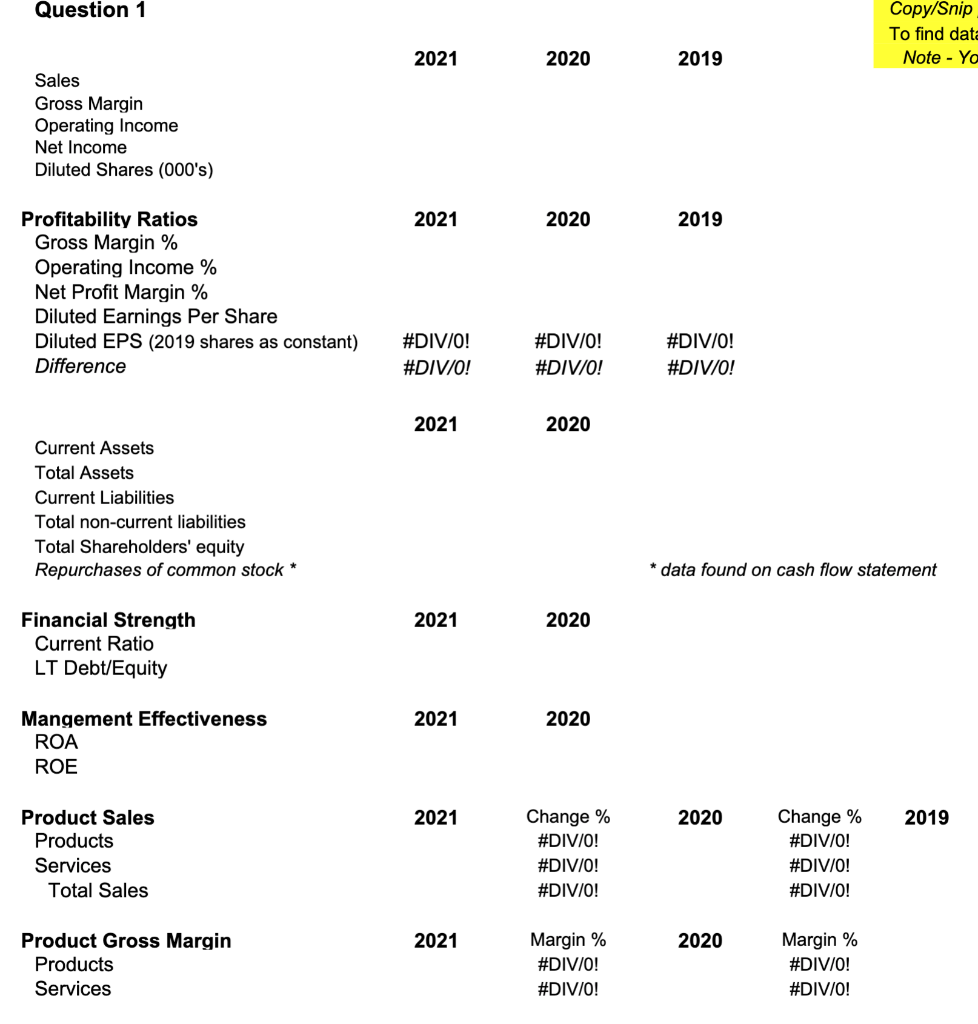

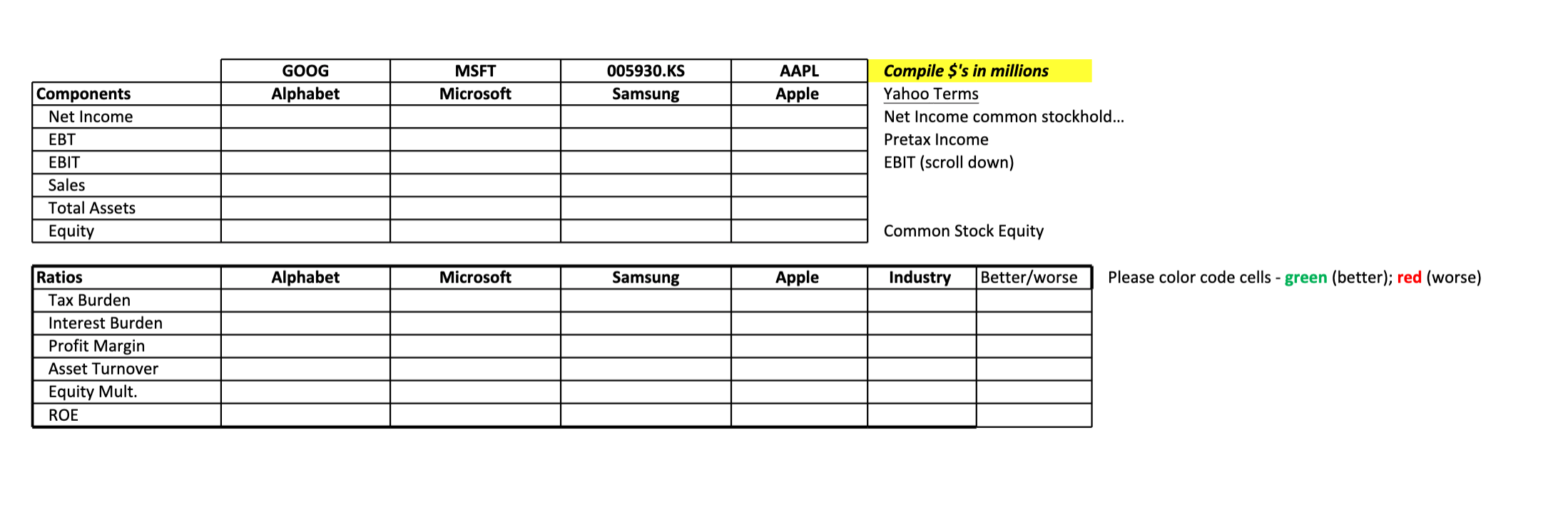

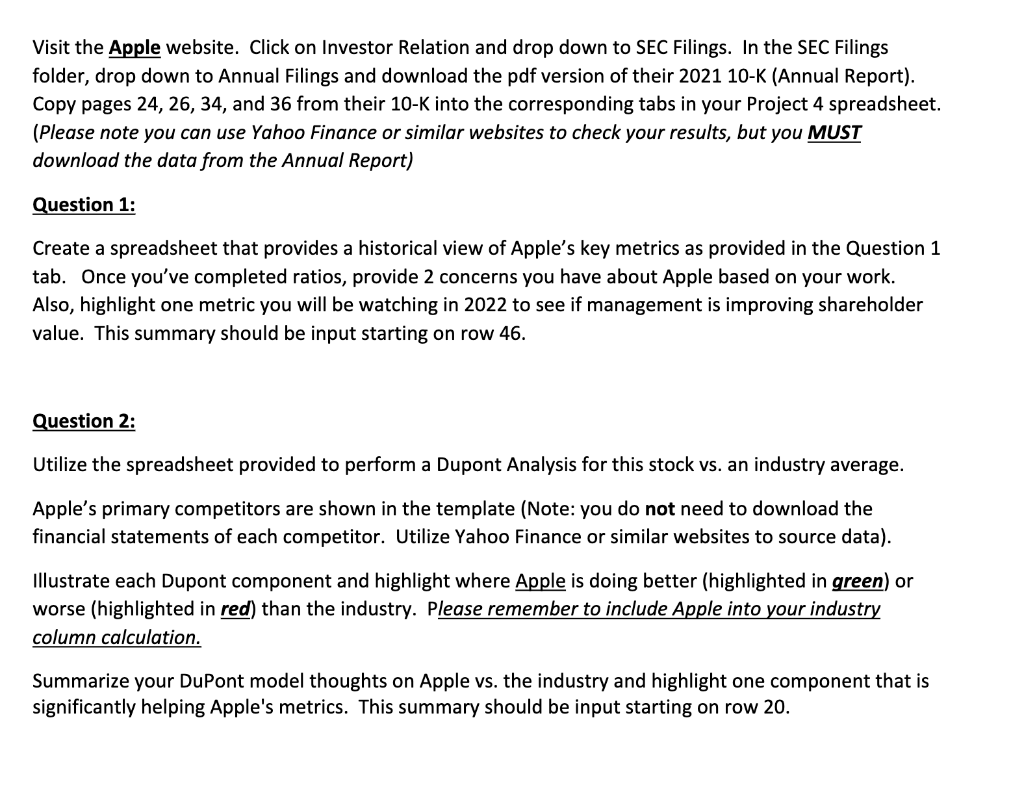

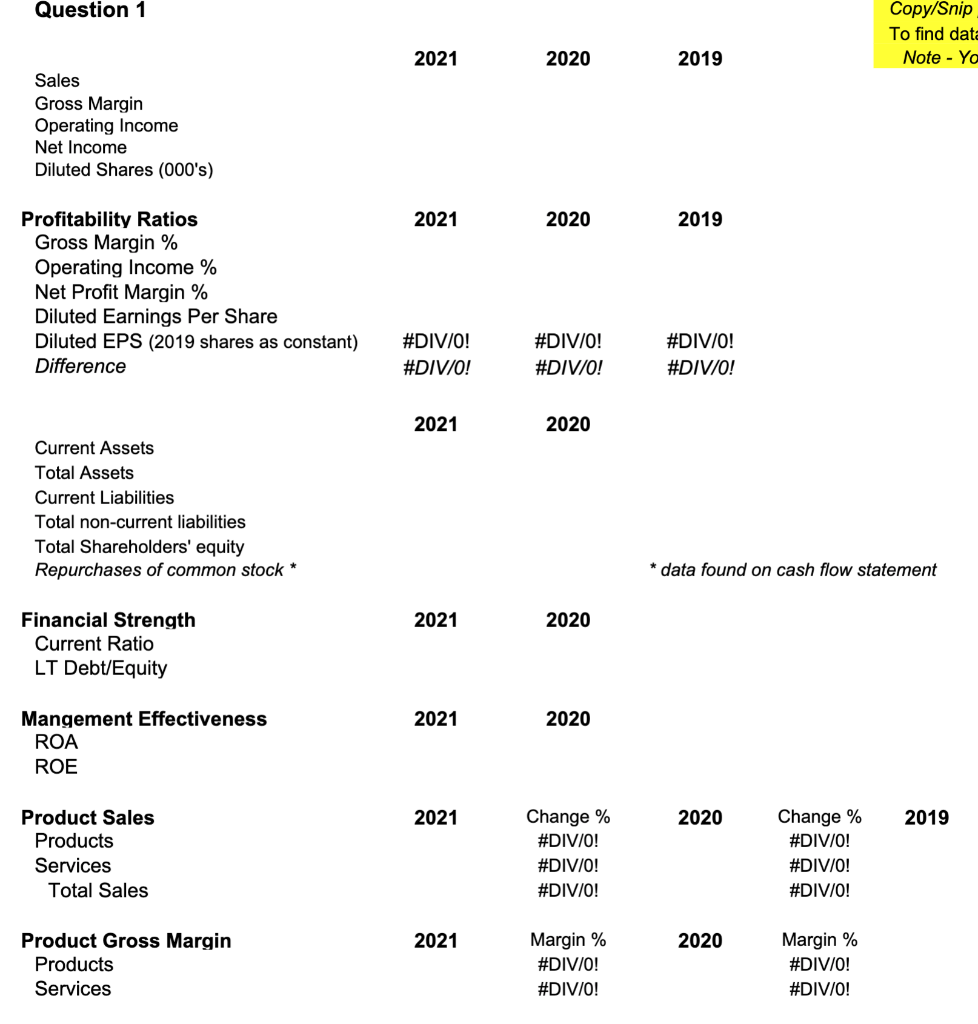

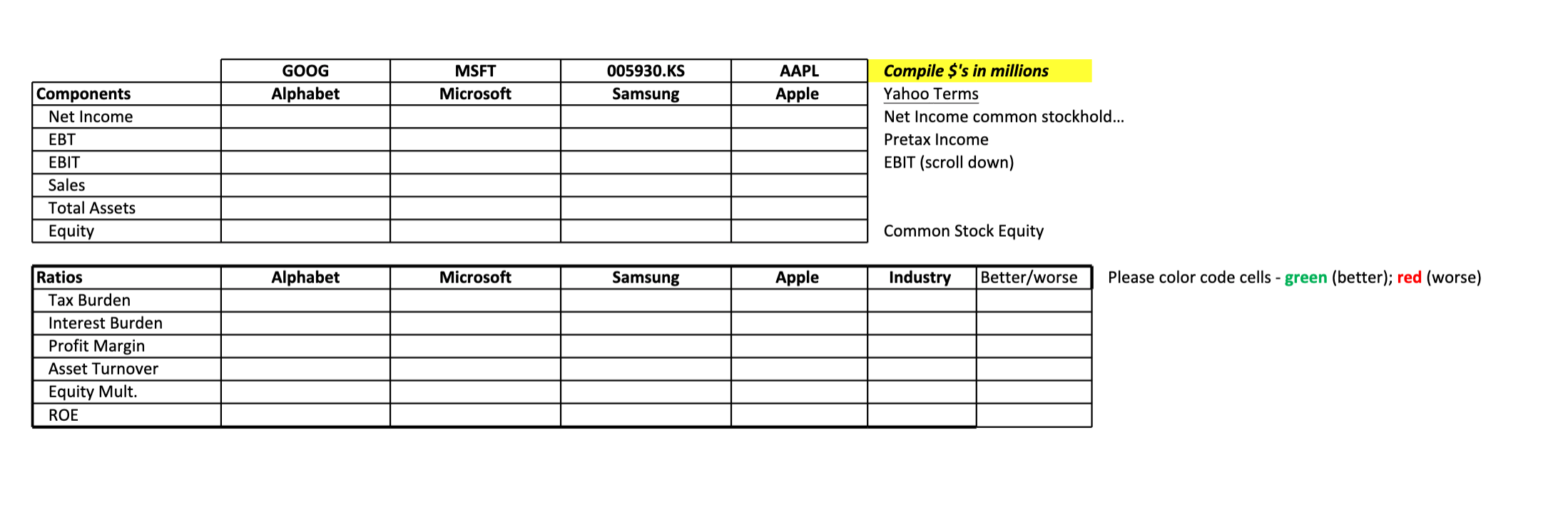

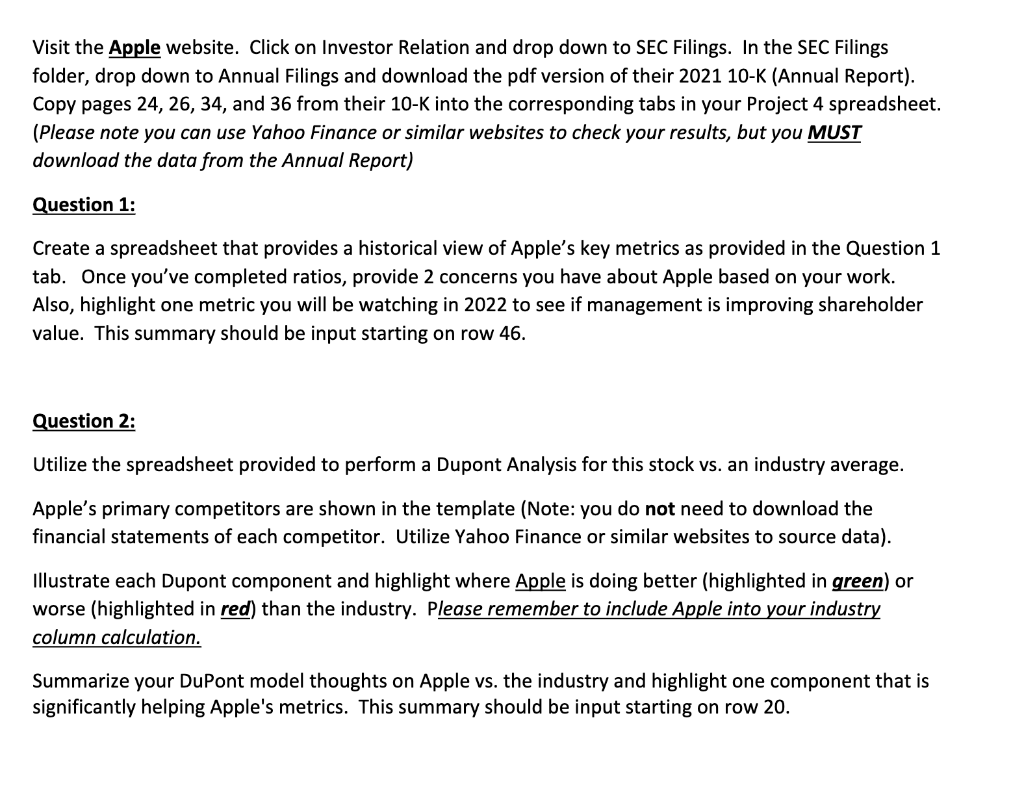

Question 1 Copy/Snip To find data Note - Yo 2021 2020 2019 Sales Gross Margin Operating Income Net Income Diluted Shares (000's) 2021 2020 2019 Profitability Ratios Gross Margin % Operating Income % Net Profit Margin % Diluted Earnings Per Share Diluted EPS (2019 shares as constant) Difference #DIV/O! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! 2021 2020 Current Assets Total Assets Current Liabilities Total non-current liabilities Total Shareholders' equity Repurchases of common stock * * data found on cash flow statement 2021 2020 Financial Strength Current Ratio LT Debt/Equity 2021 2020 Mangement Effectiveness ROA ROE 2021 2020 2019 Product Sales Products Services Total Sales Change % #DIV/0! #DIV/0! #DIV/0! Change % #DIV/0! #DIV/0! #DIV/0! 