Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1: Exclusive Resorts (ER) operates a five-star hotel with a championship golf course. ER has a decentralized management structure, with three divisions: -

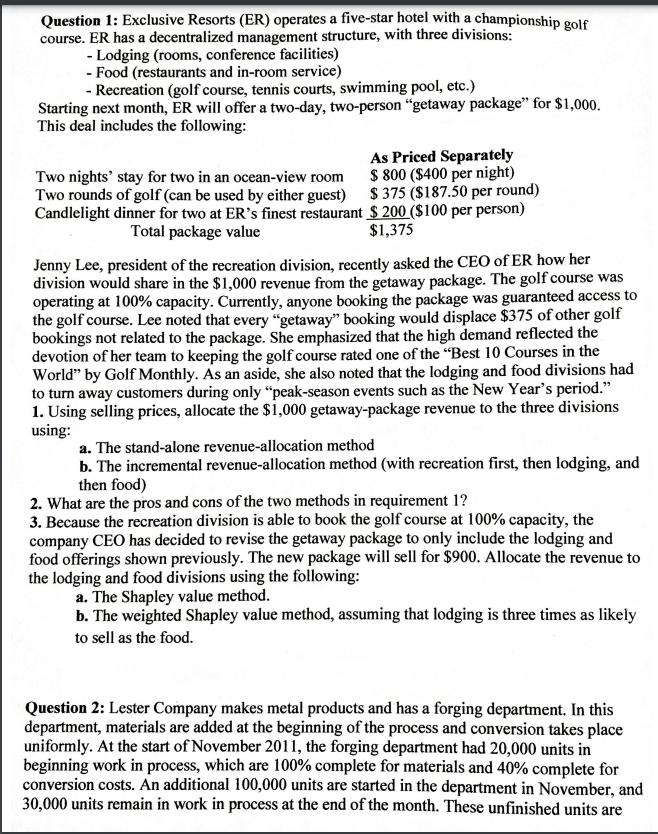

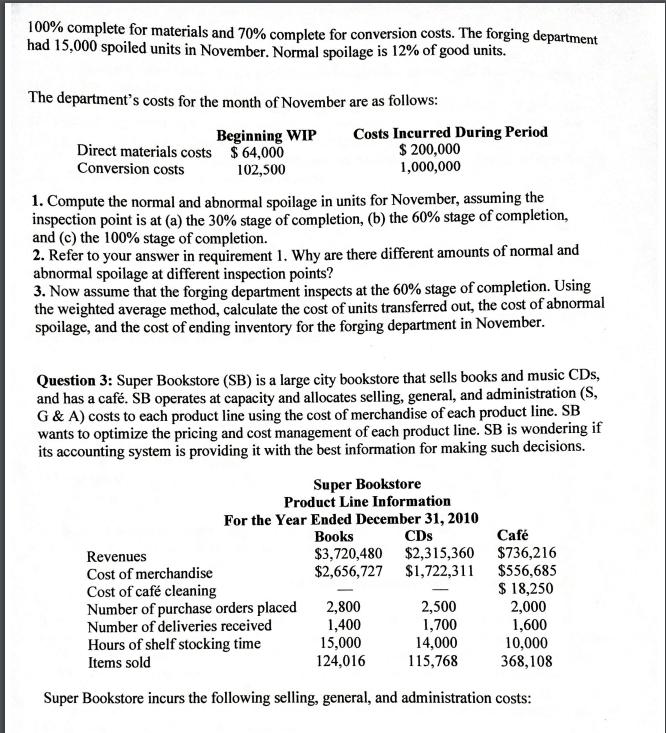

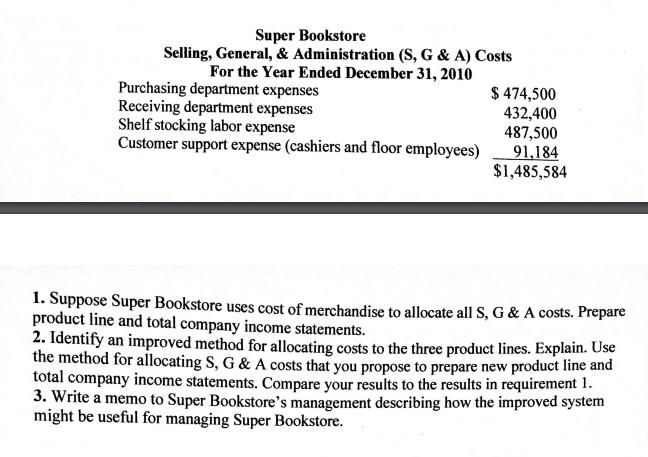

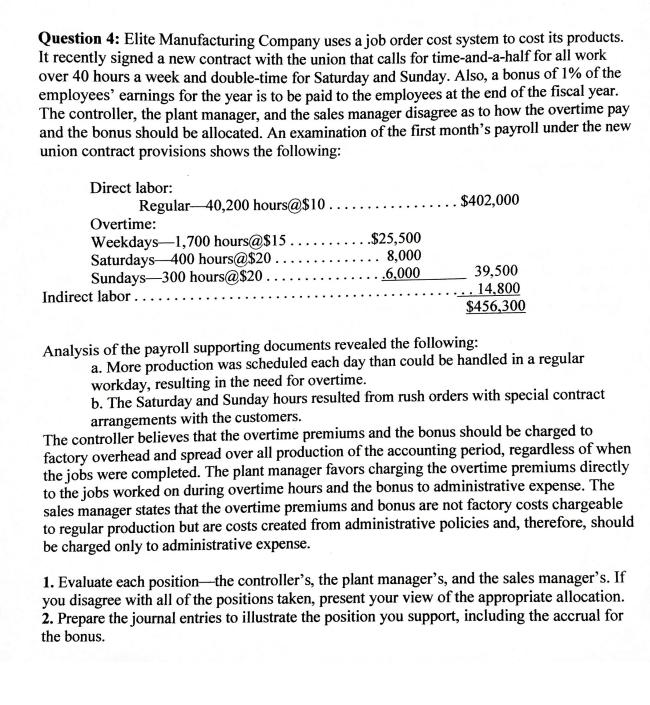

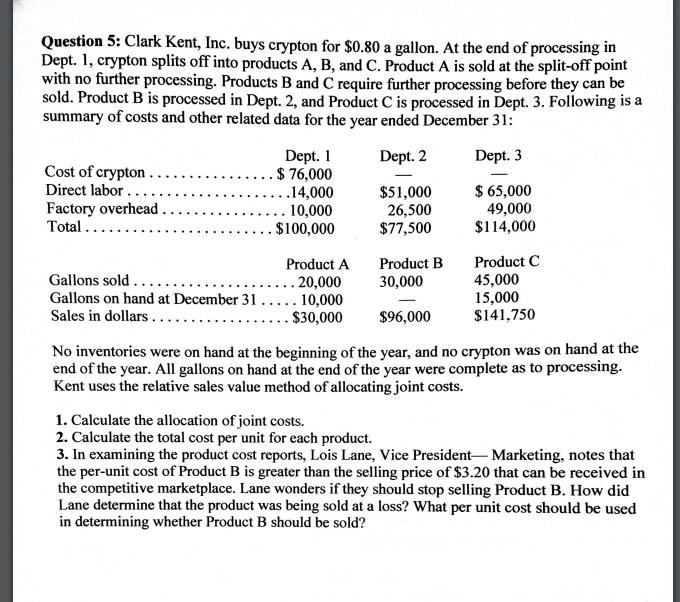

Question 1: Exclusive Resorts (ER) operates a five-star hotel with a championship golf course. ER has a decentralized management structure, with three divisions: - Lodging (rooms, conference facilities) - Food (restaurants and in-room service) - Recreation (golf course, tennis courts, swimming pool, etc.) Starting next month, ER will offer a two-day, two-person "getaway package" for $1,000. This deal includes the following: Two nights' stay for two in an ocean-view room Two rounds of golf (can be used by either guest) Candlelight dinner for two at ER's finest restaurant Total package value As Priced Separately $ 800 ($400 per night) $375 ($187.50 per round) $ 200 ($100 per person) $1,375 Jenny Lee, president of the recreation division, recently asked the CEO of ER how her division would share in the $1,000 revenue from the getaway package. The golf course was operating at 100% capacity. Currently, anyone booking the package was guaranteed access to the golf course. Lee noted that every "getaway" booking would displace $375 of other golf bookings not related to the package. She emphasized that the high demand reflected the devotion of her team to keeping the golf course rated one of the "Best 10 Courses in the World" by Golf Monthly. As an aside, she also noted that the lodging and food divisions had to turn away customers during only "peak-season events such as the New Year's period." 1. Using selling prices, allocate the $1,000 getaway-package revenue to the three divisions using: a. The stand-alone revenue-allocation method b. The incremental revenue-allocation method (with recreation first, then lodging, and then food) 2. What are the pros and cons of the two methods in requirement 1? 3. Because the recreation division is able to book the golf course at 100% capacity, the company CEO has decided to revise the getaway package to only include the lodging and food offerings shown previously. The new package will sell for $900. Allocate the revenue to the lodging and food divisions using the following: a. The Shapley value method. b. The weighted Shapley value method, assuming that lodging is three times as likely to sell as the food. Question 2: Lester Company makes metal products and has a forging department. In this department, materials are added at the beginning of the process and conversion takes place uniformly. At the start of November 2011, the forging department had 20,000 units in beginning work in process, which are 100% complete for materials and 40% complete for conversion costs. An additional 100,000 units are started in the department in November, and 30,000 units remain in work in process at the end of the month. These unfinished units are 100% complete for materials and 70% complete for conversion costs. The forging department had 15,000 spoiled units in November. Normal spoilage is 12% of good units. The department's costs for the month of November are as follows: Direct materials costs Conversion costs Beginning WIP $ 64,000 102,500 1. Compute the normal and abnormal spoilage in units for November, assuming the inspection point is at (a) the 30% stage of completion, (b) the 60% stage of completion, and (c) the 100% stage of completion. 