Answered step by step

Verified Expert Solution

Question

1 Approved Answer

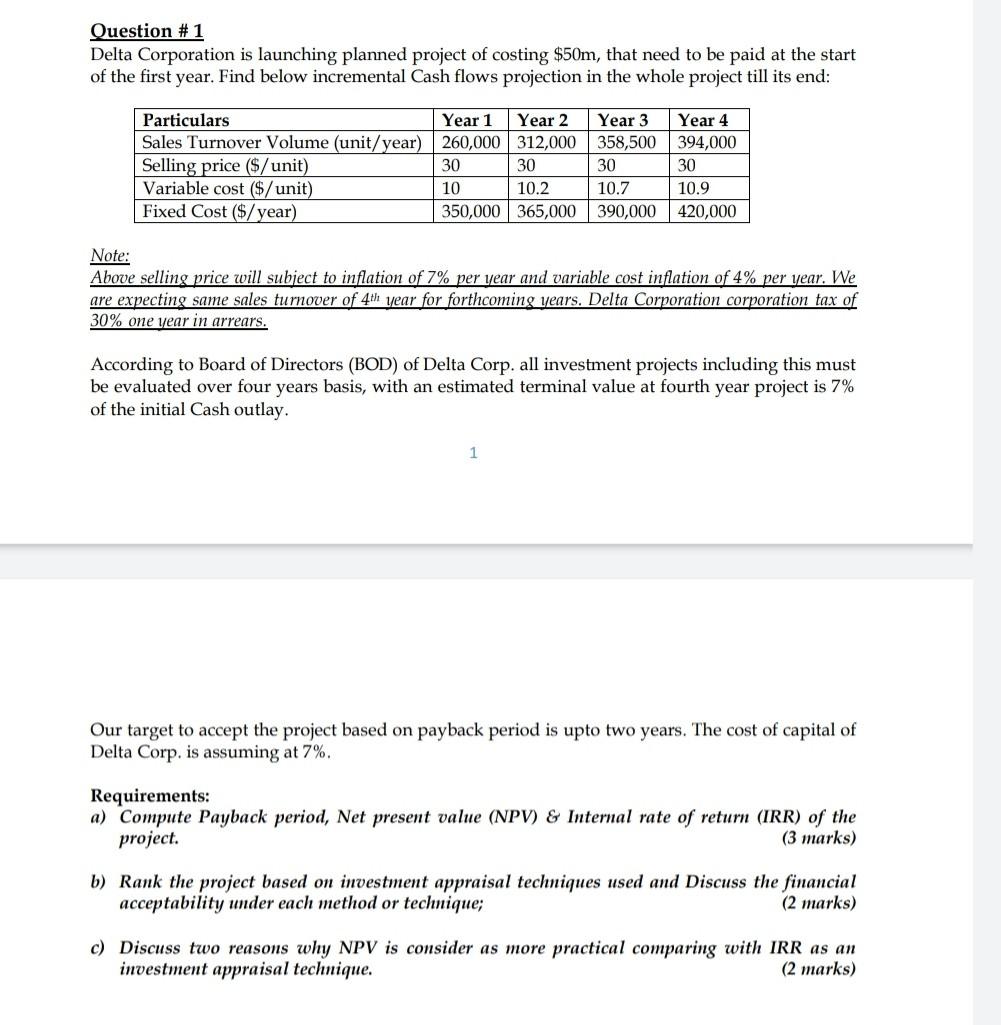

Question # 1 Delta Corporation is launching planned project of costing $50m, that need to be paid at the start of the first year. Find

Question # 1 Delta Corporation is launching planned project of costing $50m, that need to be paid at the start of the first year. Find below incremental Cash flows projection in the whole project till its end: Particulars Year 1 Year 2 Sales Turnover Volume (unit/year) 260,000 312,000 Selling price ($/unit) 30 30 Variable cost ($/ unit) 10 10.2 Fixed Cost ($/year) 350,000 365,000 Year 3 358,500 30 10.7 390,000 Year 4 394,000 30 10.9 420,000 Note: Above selling price will subject to inflation of 7% per year and variable cost inflation of 4% per vear. We are expecting same sales turnover of 4th year for forthcoming years. Delta Corporation corporation tax of 30% one year in arrears. According to Board of Directors (BOD) of Delta Corp. all investment projects including this must be evaluated over four years basis, with an estimated terminal value at fourth year project is 7% of the initial Cash outlay. 1 Our target to accept the project based on payback period is upto two years. The cost of capital of Delta Corp. is assuming at 7%. Requirements: a) Compute Payback period, Net present value (NPV) & Internal rate of return (IRR) of the project. (3 marks) b) Rank the project based on investment appraisal techniques used and Discuss the financial acceptability under each method or technique; (2 marks) c) Discuss two reasons why NPV is consider as more practical comparing with IRR as an investment appraisal technique. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started