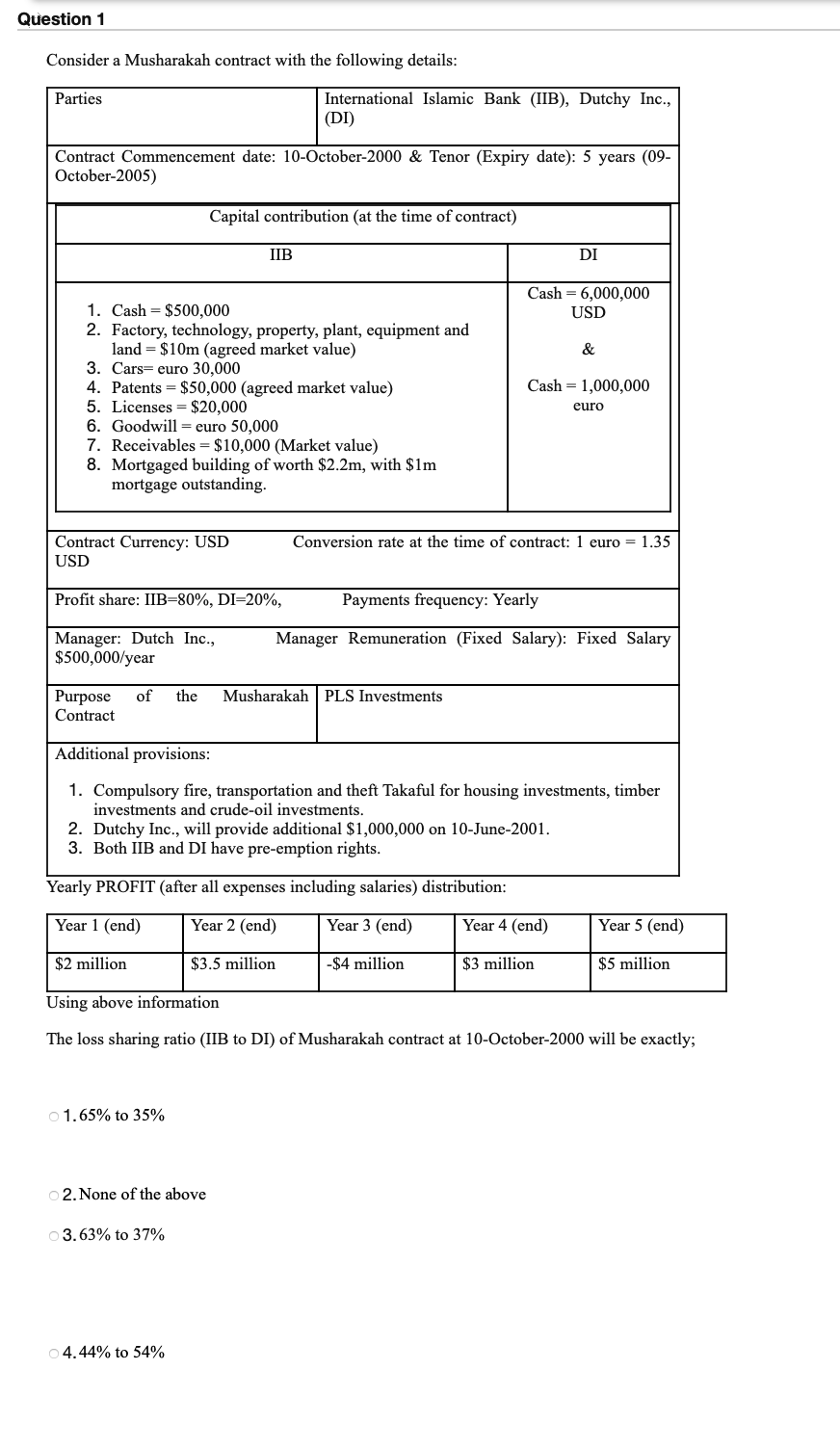

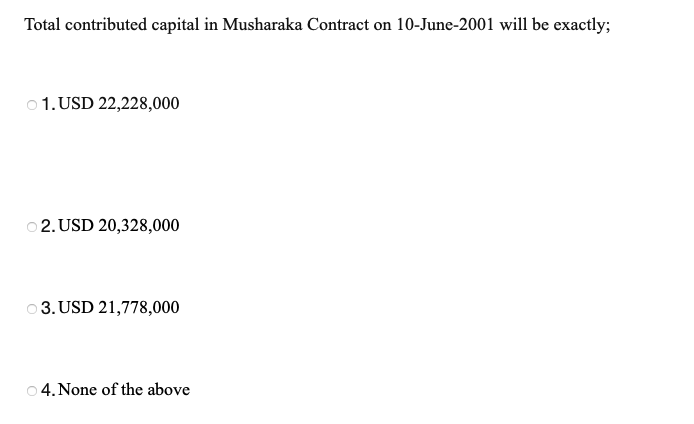

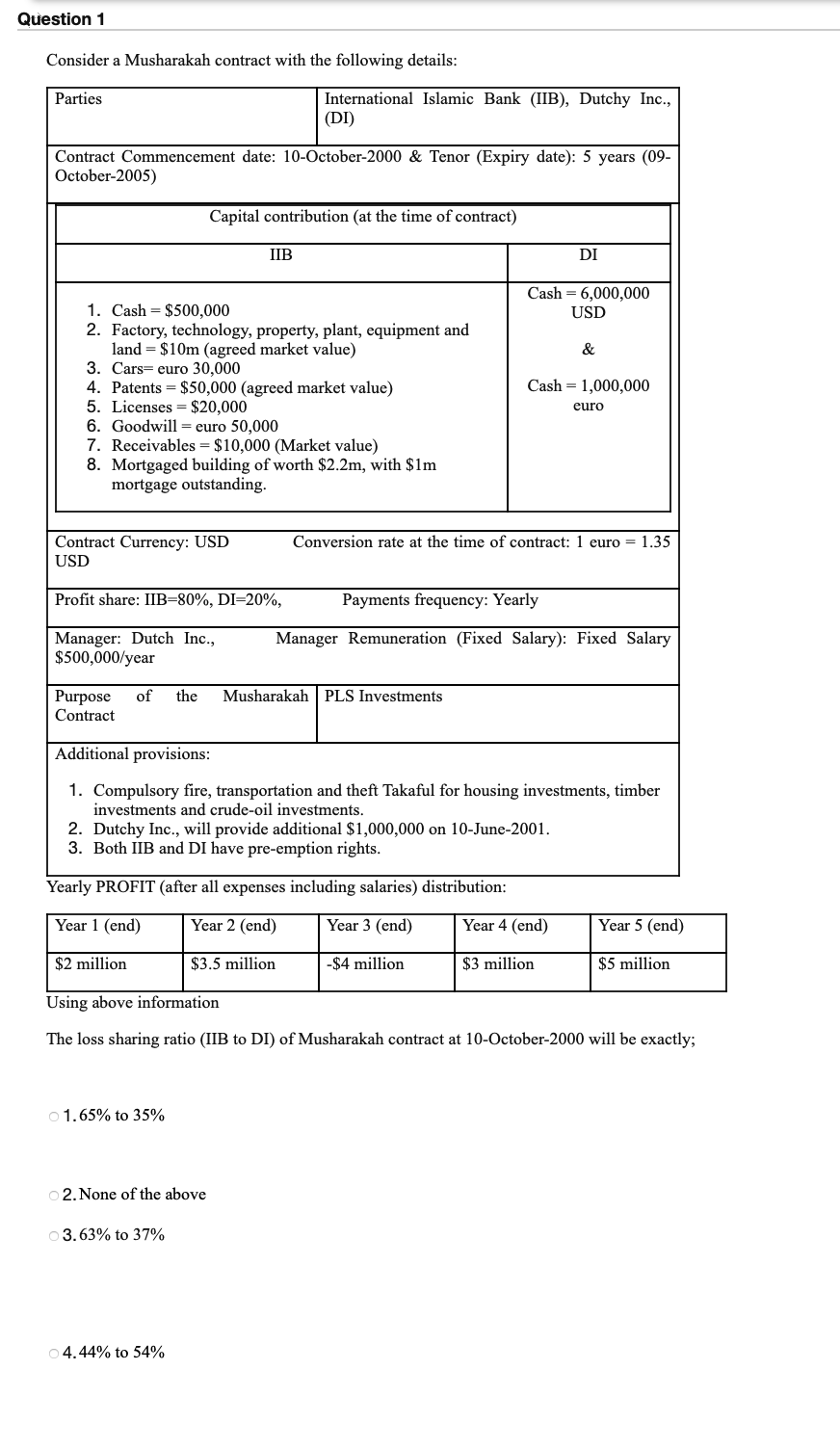

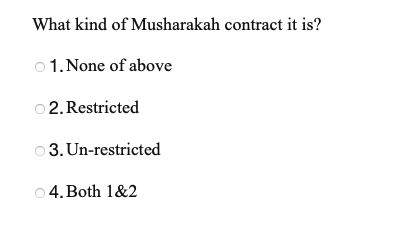

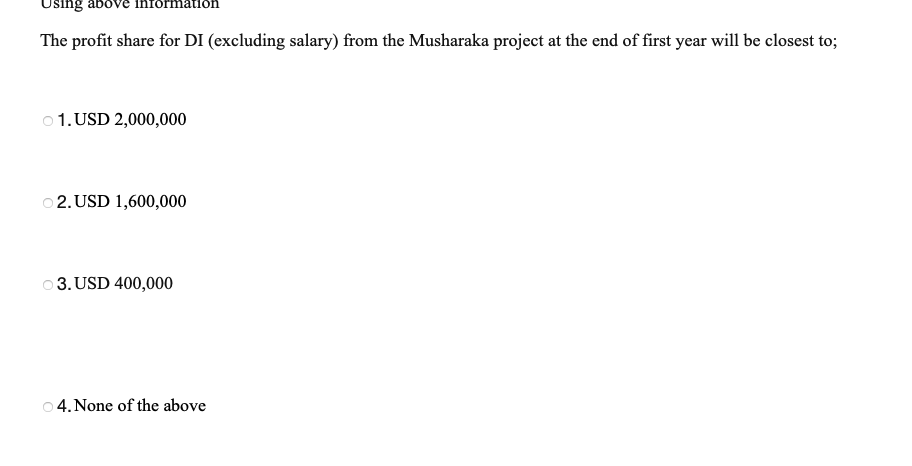

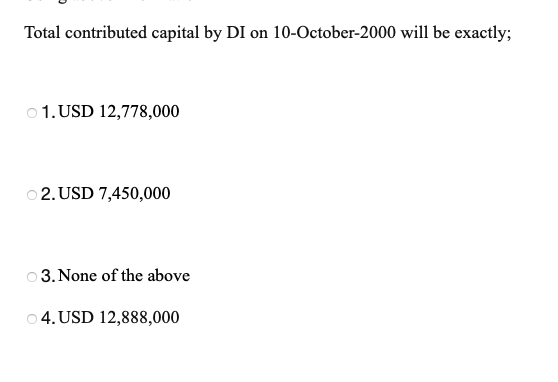

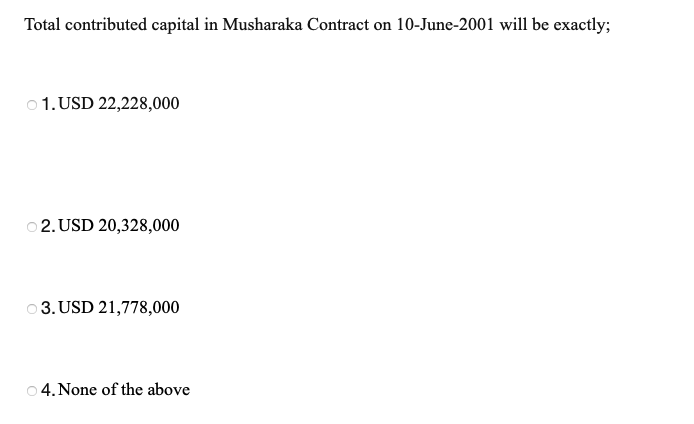

Question 1 Consider a Musharakah contract with the following details: Parties International Islamic Bank (IIB), Dutchy Inc., (DI) Contract Commencement date: 10-October-2000 & Tenor (Expiry date): 5 years (09- October-2005) Capital contribution (at the time of contract) IIB DI Cash = 6,000,000 USD 1. Cash = $500,000 2. Factory, technology, property, plant, equipment and land=$10m (agreed market value) 3. Cars= euro 30,000 4. Patents = $50,000 (agreed market value) 5. Licenses = $20,000 6. Goodwill = euro 50,000 7. Receivables = $10,000 (Market value) 8. Mortgaged building of worth $2.2m, with $1m mortgage outstanding. Cash = 1,000,000 euro Contract Currency: USD Conversion rate at the time of contract: 1 euro = 1.35 USD Profit share: IIB=80%, DI=20%, Payments frequency: Yearly Manager: Dutch Inc., $500,000/year Manager Remuneration (Fixed Salary): Fixed