2. Refer to your answer in requirement 1. Why are there different amounts of normal and abnormal spoilage at different inspection points? 3. Now assume that the forging department inspects at the 60% stage of completion. Using the weighted average method, calculate the cost of units transferred out, the cost of abnormal spoilage, and the cost of ending inventory for the forging department in November. Costs Incurred During Period $ 200,000 1,000,000 Question 3: Super Bookstore (SB) is a large city bookstore that sells books and music CDs, and has a caf. SB operates at capacity and allocates selling, general, and administration (S, G & A) costs to each product line using the cost of merchandise of each product line. SB wants to optimize the pricing and cost management of each product line. SB is wondering if its accounting system is providing it with the best information for making such decisions. Super Bookstore Product Line Information For the Year Ended December 31, 2010 Books CDs Revenues Cost of merchandise Cost of caf cleaning Number of purchase orders placed $3,720,480 $2,315,360 $2,656,727 $1,722,311 - 2,800 1,400 15,000 124,016 2,500 1,700 14,000 115,768 Caf $736,216 $556,685 $ 18,250 2,000 1,600 10,000 368,108 Number of deliveries received Hours of shelf stocking time Items sold Super Bookstore incurs the following selling, general, and administration costs: Super Bookstore Selling, General, & Administration (S, G & A) Costs For the Year Ended December 31, 2010 Purchasing department expenses Receiving department expenses Shelf stocking labor expense Customer support expense (cashiers and floor employees) $ 474,500 432,400 487,500 91,184 $1,485,584 1. Suppose Super Bookstore uses cost of merchandise to allocate all S, G & A costs. Prepare product line and total company income statements. 2. Identify an improved method for allocating costs to the three product lines. Explain. Use the method for allocating S, G & A costs that you propose to prepare new product line and total company income statements. Compare your results to the results in requirement 1. 3. Write a memo to Super Bookstore's management describing how the improved system might be useful for managing Super Bookstore. Question 4: Elite Manufacturing Company uses a job order cost system to cost its products. It recently signed a new contract with the union that calls for time-and-a-half for all work over 40 hours a week and double-time for Saturday and Sunday. Also, a bonus of 1% of the employees' earnings for the year is to be paid to the employees at the end of the fiscal year. The controller, the plant manager, and the sales manager disagree as to how the overtime pay and the bonus should be allocated. An examination of the first month's payroll under the new union contract provisions shows the following: Direct labor: Regular 40,200 hours@$10.. Overtime: Weekdays 1,700 hours@$15. Saturdays 400 hours@$20. Sundays 300 hours@$20. Indirect labor... ... ..