Answered step by step

Verified Expert Solution

Question

1 Approved Answer

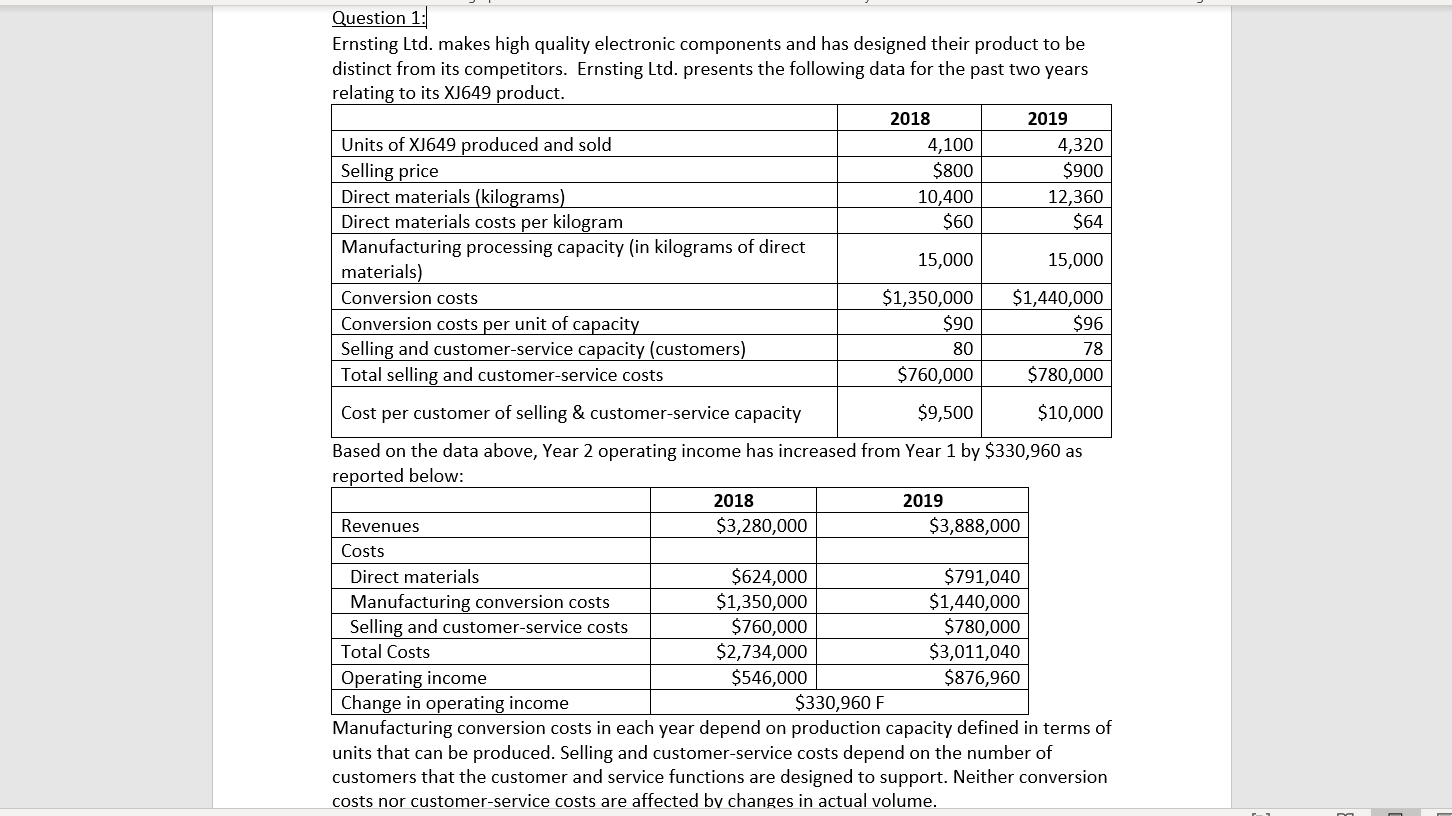

Question 1: Ernsting Ltd. makes high quality electronic components and has designed their product to be distinct from its competitors. Ernsting Ltd. presents the

