Answered step by step

Verified Expert Solution

Question

1 Approved Answer

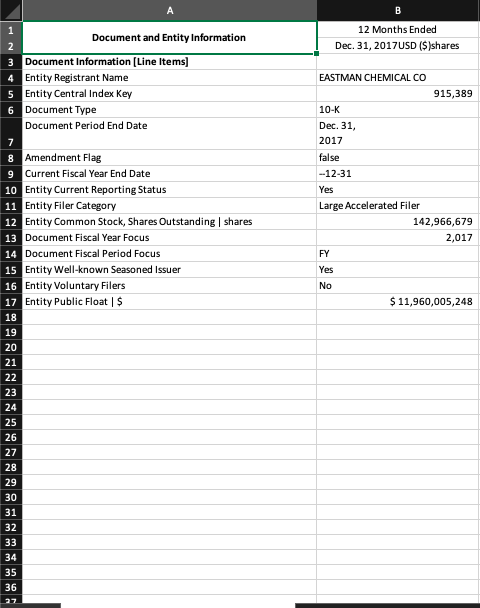

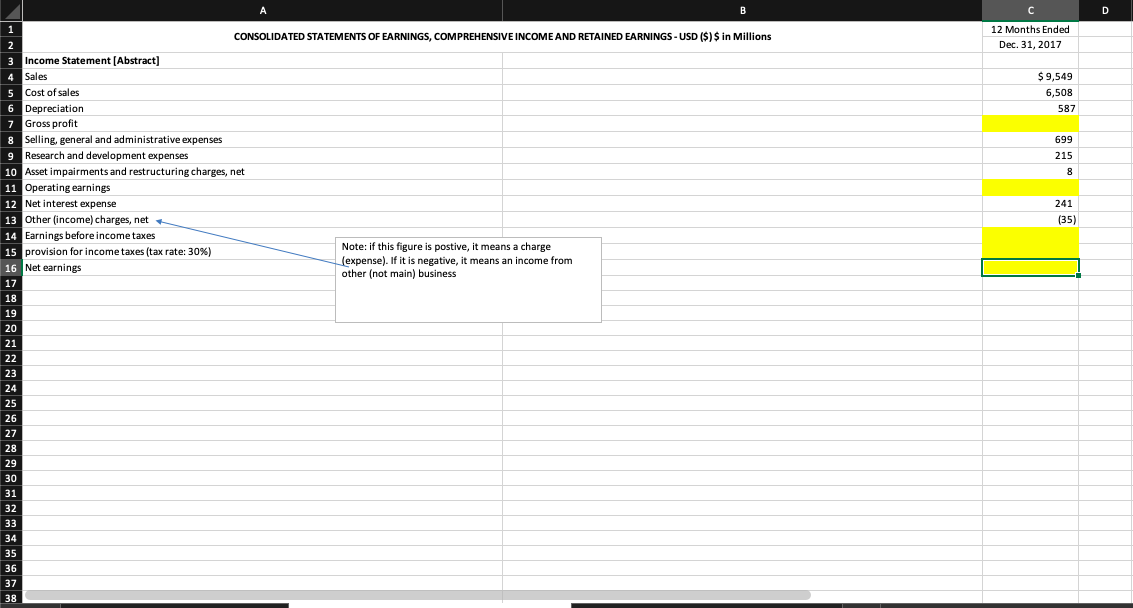

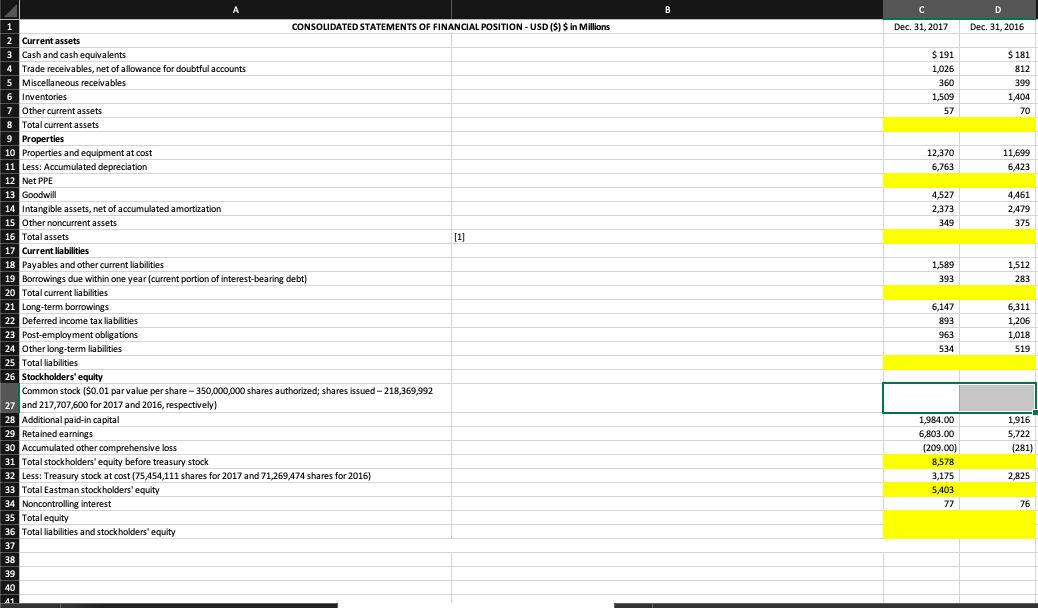

Question 1 Complete the 2017 income statement and the balance sheets of 2016 and 2017 (i.e. fill in the colored cell with proper formulas). Make

Question 1

- Complete the 2017 income statement and the balance sheets of 2016 and 2017 (i.e. fill in the colored cell with proper formulas). Make sure you have a balanced balance sheet for each year.

- Use the information in the statements to calculate financial cash flow of the company in year 2017.

I really need to know what exactly the cell references are also just so I know how to do it. I am confused on so many different cell references I have to use for them. Thank you!

B 12 Months Ended Dec. 31, 2017USD ($)shares Document and Entity Information 3 Document Information (Line Items] 4 Entity Registrant Name 5 Entity Central Index Key 6 Document Type Document Period End Date 7 8 Amendment Flag 9 Current Fiscal Year End Date 10 Entity Current Reporting Status 11 Entity Filer Category 12 EntityCommon Stock, Shares Outstanding shares 13 Document Fiscal Year Focus 14 Document Fiscal Period Focus 15 Entity Well-known Seasoned issuer 16 Entity Voluntary Filers 17 Entity Public Float $ 18 19 20 21 22 23 24 EASTMAN CHEMICAL CO 915,389 10-K Dec. 31, 2017 false --12-31 Yes Large Accelerated Filer 142,966,679 2,017 FY Yes No $ 11,960,005,248 25 26 27 28 29 30 31 32 33 34 35 36 27 B D 12 Months Ended Dec. 31, 2017 $ 9,549 6,508 587 699 215 8 241 (35) CONSOLIDATED STATEMENTS OF EARNINGS, COMPREHENSIVE INCOME AND RETAINED EARNINGS- USD ($) $ in Millions 2 3 Income Statement(Abstract) 4 Sales 5 Cost of sales 6 Depreciation 7 Gross profit 7 8 Selling, general and administrative expenses 9 Research and development expenses 10 Asset impairments and restructuring charges, net 11 Operating earnings 12 Net interest