Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 (Daggers Traders) 27 MARKS Daggers Traders, a sole trader, is registered as a VAT vendor and sells merchandise for cash and on

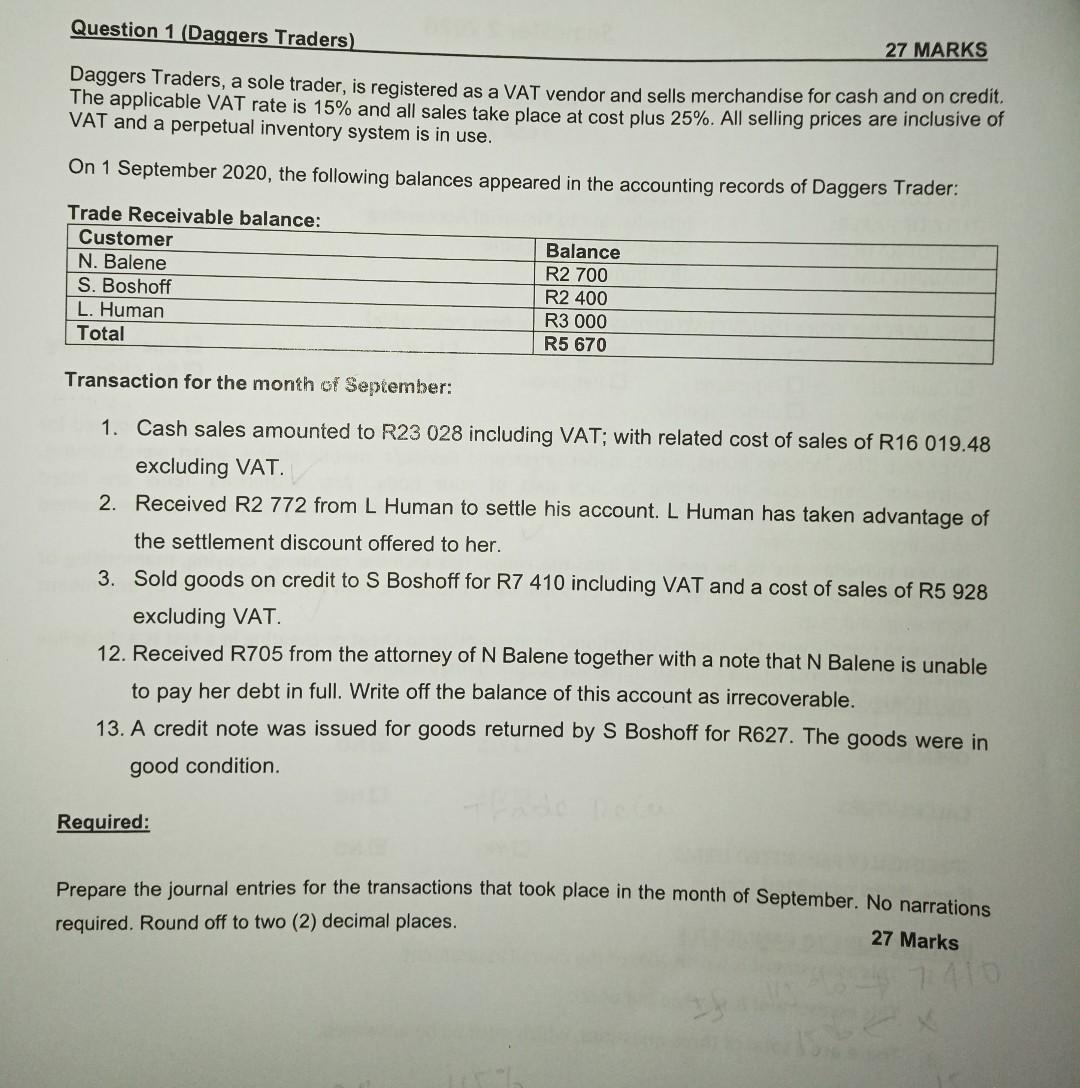

Question 1 (Daggers Traders) 27 MARKS Daggers Traders, a sole trader, is registered as a VAT vendor and sells merchandise for cash and on credit. The applicable VAT rate is 15% and all sales take place at cost plus 25%. All selling prices are inclusive of VAT and a perpetual inventory system is in use. On 1 September 2020, the following balances appeared in the accounting records of Daggers Trader: Trade Receivable balance: Customer N. Balene S. Boshoff L. Human Total Transaction for the month of September: Balance R2 700 R2 400 R3 000 R5 670 1. Cash sales amounted to R23 028 including VAT; with related cost of sales of R16 019.48 excluding VAT. 2. Received R2 772 from L Human to settle his account. L Human has taken advantage of the settlement discount offered to her. 3. Sold goods on credit to S Boshoff for R7 410 including VAT and a cost of sales of R5 928 excluding VAT. 12. Received R705 from the attorney of N Balene together with a note that N Balene is unable to pay her debt in full. Write off the balance of this account as irrecoverable. 13. A credit note was issued for goods returned by S Boshoff for R627. The goods were in good condition. Required: Prepare the journal entries for the transactions that took place in the month of September. No narrations required. Round off to two (2) decimal places. 27 Marks 7410

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started