange for cash if the company undertakes certain specified actions or if specified events occur. This is an example of what type of bond? Scott County wants to renovate a local municipal park. The county commissioners think that the renovations will help attract more people to its facilities (including an aquatic center and tennis courts). There are fees attached to using these facilities, and the commission is confident that the additional revenue will more than justify these improvements. The county wants to issue bonds to pay for the renovations, and the bondholders will be paid from the cash flow generated by the park. This is an example of what type of bond? Last year, Wellington Industries sold an issue of bonds that are secured by the firm's real property and real estate. Under the terms of the issue's indenture, however, in the event of default, bondholders will not receive any proceeds of the sale of the underlying collateral until the company's first (or senior) bondholders are paid. What type of bonds did Wellington Industries issue last year? Alexander and Akiko are retired and rely on their investments to generate income to live on. Naturally, they are very worried about losing purchasing power due to inflation and would really like an investment that protects their purchasing power. Which debt security would help them accomplish this goal? Issuers can gradually reduce the outstanding balance of a bond issue by using a sinking fund account into which they deposit a specified amount of money each year. To operationalize the sinking fund provision of an indenture, issuers can (1) purchase a portion of the debt in the open market or (2) call the bonds if they contain a call provision. Under what circumstances would a firm be more likely to buy the required number of bonds in the open market as opposed to using one of the other procedures? When interest rates are higher than they were when the bonds were issued O When interest rates are lower than they were when the bonds were issued 7. Constant growth stocks Super Carpeting Inc. just paid a dividend (D) of $1.44, and its dividend is expected to grow at a constant rate (9) of 2.10% per year. If the required return (rs) on Super's stock is 5.25%, then the intrinsic, or theoretical market, value of Super's shares is per share. Which of the following statements is true about the constant growth model? When using a constant growth model to analyze a stock, if an increase in the required rate of return occurs while the growth rate remains the same, this will lead to an increased value of the stock. When using a constant growth model to analyze a stock, if an increase in the required rate of return occurs while the growth rate remains the same, this will lead to a decreased value of the stock