Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1: Consider the following investment opportunity which offers the following sure real cash flows: A reminder from the pre-programme: real cash flows are measured

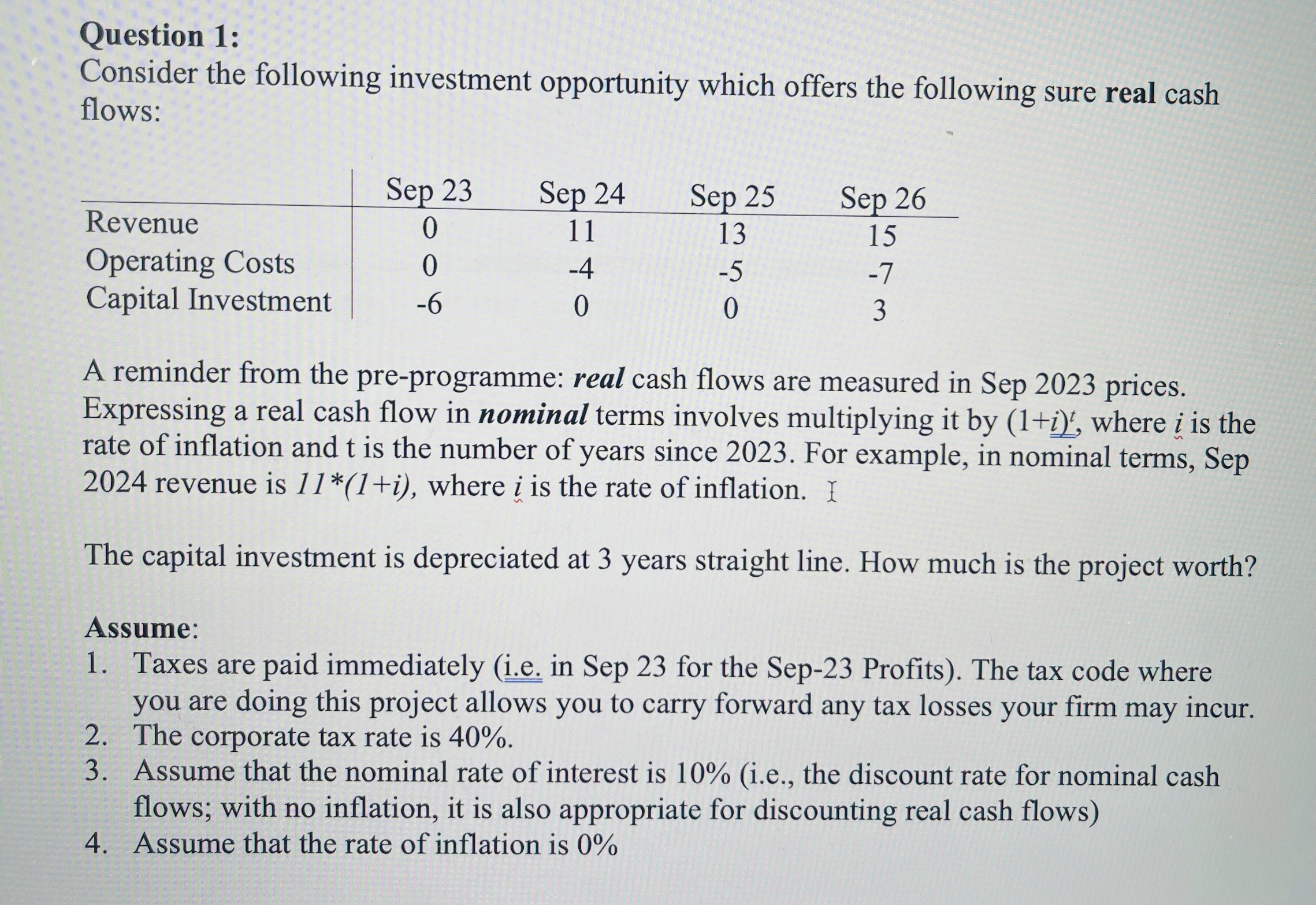

Question 1: Consider the following investment opportunity which offers the following sure real cash flows: A reminder from the pre-programme: real cash flows are measured in Sep 2023 prices. Expressing a real cash flow in nominal terms involves multiplying it by (1+i)t, where i is the rate of inflation and t is the number of years since 2023. For example, in nominal terms, Sep 2024 revenue is 11(1+i), where i is the rate of inflation. The capital investment is depreciated at 3 years straight line. How much is the project worth? Assume: 1. Taxes are paid immediately (i.e. in Sep 23 for the Sep-23 Profits). The tax code where you are doing this project allows you to carry forward any tax losses your firm may incur. 2. The corporate tax rate is 40%. 3. Assume that the nominal rate of interest is 10% (i.e., the discount rate for nominal cash flows; with no inflation, it is also appropriate for discounting real cash flows) 4. Assume that the rate of inflation is 0%

Question 1: Consider the following investment opportunity which offers the following sure real cash flows: A reminder from the pre-programme: real cash flows are measured in Sep 2023 prices. Expressing a real cash flow in nominal terms involves multiplying it by (1+i)t, where i is the rate of inflation and t is the number of years since 2023. For example, in nominal terms, Sep 2024 revenue is 11(1+i), where i is the rate of inflation. The capital investment is depreciated at 3 years straight line. How much is the project worth? Assume: 1. Taxes are paid immediately (i.e. in Sep 23 for the Sep-23 Profits). The tax code where you are doing this project allows you to carry forward any tax losses your firm may incur. 2. The corporate tax rate is 40%. 3. Assume that the nominal rate of interest is 10% (i.e., the discount rate for nominal cash flows; with no inflation, it is also appropriate for discounting real cash flows) 4. Assume that the rate of inflation is 0% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started