Question

Question 1: Complete the following. Marks are allocated for before tax unrealized profit and after tax unrealized profit. Show calculations for possible part marks. a)

Question 1: Complete the following. Marks are allocated for before tax unrealized profit and after tax unrealized profit. Show calculations for possible part marks.

a) P Company sold merchandise to a subsidiary for $64,000. Gross profit rate is 40%. At year end, 20% of this remains unsold. The tax rate is 30%. What is the before tax and after-tax unrealized profit in ending inventory? Please highlight the after-tax unrealized profit in yellow. (2 marks)

Clearly indicate your answers as shown below:

Calculations:

Before tax unrealized profit:

After tax unrealized profit:

b) P Company sold merchandise to a subsidiary for $63,000. The mark-up on cost is 50%. At year end, 20% of this remains unsold. The tax rate is 30%. What is the before tax and after tax unrealized profit in ending inventory? Please highlight the after-tax unrealized profit in yellow. (2 marks)

Clearly indicate your answers as indicated below:

Calculations:

Before tax unrealized profit:

After tax unrealized profit:

c) AB Company issued a 10 year, 5%, $2,000,000 bond paying interest twice a year at a market rate of 4.2%. What was the issue price? Please highlight the issue price in yellow. (2 marks)

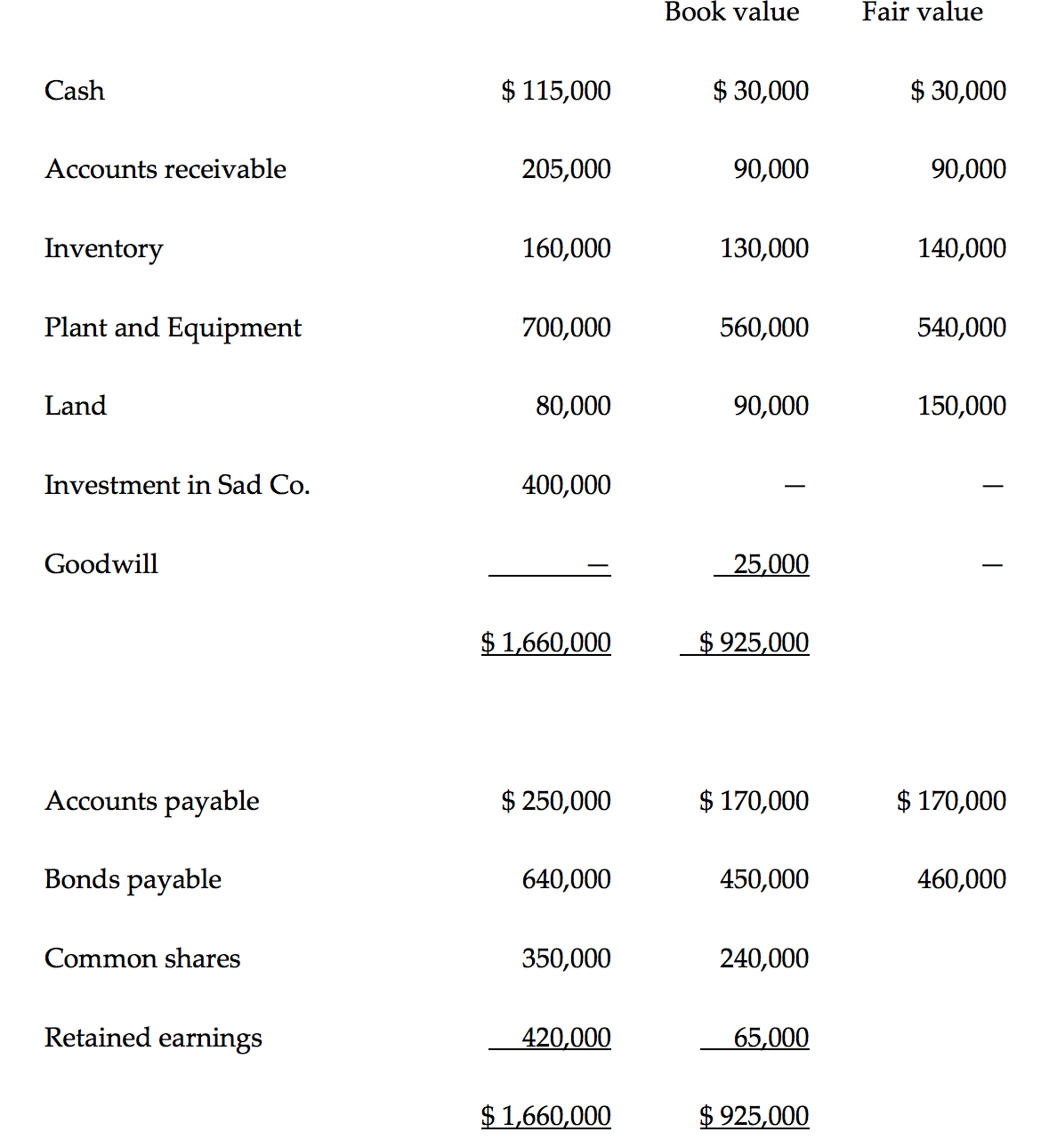

Question 2: On January 1, 2017, Happy Inc. purchased 80% of the outstanding common shares of Sad Co. for $400,000. Happy will account for Sad using the Fair Value Enterprise method. The balance sheets for both companies immediately after the transaction appear below.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started