$25,500 8,000 .6,000 $402,000 39,500 14,800 $456,300 Analysis of the payroll supporting documents revealed the following: a. More production was scheduled each day than could be handled in a regular workday, resulting in the need for overtime. b. The Saturday and Sunday hours resulted from rush orders with special contract arrangements with the customers. The controller believes that the overtime premiums and the bonus should be charged to factory overhead and spread over all production of the accounting period, regardless of when the jobs were completed. The plant manager favors charging the overtime premiums directly to the jobs worked on during overtime hours and the bonus to administrative expense. The sales manager states that the overtime premiums and bonus are not factory costs chargeable to regular production but are costs created from administrative policies and, therefore, should be charged only to administrative expense. 1. Evaluate each position the controller's, the plant manager's, and the sales manager's. If you disagree with all of the positions taken, present your view of the appropriate allocation. 2. Prepare the journal entries to illustrate the position you support, including the accrual for the bonus. Question 5: Clark Kent, Inc. buys crypton for $0.80 a gallon. At the end of processing in Dept. 1, crypton splits off into products A, B, and C. Product A is sold at the split-off point with no further processing. Products B and C require further processing before they can be sold. Product B is processed in Dept. 2, and Product C is processed in Dept. 3. Following is a summary of costs and other related data for the year ended December 31: Dept. 2 Dept. 3 $51,000 26,500 $77,500 Cost of crypton. Direct labor... Factory overhead. Total..... Dept. 1 $ 76,000 .14,000 10,000 $100,000 Product A $ 65,000 49,000 $114,000 Product B 30,000 $96,000 No inventories were on hand at the beginning of the year, and no crypton was on hand at the end of the year. All gallons on hand at the end of the year were complete as to processing. Kent uses the relative sales value method of allocating joint costs. Gallons sold. ... 20,000 Gallons on hand at December 31..... 10,000 Sales in dollars.... . $30,000 Product C 45,000 15,000 $141,750 1. Calculate the allocation of joint costs. 2. Calculate the total cost per unit for each product. 3. In examining the product cost reports, Lois Lane, Vice President Marketing, notes that the per-unit cost of Product B is greater than the selling price of $3.20 that can be received in the competitive marketplace. Lane wonders if they should stop selling Product B. How did Lane determine that the product was being sold at a loss? What per unit cost should be used in determining whether Product B should be sold?

Step by Step Solution

★★★★★

3.38 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

The standalone revenues using unit selling prices of the three components of the 1000 package are Lodging 320 2 640 Recreation 150 x 2 300 Food 80 x 2 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started