2021 2020 Product Gross Margin Products Services Margin % #DIV/0! #DIV/0! Margin % #DIV/0! #DIV/0! GOOG Alphabet MSFT Microsoft 005930.KS Samsung AAPL Apple Components Net Income EBT EBIT Sales Total Assets Equity Compile $'s in millions Yahoo Terms Net Income common stockhold... Pretax Income EBIT (scroll down) Common Stock Equity Alphabet Microsoft Samsung Apple Industry Better/worse Please color code cells - green (better); red (worse) Ratios Tax Burden Interest Burden Profit Margin Asset Turnover Equity Mult. ROE Visit the Apple website. Click on Investor Relation and drop down to SEC Filings. In the SEC Filings folder, drop down to Annual Filings and download the pdf version of their 2021 10-K (Annual Report). Copy pages 24, 26, 34, and 36 from their 10-K into the corresponding tabs in your Project 4 spreadsheet. (Please note you can use Yahoo Finance or similar websites to check your results, but you MUST download the data from the Annual Report) Question 1: Create a spreadsheet that provides a historical view of Apple's key metrics as provided in the Question 1 tab. Once you've completed ratios, provide 2 concerns you have about Apple based on your work. Also, highlight one metric you will be watching in 2022 to see if management is improving shareholder value. This summary should be input starting on row 