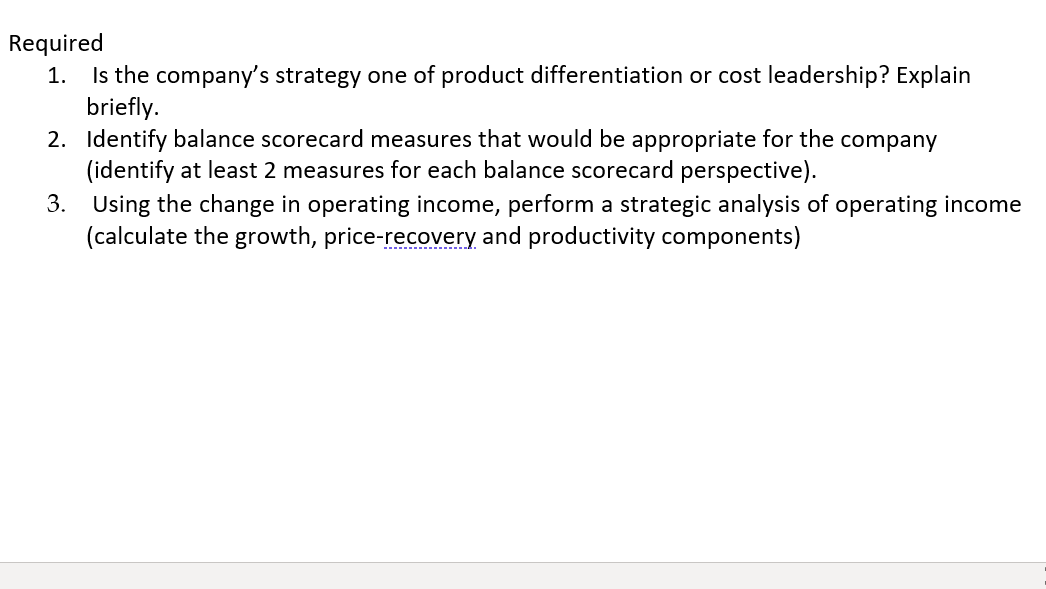

Question 1: Ernsting Ltd. makes high quality electronic components and has designed their product to be distinct from its competitors. Ernsting Ltd. presents the following data for the past two years relating to its XJ649 product. 2018 2019 Units of XJ649 produced and sold 4,100 4,320 Selling price $800 $900 Direct materials (kilograms) 10,400 12,360 Direct materials costs per kilogram $60 $64 Manufacturing processing capacity (in kilograms of direct 15,000 15,000 materials) Conversion costs $1,350,000 Conversion costs per unit of capacity $90 $1,440,000 $96 Selling and customer-service capacity (customers) 80 78 Total selling and customer-service costs $760,000 $780,000 Cost per customer of selling & customer-service capacity $10,000 Based on the data above, Year 2 operating income has increased from Year 1 by $330,960 as $9,500 reported below: 2018 Revenues $3,280,000 Costs Direct materials $624,000 Manufacturing conversion costs $1,350,000 Selling and customer-service costs $760,000 Total Costs $2,734,000 Operating income $546,000 Change in operating income 2019 $3,888,000 $791,040 $1,440,000 $780,000 $3,011,040 $330,960 F $876,960 Manufacturing conversion costs in each year depend on production capacity defined in terms of units that can be produced. Selling and customer-service costs depend on the number of customers that the customer and service functions are designed to support. Neither conversion costs nor customer-service costs are affected by changes in actual volume. Required 1. Is the company's strategy one of product differentiation or cost leadership? Explain briefly. 2. Identify balance scorecard measures that would be appropriate for the company (identify at least 2 measures for each balance scorecard perspective). 3. Using the change in operating income, perform a strategic analysis of operating income (calculate the growth, price-recovery and productivity components)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Is the companys strategy one of product differentiation or cost leadership Explain briefly Based o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started