Question

Question 1: Empirical evidence on the long-run wealth effects of initial public offerings (as discussed in lectures) demonstrates that in the long run investors in

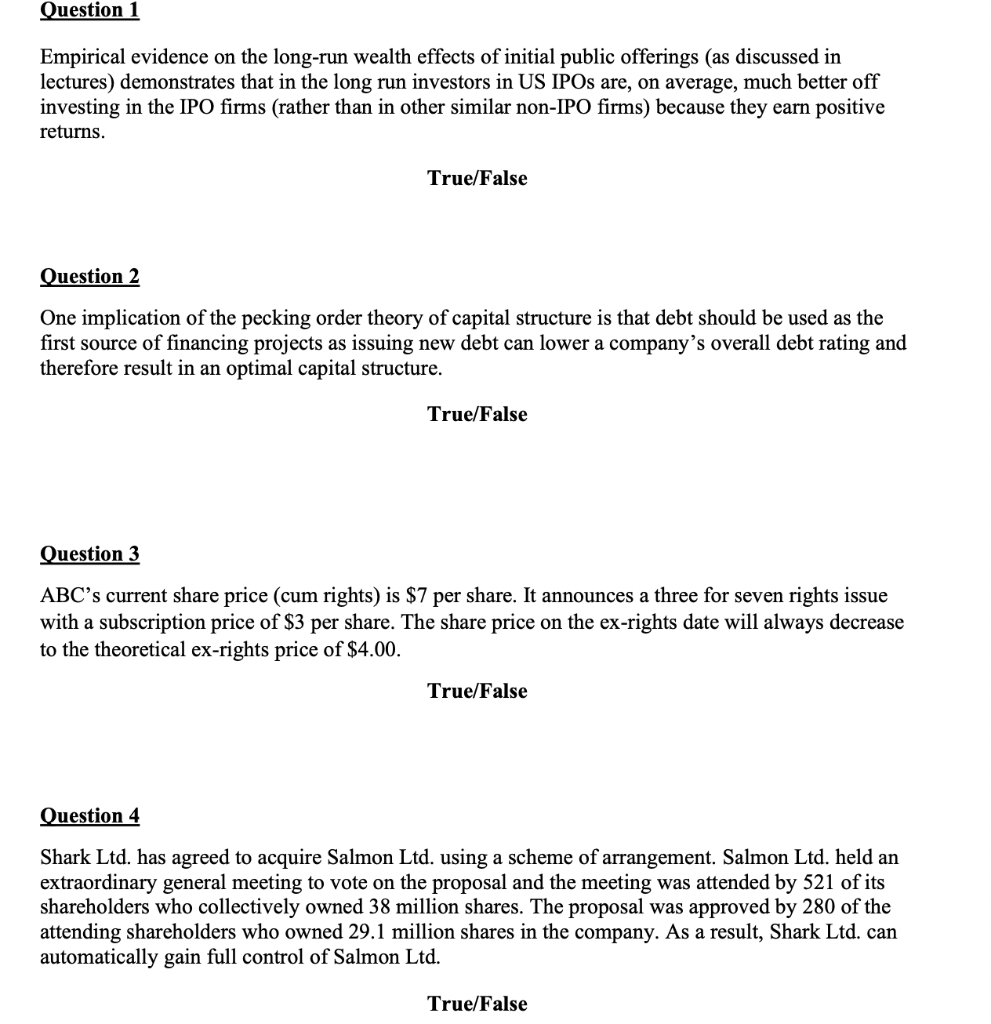

Question 1: Empirical evidence on the long-run wealth effects of initial public offerings (as discussed in lectures) demonstrates that in the long run investors in US IPOs are, on average, much better off investing in the IPO firms (rather than in other similar non-IPO firms) because they earn positive returns. (True/False)

Question 2: One implication of the pecking order theory of capital structure is that debt should be used as the first source of financing projects as issuing new debt can lower a companys overall debt rating and therefore result in an optimal capital structure. (True/False)

Question 3: ABCs current share price (cum rights) is $7 per share. It announces a three for seven rights issue with a subscription price of $3 per share. The share price on the ex-rights date will always decrease to the theoretical ex-rights price of $4.00. (True/False)

Question 4: Shark Ltd. has agreed to acquire Salmon Ltd. using a scheme of arrangement. Salmon Ltd. held an extraordinary general meeting to vote on the proposal and the meeting was attended by 521 of its shareholders who collectively owned 38 million shares. The proposal was approved by 280 of the attending shareholders who owned 29.1 million shares in the company. As a result, Shark Ltd. can automatically gain full control of Salmon Ltd. (True/False)

Hi, I want to know the answer to these four questions with an explanation for each question. Thank you

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started