Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 Copernicus Ltd is trying to assess a business investment opportunity that includes purchasing a new production machine. The estimated cash flows for this

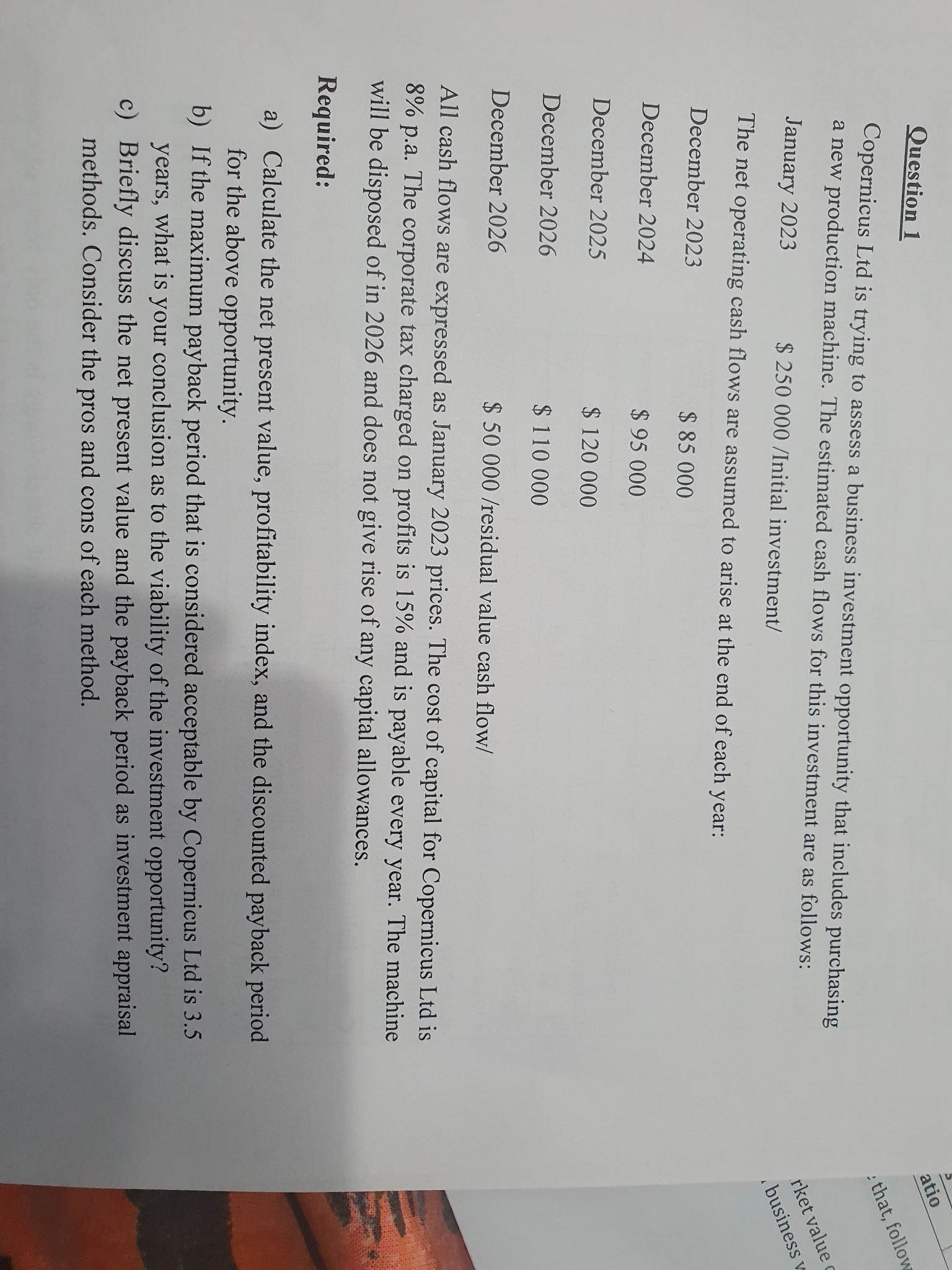

Question 1 Copernicus Ltd is trying to assess a business investment opportunity that includes purchasing a new production machine. The estimated cash flows for this investment are as follows: January 2023$250000 /Initial investment/ The net operating cash flows are assumed to arise at the end of each year: dual value cash flow/ All cash flows are expressed as January 2023 prices. The cost of capital for Copernicus Ltd is 8% p.a. The corporate tax charged on profits is 15% and is payable every year. The machine will be disposed of in 2026 and does not give rise of any capital allowances. Required: a) Calculate the net present value, profitability index, and the discounted payback period for the above opportunity. b) If the maximum payback period that is considered acceptable by Copernicus Ltd is 3.5 years, what is your conclusion as to the viability of the investment opportunity? c) Briefly discuss the net present value and the payback period as investment appraisal methods. Consider the pros and cons of each method

Question 1 Copernicus Ltd is trying to assess a business investment opportunity that includes purchasing a new production machine. The estimated cash flows for this investment are as follows: January 2023$250000 /Initial investment/ The net operating cash flows are assumed to arise at the end of each year: dual value cash flow/ All cash flows are expressed as January 2023 prices. The cost of capital for Copernicus Ltd is 8% p.a. The corporate tax charged on profits is 15% and is payable every year. The machine will be disposed of in 2026 and does not give rise of any capital allowances. Required: a) Calculate the net present value, profitability index, and the discounted payback period for the above opportunity. b) If the maximum payback period that is considered acceptable by Copernicus Ltd is 3.5 years, what is your conclusion as to the viability of the investment opportunity? c) Briefly discuss the net present value and the payback period as investment appraisal methods. Consider the pros and cons of each method Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started