Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 Dunelm Avionics Ltd started trading on 1 January 2021. The income statement for the year ended 31 December 2021 and the statement of

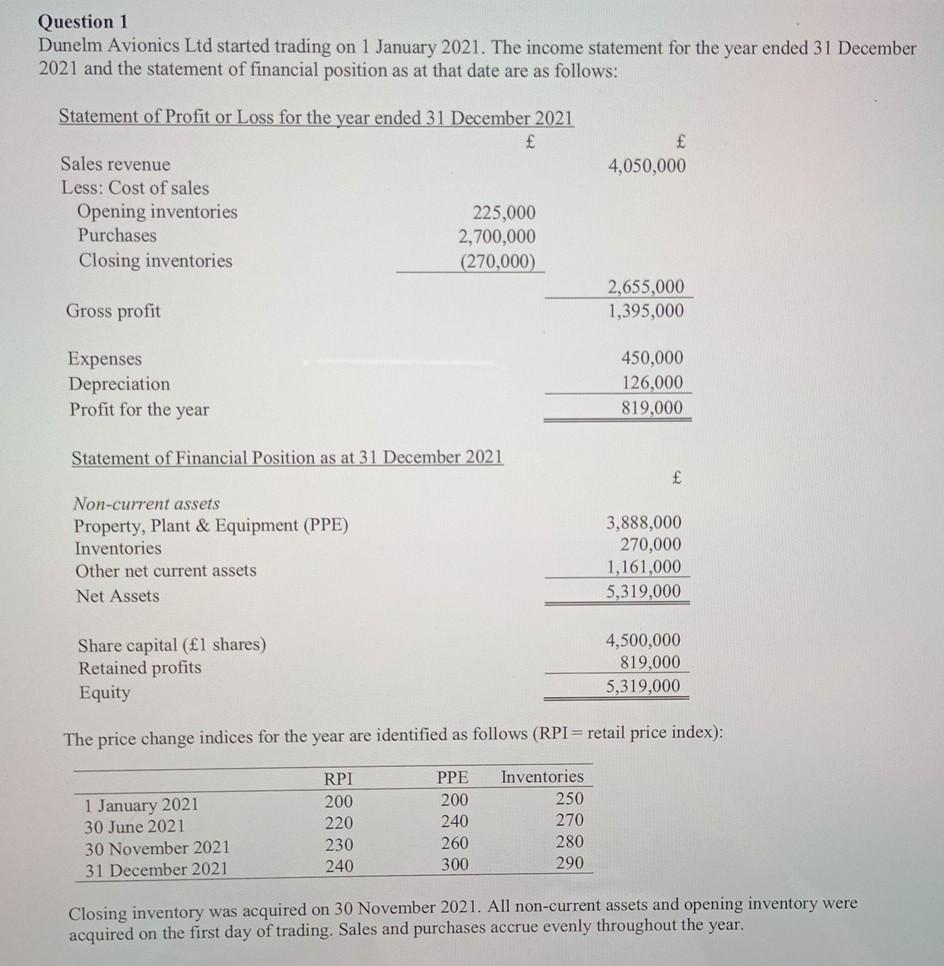

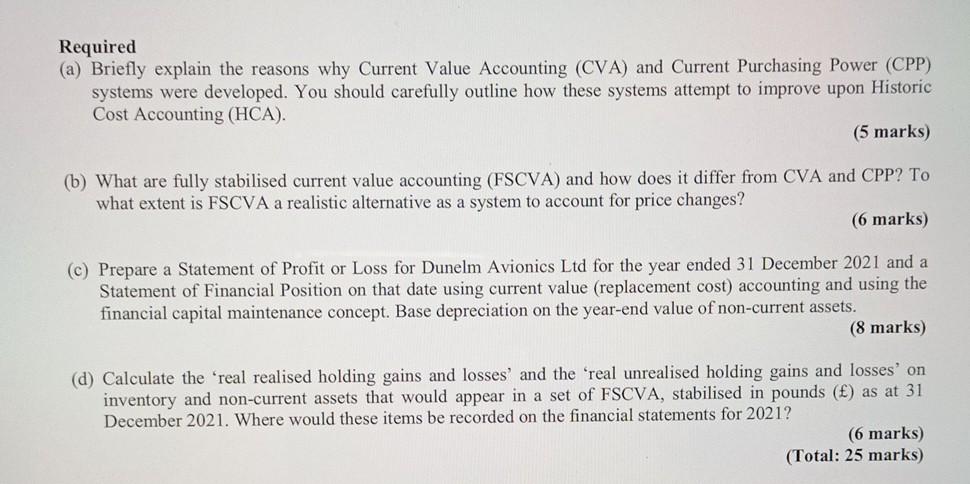

Question 1 Dunelm Avionics Ltd started trading on 1 January 2021. The income statement for the year ended 31 December 2021 and the statement of financial position as at that date are as follows: 4,050,000 Statement of Profit or Loss for the year ended 31 December 2021 Sales revenue Less: Cost of sales Opening inventories 225,000 Purchases 2,700,000 Closing inventories (270,000) Gross profit 2,655.000 1,395,000 Expenses Depreciation Profit for the year 450,000 126,000 819,000 Statement of Financial Position as at 31 December 2021 Non-current assets Property, Plant & Equipment (PPE) Inventories Other net current assets Net Assets 3,888,000 270,000 1,161,000 5,319,000 Share capital (1 shares) Retained profits Equity 4,500,000 819,000 5,319,000 The price change indices for the year are identified as follows (RPI = retail price index): RPI 200 220 PPE 200 240 1 January 2021 30 June 2021 30 November 2021 31 December 2021 Inventories 250 270 280 290 230 260 240 300 Closing inventory was acquired on 30 November 2021. All non-current assets and opening inventory were acquired on the first day of trading. Sales and purchases accrue evenly throughout the year. Required (a) Briefly explain the reasons why Current Value Accounting (CVA) and Current Purchasing Power (CPP) systems were developed. You should carefully outline how these systems attempt to improve upon Historic Cost Accounting (HCA). (5 marks) (b) What are fully stabilised current value accounting (FSCVA) and how does it differ from CVA and CPP? To what extent is FSCVA a realistic alternative as a system to account for price changes? (6 marks) (c) Prepare a Statement of Profit or Loss for Dunelm Avionics Ltd for the year ended 31 December 2021 and a Statement of Financial Position on that date using current value (replacement cost) accounting and using the financial capital maintenance concept. Base depreciation on the year-end value of non-current assets. (8 marks) (d) Calculate the 'real realised holding gains and losses and the real unrealised holding gains and losses' on inventory and non-current assets that would appear in a set of FSCVA, stabilised in pounds () as at 31 December 