46. Question 2: Utilize the spreadsheet provided to perform a Dupont Analysis for this stock vs. an industry average. Apple's primary competitors are shown in the template (Note: you do not need to download the financial statements of each competitor. Utilize Yahoo Finance or similar websites to source data). Illustrate each Dupont component and highlight where Apple is doing better (highlighted in green) or worse (highlighted in red) than the industry. Please remember to include Apple into your industry column calculation. Summarize your DuPont model thoughts on Apple vs. the industry and highlight one component that is significantly helping Apple's metrics. This summary should be input starting on row 20. Question 1 Copy/Snip To find data Note - Yo 2021 2020 2019 Sales Gross Margin Operating Income Net Income Diluted Shares (000's) 2021 2020 2019 Profitability Ratios Gross Margin % Operating Income % Net Profit Margin % Diluted Earnings Per Share Diluted EPS (2019 shares as constant) Difference #DIV/O! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! 2021 2020 Current Assets Total Assets Current Liabilities Total non-current liabilities Total Shareholders' equity Repurchases of common stock * * data found on cash flow statement 2021 2020 Financial Strength Current Ratio LT Debt/Equity 2021 2020 Mangement Effectiveness ROA ROE 2021 2020 2019 Product Sales Products Services Total Sales Change % #DIV/0! #DIV/0! #DIV/0! Change % #DIV/0! #DIV/0! #DIV/0! 2021 2020 Product Gross Margin Products Services Margin % #DIV/0! #DIV/0! Margin % #DIV/0! #DIV/0! GOOG Alphabet MSFT Microsoft 005930.KS Samsung AAPL Apple Components Net Income EBT EBIT Sales Total Assets Equity Compile $'s in millions Yahoo Terms Net Income common stockhold... Pretax Income EBIT (scroll down) Common Stock Equity Alphabet Microsoft Samsung Apple Industry Better/worse Please color code cells - green (better); red (worse) Ratios Tax Burden Interest Burden Profit Margin Asset Turnover Equity Mult. ROE Visit the Apple website. Click on Investor Relation and drop down to SEC Filings. In the SEC Filings folder, drop down to Annual Filings and download the pdf version of their 2021 10-K (Annual Report). Copy pages 24, 26, 34, and 36 from their 10-K into the corresponding tabs in your Project 4 spreadsheet. (Please note you can use Yahoo Finance or similar websites to check your results, but you MUST download the data from the Annual Report) Question 1: Create a spreadsheet that provides a historical view of Apple's key metrics as provided in the Question 1 tab. Once you've completed ratios, provide 2 concerns you have about Apple based on your work. Also, highlight one metric you will be watching in 2022 to see if management is improving shareholder value. This summary should be input starting on row 46. Question 2: Utilize the spreadsheet provided to perform a Dupont Analysis for this stock vs. an industry average. Apple's primary competitors are shown in the template (Note: you do not need to download the financial statements of each competitor. Utilize Yahoo Finance or similar websites to source data). Illustrate each Dupont component and highlight where Apple is doing better (highlighted in green) or worse (highlighted in red) than the industry. Please remember to include Apple into your industry column calculation. Summarize your DuPont model thoughts on Apple vs. the industry and highlight one component that is significantly helping Apple's metrics. This summary should be input starting on row 20