expense 13 Other (income) charges, net 14 Earnings before income taxes 15 provision for income taxes (tax rate: 30%) Note: if this figure is postive, it means a charge expense). If it is negative, it means an income from 16 Net earnings other (not main) business 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 A B B D Dec. 31, 2017 Dec. 31, 2016 $ 191 1,026 360 1.509 57 $ 181 812 399 1404 70 12,370 6,763 11,699 6,423 4,527 2,373 349 4,461 2479 375 1,589 393 1,512 283 1 CONSOLIDATED STATEMENTS OF FINANCIAL POSITION - USD ($) $ in Millions 2 Current assets 3 Cash and cash equivalents 4 Trade receivables, net of allowance for doubtful accounts 5 Miscellaneous receivables 6 Inventories 7 Other current assets 8 Total current assets 9 Properties 10 Properties and equipment at cost 11 Less: Accumulated depreciation 12 Net PPE 13 Goodwill 14 Intangible assets, net of accumulated amortization 15 Other noncurrent assets 16 Total assets [1] 17 Current liabilities 18 Payables and other current liabilities 19 Borrowings due within one year (current portion of interest-bearing debt) 20 Total current liabilities 21 Long-term borrowings 22 Deferred income tax liabilities 23 Post-employment obligations 24 Other long-term liabilities 25 Total liabilities Stockholders' equity Common stock ($0.01 par value per share - 350,000,000 shares authorized; shares issued - 218,369,992 27 and 217,707,600 for 2017 and 2016, respectively) 28 Additional paid-in capital 29 Retained earnings 30 Accumulated other comprehensive loss 31 Total stockholders' equity before treasury stock 32 Less: Treasury stock at cost (75,454,111 shares for 2017 and 71,269,474 shares for 2016) 33 Total Eastman stockholders' equity ' 34 Noncontrolling interest 35 Total equity Total liabilities and stockholders' equity 37 38 39 40 6,147 893 963 534 6,311 1,206 1,018 519 1,916 5,722 (281) 1,984.00 6,803.00 (209.00) 8,578 3,175 5,403 77 2,825 76 41

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started