2021. Where would these items be recorded on the financial statements for 2021? (6 marks) (Total: 25 marks) Question 1 Dunelm Avionics Ltd started trading on 1 January 2021. The income statement for the year ended 31 December 2021 and the statement of financial position as at that date are as follows: 4,050,000 Statement of Profit or Loss for the year ended 31 December 2021 Sales revenue Less: Cost of sales Opening inventories 225,000 Purchases 2,700,000 Closing inventories (270,000) Gross profit 2,655.000 1,395,000 Expenses Depreciation Profit for the year 450,000 126,000 819,000 Statement of Financial Position as at 31 December 2021 Non-current assets Property, Plant & Equipment (PPE) Inventories Other net current assets Net Assets 3,888,000 270,000 1,161,000 5,319,000 Share capital (1 shares) Retained profits Equity 4,500,000 819,000 5,319,000 The price change indices for the year are identified as follows (RPI = retail price index): RPI 200 220 PPE 200 240 1 January 2021 30 June 2021 30 November 2021 31 December 2021 Inventories 250 270 280 290 230 260 240 300 Closing inventory was acquired on 30 November 2021. All non-current assets and opening inventory were acquired on the first day of trading. Sales and purchases accrue evenly throughout the year. Required (a) Briefly explain the reasons why Current Value Accounting (CVA) and Current Purchasing Power (CPP) systems were developed. You should carefully outline how these systems attempt to improve upon Historic Cost Accounting (HCA). (5 marks) (b) What are fully stabilised current value accounting (FSCVA) and how does it differ from CVA and CPP? To what extent is FSCVA a realistic alternative as a system to account for price changes? (6 marks) (c) Prepare a Statement of Profit or Loss for Dunelm Avionics Ltd for the year ended 31 December 2021 and a Statement of Financial Position on that date using current value (replacement cost) accounting and using the financial capital maintenance concept. Base depreciation on the year-end value of non-current assets. (8 marks) (d) Calculate the 'real realised holding gains and losses and the real unrealised holding gains and losses' on inventory and non-current assets that would appear in a set of FSCVA, stabilised in pounds () as at 31 December 2021. Where would these items be recorded on the financial statements for 2021? (6 marks) (Total: 25 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started