Salary of the Musharakah | PLS Investments Purpose Contract Additional provisions: 1. Compulsory fire, transportation and theft Takaful for housing investments, timber investments and crude-oil investments. 2. Dutchy Inc., will provide additional $1,000,000 on 10-June-2001. 3. Both IIB and DI have pre-emption rights. Yearly PROFIT (after all expenses including salaries) distribution: Year 1 (end) Year 2 (end) Year 3 (end) Year 4 (end) Year 5 (end) $2 million $3.5 million -$4 million $3 million $5 million Using above information The loss sharing ratio (IIB to DI) of Musharakah contract at 10-October-2000 will be exactly; o 1.65% to 35% 2. None of the above 3.63% to 37% 4.44% to 54% What kind of Musharakah contract it is? o 1. None of above 2. Restricted 3. Un-restricted 4. Both 1&2 Using above information The profit share for DI (excluding salary) from the Musharaka project at the end of first year will be closest to; 1. USD 2,000,000 2. USD 1,600,000 3. USD 400,000 4. None of the above Total contributed capital by DI on 10-October-2000 will be exactly; 1. USD 12,778,000 2. USD 7,450,000 3. None of the above 4.USD 12,888,000 Total contributed capital in Musharaka Contract on 10-June-2001 will be exactly; 1.USD 22,228,000 2. USD 20,328,000 3.USD 21,778,000 4. None of the above Question 1 Consider a Musharakah contract with the following details: Parties International Islamic Bank (IIB), Dutchy Inc., (DI) Contract Commencement date: 10-October-2000 & Tenor (Expiry date): 5 years (09- October-2005) Capital contribution (at the time of contract) IIB DI Cash = 6,000,000 USD 1. Cash = $500,000 2. Factory, technology, property, plant, equipment and land=$10m (agreed market value) 3. Cars= euro 30,000 4. Patents = $50,000 (agreed market value) 5. Licenses = $20,000 6. Goodwill = euro 50,000 7. Receivables = $10,000 (Market value) 8. Mortgaged building of worth $2.2m, with $1m mortgage outstanding. Cash = 1,000,000 euro Contract Currency: USD Conversion rate at the time of contract: 1 euro = 1.35 USD Profit share: IIB=80%, DI=20%, Payments frequency: Yearly Manager: Dutch Inc., $500,000/year Manager Remuneration (Fixed Salary): Fixed Salary of the Musharakah | PLS Investments Purpose Contract Additional provisions: 1. Compulsory fire, transportation and theft Takaful for housing investments, timber investments and crude-oil investments. 2. Dutchy Inc., will provide additional $1,000,000 on 10-June-2001. 3. Both IIB and DI have pre-emption rights. Yearly PROFIT (after all expenses including salaries) distribution: Year 1 (end) Year 2 (end) Year 3 (end) Year 4 (end) Year 5 (end) $2 million $3.5 million -$4 million $3 million $5 million Using above information The loss sharing ratio (IIB to DI) of Musharakah contract at 10-October-2000 will be exactly; o 1.65% to 35% 2. None of the above 3.63% to 37% 4.44% to 54% What kind of Musharakah contract it is? o 1. None of above 2. Restricted 3. Un-restricted 4. Both 1&2 Using above information The profit share for DI (excluding salary) from the Musharaka project at the end of first year will be closest to; 1. USD 2,000,000 2. USD 1,600,000 3. USD 400,000 4. None of the above Total contributed capital by DI on 10-October-2000 will be exactly; 1. USD 12,778,000 2. USD 7,450,000 3. None of the above 4.USD 12,888,000 Total contributed capital in Musharaka Contract on 10-June-2001 will be exactly; 1.USD 22,228,000 2. USD 20,328,000 3.USD 21,778,000 4. None of the above