Answered step by step

Verified Expert Solution

Question

1 Approved Answer

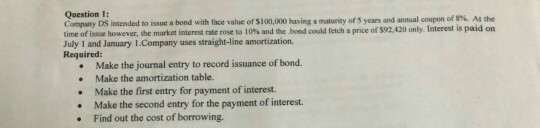

Question 1: Company DS intended to issue a bond with face value of S100,000 having a maturity of 5 years and annual coupon of 8%

Question 1: Company DS intended to issue a bond with face value of S100,000 having a maturity of 5 years and annual coupon of 8% At the time of issae however, the market interest rate rose to 10% and the bond could fetch a price of $92,420 only. Interest is paid on July 1 and January 1.Company uses straight-line amortization. Required: Make the journal entry to record issuance of bond. Make the amortization table. Make the first entry for payment of interest. Make the second entry for the payment of interest. Find out the cost of borrowing

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started